Fed Put

The Fed Put is the belief that the US Federal Reserve will step in to rescue the markets if prices fall too much

Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.

What is the Fed Put?

The “Fed Put” is a commonly used term in financial markets to describe the belief that many market practitioners hold that the U.S. Federal Reserve (the Fed) will step in with accommodative monetary policy to buoy markets, specifically the U.S. equity market, if prices fall too fast too quickly.

Summary

- The Fed put is a belief by financial market participants that the Federal Reserve will step in to buoy markets if the price of markets falls to a certain level.

- Fed puts have occurred throughout history, such as in 1987, 2010, 2016, and 2018.

- The Fed put is not a confirmed notion by the Federal Reserve themselves. As a result, there are no specific conditions that must be met for a Fed put.

Understanding the Fed Put

The Fed’s dual mandate

The U.S. Federal Reserve operates under a dual mandate from the U.S. Congress to “promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.” It generally involves:

- Setting accommodative monetary policies during a business cycle downturn to encourage consumer demand by increasing money supply; and

- Setting restrictive monetary policies in a late business cycle to moderate inflation by restricting money supply.

Not a policy but a widely held market belief

Although the Federal Reserve does not have a Congressional mandate to support financial asset prices, it has become widely accepted by financial market participants that the Federal Reserve would step in should there be strong financial market distress. This is what is termed the “Fed Put,” in which market participants believe that the Federal Reserve will step in to buoy asset prices, specifically U.S. stocks, if they fall too fast.

How Would It Work?

Since this is not a Fed policy, there is no set playbook by which the Fed will enact the “Fed Put.” However, historically the Fed would most likely begin by using its officials and the Federal Open Market Committee (FOMC) to calm down the market through their scheduled speeches, press conferences, and appearances at other public events, such as investor conferences.

Should this not calm the market, the Fed may enact different quantitative easing, asset purchase, or other liquidity facilities to bring stability to the asset markets.

As a last measure, the FOMC might lower its policy rates, such as the Federal Funds Overnight Target Rate (Fed Funds). This is really a last straw option as the Fed Funds is often likened to a very blunt instrument that is difficult to reverse and may carry unintended consequences.

Why is It Called a “Put”?

The Fed put is a play on the option term “put,” which acts as a form of insurance. A put option on an asset is defined as a contract that allows the holder of the put the right, but not the obligation, to sell the underlying asset at a pre-specified price before or at a predetermined point of time in the future.

Any accommodative action by the Fed, real or just verbal, has the strong possibility of helping the financial market recover, or even rally. So you might say that if the Fed enacts the “Fed Put,” the investor’s downside risk is covered, just like they would be if they actually owned a protective put.

As you can see from the diagram above, being long a put essentially protects, or hedges, the holder of the put option from a fall in the price of that underlying asset. The way that works is because the holder of the put option can choose to instead sell, or put, the underlying asset to the seller of the put option at the predetermined price, or strike, should the market price fall below the strike price.

Historical Examples of the Fed Put

History has shown that the Federal Reserve has intervened in the wake of significant financial market distress. With that said, it is important to note that the Fed put is not a confirmed notion by the Federal Reserve themselves but rather a belief by financial market participants. As a result, there are no specific conditions that must be met to trigger a Fed put.

Below are some examples of Fed puts throughout history:

- In the Black Monday crash of autumn 1987, when the Dow Jones fell by 508 points (22.6%) due to hostilities in the Persian Gulf, fear of higher interest rates, and the introduction of electronic/program trading. The next day, the Federal Research intervened by affirming its readiness to serve as a source of liquidity to support the economic and financial system.

- During the 2008-2010 Global Financial Crisis, the Federal Reserve reduced interest rates and conducted quantitative easing. With the economy recovering, in June 2010, the Federal Reserve attempted to scale back monetary policy by bringing its quantitative easing program to a close. It, however, caused market jitters, causing the Federal Reserve to introduce a new quantitative easing program (called QE2) to soothe financial markets.

