Economic Exposure

A type of foreign exchange risk caused by unexpected currency fluctuations

What is Economic Exposure?

Economic exposure, also sometimes called operating exposure, is a measure of the change in the future cash flows of a company as a result of unexpected changes in foreign exchange rates (FX).

Economic exposure cannot be easily mitigated because it is caused by the unpredictable volatility of currency exchange rates. Increasing globalization and economic relations between countries make economic exposure a source of risk almost for all companies and consumers.

Effects of Economic Exposure

Since unanticipated rate changes affect a company’s cash flows, economic exposure can result in serious negative consequences for the company’s operations and profitability. A stronger foreign currency may make production inputs more expensive, causing decreased profits.

Furthermore, economic exposure can undermine the company’s competitive position. For example, if the local currency strengthens, local manufacturers will face more intense competition from foreign manufacturers whose products will become cheaper.

Mitigation of Economic Exposure

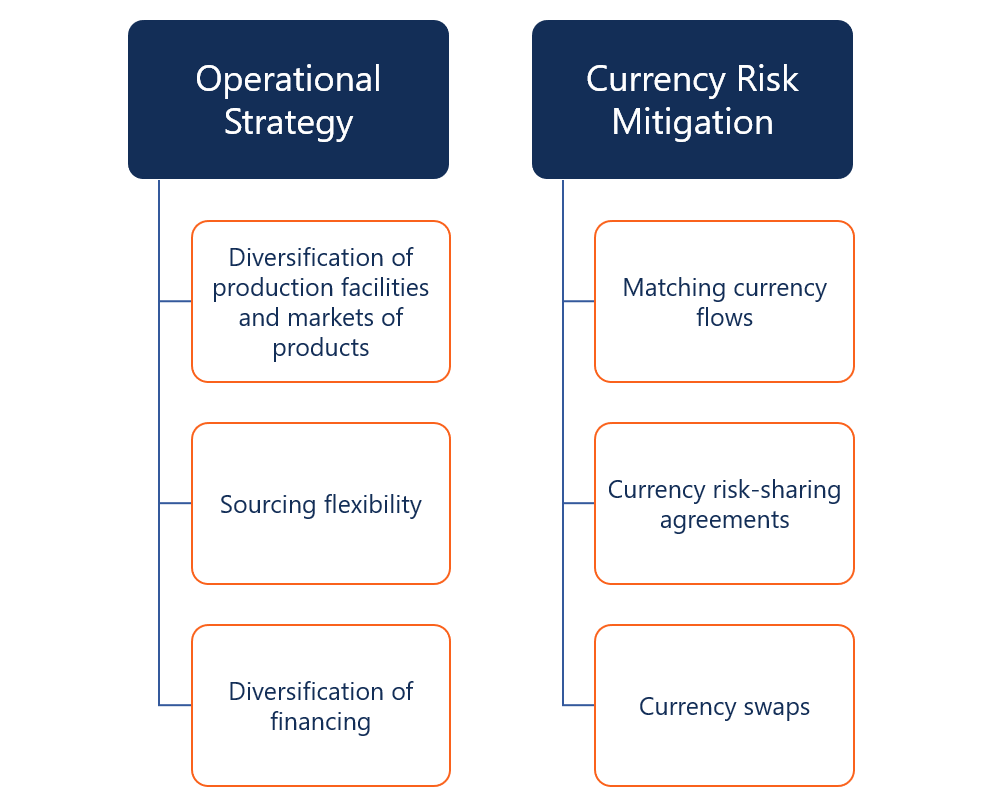

There are two main strategies to mitigate economic exposure: operational and currency risk mitigation.

Operational strategy

Operational strategy is aiming to adjust or change the current company’s operations to prevent possible risks associated with future currency fluctuations. The operational mitigation strategy may involve the following steps:

- Diversification of production facilities and markets of products: The expansion of operating facilities and sales to a mixture of markets.

- Sourcing flexibility: A company considers the acquisition of its key inputs from different regions.

- Diversification of financing: A company may seek financing from capital markets in different regions.

Currency risk mitigation strategy

The main goal of the currency risk mitigation strategy is to minimize or eliminate economic exposure through hedging. Some of the currency risk mitigation strategies are:

- Matching currency flows: A company matches the foreign currency outflows with foreign currency inflows.

- Currency risk-sharing agreements: A company enters into a currency risk-sharing agreement with its supplier/customer. According to this agreement, the sale/purchase contract is executed at a predetermined price. Thus, both parties share the potential currency risk.

- Currency swaps: A company can use currency swaps to obtain the required cash flows in foreign currency at the desired exchange rate. The counterparties will exchange the interest and principal in one currency for the same in another currency at fixed dates until the maturity of the swap.

Related Reading

CFI is the official provider of the Capital Markets & Securities Analyst (CMSA®) certification program, designed to transform anyone into a world-class financial analyst. To keep learning and developing your knowledge of financial analysis, we highly recommend the additional CFI resources below: