- What is the Asset Turnover Ratio?

- Formula for Asset Turnover Ratio

- Asset Turnover Ratio Example

- Comparing the Ratios

- How to Interpret the Asset Turnover Ratio

- Video Explanation of the Asset Turnover Ratio

- What is the Operating Asset Turnover Ratio?

- Formula for Operating Asset Turnover Ratio

- Operating Asset Turnover Ratio Example

- How to Interpret the Operating Asset Turnover Ratio

- Summary

Asset Turnover Ratio

A ratio that measures how efficiently a company uses its assets to generate sales

What is the Asset Turnover Ratio?

The asset turnover ratio, also known as the total asset turnover ratio, measures the efficiency with which a company uses its assets to produce sales. The asset turnover ratio formula is equal to net sales divided by the total or average assets of a company. A company with a high asset turnover ratio operates more efficiently as compared to competitors with a lower ratio.

Key Highlights

- The asset turnover ratio measures is an efficiency ratio that measures how profitably a company uses its assets to produce sales.

- Comparing the ratios of companies in different industries is not appropriate, as industries vary in capital intensiveness.

- A higher ratio is generally favorable, as it indicates an efficient use of assets.

- A lower ratio indicates poor efficiency, which may be due to poor utilization of fixed assets, poor collection methods, or poor inventory management.

Formula for Asset Turnover Ratio

The formula for the asset turnover ratio is as follows:

Where:

- Net sales are the amount of revenue generated after deducting sales returns, sales discounts, and sales allowances.

- Average total assets is the average of total assets at year-end of the current and preceding fiscal year. Note: an analyst may use either average or end-of-period assets.

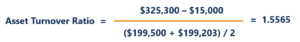

Asset Turnover Ratio Example

Company A reported beginning total assets of $199,500 and ending total assets of $199,203. Over the same period, the company generated sales of $325,300 with sales returns of $15,000.

The asset turnover ratio for Company A is calculated as follows:

Therefore, for every dollar in total assets, Company A generated $1.5565 in sales.

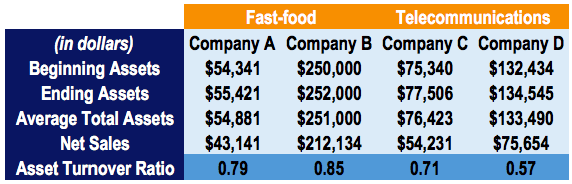

Comparing the Ratios

Consider four hypothetical companies: Company A, Company B, Company C, and Company D. Companies A and B operate in the fast-food industry, while companies C and D operate in the telecommunications industry:

The asset turnover ratio for each company is calculated as net sales divided by average total assets.

Ratio comparisons across markedly different industries do not provide a good insight into how well a company is doing. For example, it would be incorrect to compare the ratios of Company A to that of Company C, as they operate in different industries.

It is only appropriate to compare the asset turnover ratio of companies operating in the same industry. We can see that Company B operates more efficiently than Company A. This may indicate that Company A is experiencing poor sales or that its fixed assets are not being utilized to their full capacity.

How to Interpret the Asset Turnover Ratio

The asset turnover ratio measures the efficiency of how well a company uses assets to produce sales.

- A higher ratio is favorable, as it indicates a more efficient use of assets. Conversely, a lower ratio indicates the company is not using its assets as efficiently.

- Obsolete inventory or sluggish sales can lower the ratio. Same with receivables – collections may take too long, and credit accounts may pile up. Fixed assets such as property, plant, and equipment (PP&E) can be unproductive instead of being used to their full capacity.

- The asset turnover ratio can vary greatly depending on the industry. Industries with low profit margins tend to generate a higher ratio, and capital-intensive industries tend to report a lower ratio.

Video Explanation of the Asset Turnover Ratio

Watch this short video to quickly understand the definition, formula, and application of this financial metric.

What is the Operating Asset Turnover Ratio?

The operating asset turnover ratio, an efficiency ratio, is a variation of the total asset turnover ratio and identifies how well a company is using its operating assets to generate revenue.

Operating assets are assets that are essential to the day-to-day operations of a business. In other words, operating assets are the assets utilized in the ordinary income-generation process of a business.

Formula for Operating Asset Turnover Ratio

Operating Asset Turnover Ratio Example

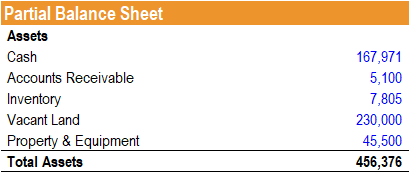

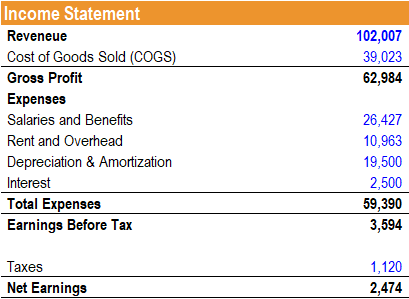

Jeff is an equity analyst and is looking to determine the efficiency of a company’s use of its assets. A partial balance sheet of the company is provided as follows:

Additionally, the income statement of the company is provided as follows:

Jeff notes that the company’s balance sheet includes a line item for vacant land at $230,000. He decides to use a variation of the total asset turnover – the operating asset turnover to account for the vacant land that is not currently used in the company’s operations. He calculates the ratio as follows:

Operating Asset Turnover Ratio = (167,971 + 5,100 + 7,805 + 45,500) / 102,007 = 2.22

Therefore, for every dollar invested in its operating assets, $2.22 of revenue is generated.

How to Interpret the Operating Asset Turnover Ratio

The operating asset turnover ratio indicates how efficiently a company is using its operating assets to generate revenue.

- A higher ratio is desirable, as it shows that a company is better at utilizing its operating assets to generate revenue.

- Although not as commonly used as the total asset turnover ratio, the operating asset turnover ratio is used when a company holds large assets on its books that are not pertinent to its operations.

- The ratio excludes such line items in its calculation and, thus, provides information regarding how well revenue-generating assets are being utilized.

- There is no absolute “ideal” operating asset turnover ratio. The ratio should be analyzed relative to that of competitors or the industry average.

- Comparing the ratio across industries does not provide a strong insight, as the operating asset requirement and revenue-generation capabilities differ significantly among industries.

Summary

The asset turnover ratio measures how efficiently a company uses its assets to generate sales, calculated as net sales divided by total or average assets.

A higher ratio indicates better efficiency, while a lower ratio suggests poor use of assets, possibly due to underutilized fixed assets, weak collections, or poor inventory management. Comparisons should only be made within the same industry, as capital intensity varies widely.