- In late 2015 and into early 2016, the value of stock prices globally sold off due to slowing growth in the GDP of China, falling oil prices, the Greek debt default in 2015, a Brexit vote announcement, and implications of the effects of the end of quantitative easing in the United States in October 2014. In Q1 2016, the Federal Reserve directly invoked monetary tools to help prop the markets.

- In 2018, the Federal Reserve was raising interest rates and commencing quantitative tightening. The move was poorly received by the markets and even drew criticism from then-president Donald Trump. In 2018, the S&P 500 ended down 6.24%. As the markets continued to wane in mid-2019, Powell provided large-scale repurchase agreements to U.S. investment banks to boost falling asset prices.

The Fed Put and Its Impact on Market Expectations

The market’s belief in the notion of the existence of a Fed Put creates a moral hazard. That means that an investor may freely take on risk but not bear the consequence of any fallout from that risk, as it is borne by another party. That’s the expectation that the Federal Reserve would bail out any significant decline in asset prices.

Experts have argued that this belief has spurred a high level of speculation in financial markets, resulting in the 1998-2000 Internet bubble and the run-up in asset prices before the 2008 Global Financial crisis. A common term used in the financial markets is “don’t fight the Fed,” which implies not to sell or short assets as the Fed would come to the rescue. It has fueled the proliferation of dip buyers whenever financial markets face a significant fall in prices.

Will There Be a Fed Put in 2022?

So far in 2022, equity markets have suffered. Partly due to geopolitical tensions stemming from Russia and Ukraine and partly due to worries about a recession, this fall in equity prices has spurred speculation that there will be a Fed put in the near term to bail out markets. For example, in a survey conducted by Bank of America, respondents believed there would be a Fed put if the S&P 500 continues its descent to reach 3,700.

However, the problem with 2022 is that inflation has been at the highest in recent history. Partly due to supply chain issues stemming from the COVID pandemic and partly due to the same Russian-Ukraine war, inflation running out of control has been one of the most significant fears for the Fed.

As such, the Fed has been very hawkish. Beginning with a somewhat surprising 75 basis point hike in June 2022, Fed Chair Jerome Powell has signaled more aggressive hikes in the second half of 2022.

Therefore, this strongly suggests that the Fed will not be able to quickly pivot from its very restrictive monetary policy stance to an accommodative, or dovish, stance in the short term, all but eliminating the chances of a Fed Put in 2022.

Additional Resources

Thank you for reading CFI’s guide to Fed Put. To keep advancing your career, the additional CFI resources below will be useful:

Economics for Capital Markets

Economics for Capital Markets Course Overview

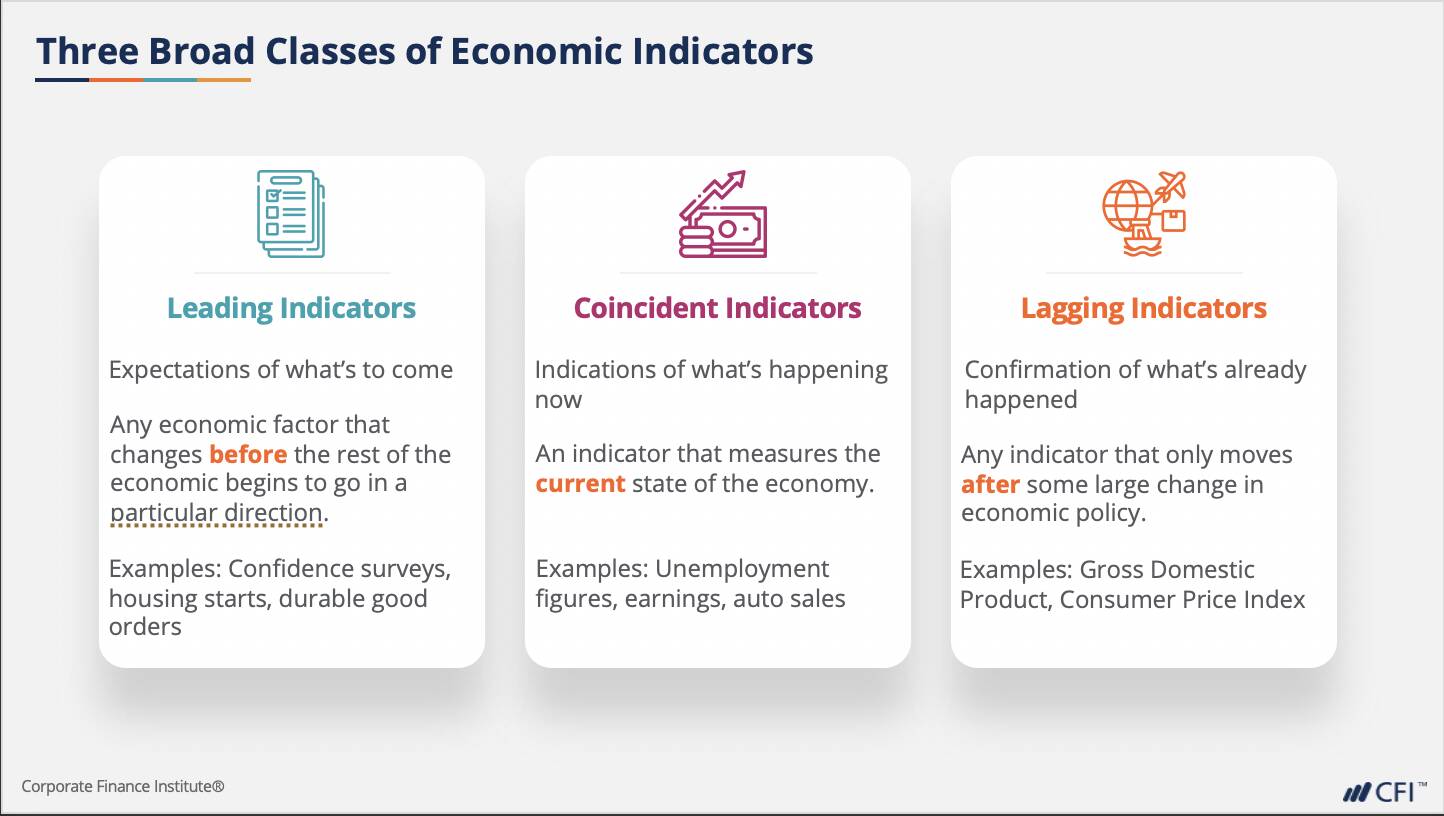

This course will cover critical economic principles that impact financial markets rather than worry about micro/macro theory. We will introduce economic events and cover how to differentiate between economic releases and economic indicators.

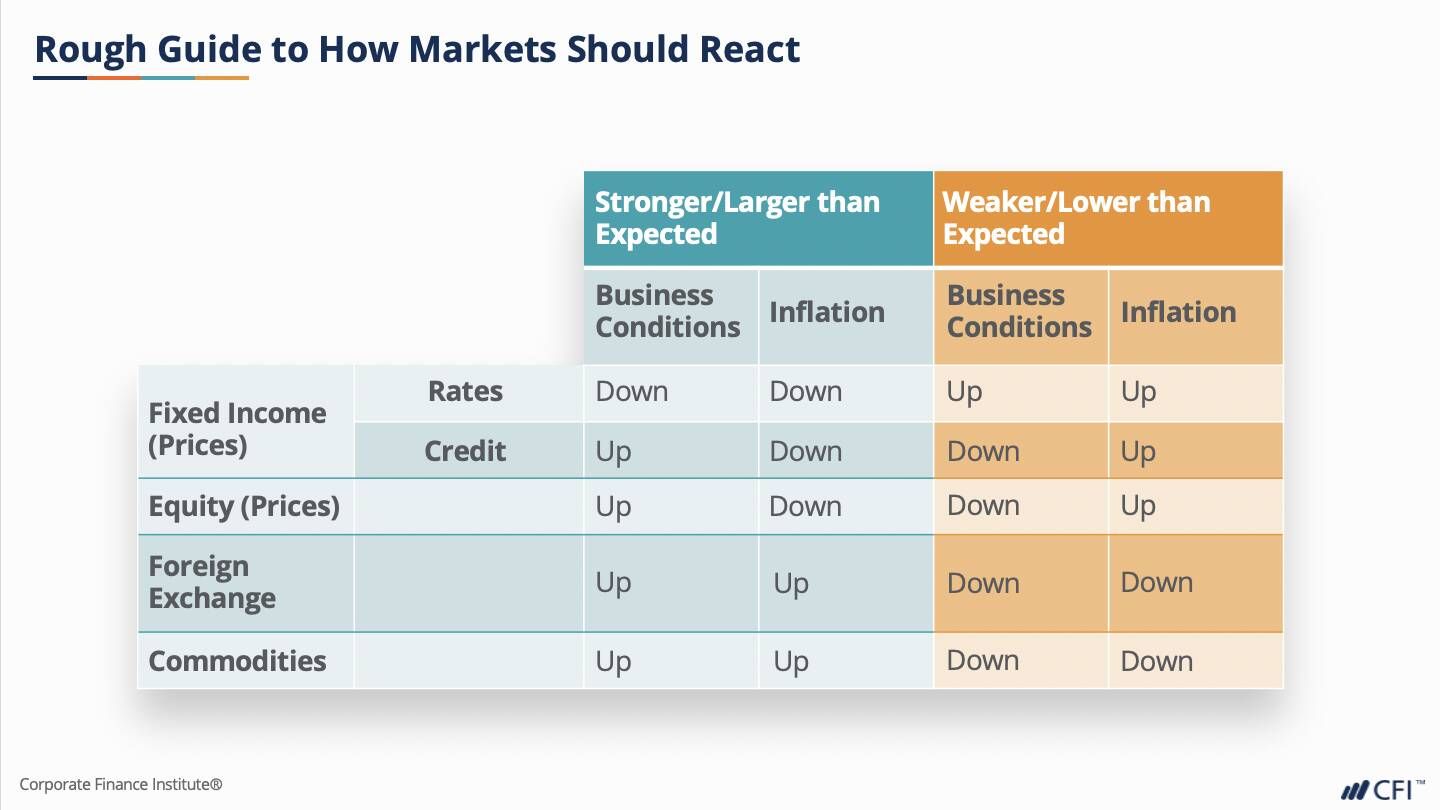

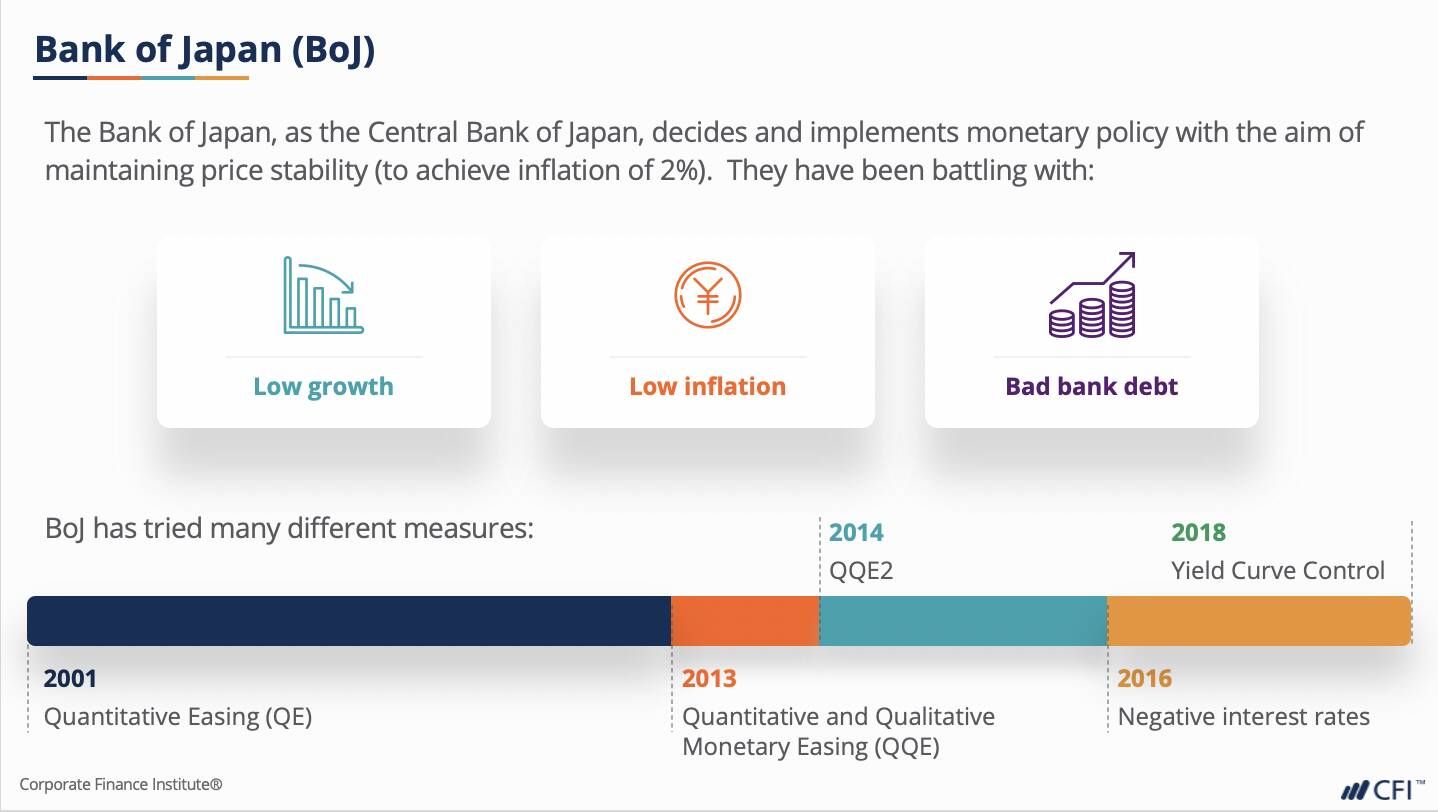

Next, we will do a quick refresher on central banks and monetary policy before we dive into specific examples such as the Federal Reserve (the Fed), European Central Bank (ECB), Bank of England, and Bank of Japan, and discuss these institutions and their policies in detail. After having learned about central banks, we will go back to economic indicators and give examples of some of the more important ones to be familiar with, such as gross domestic product (GDP), Consumer Price Index (CPI), Purchasing Managers’ Index (PMI), and building permits. Finally, we will end the course by discussing the impact on markets and how they should react to economic news vs. how they react in real life.

Economics for Capital Markets Learning Objectives

Upon completing this course, you will be able to:

- Know how economic principles impact financial markets

- Classify & interpret economic releases

- Understand central banks, their goals, and their role in the economy

- Perceive how specific economic events impact specific markets

- Grasp how market practitioners use this information to trade and invest

Who should take this course?

This Economics for Capital Markets course is perfect for anyone who would like to build a strong foundation on economic principles before jumping into financial markets, as economics forms the foundation of our monetary system. This course is designed to equip anyone who desires to begin a career in fixed income, equity, sales, trading, or other areas of finance with the fundamental knowledge of economics.

Financial Analyst Certification

Become a certified Financial Modeling and Valuation Analyst (FMVA)® by completing CFI’s online financial modeling classes!

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in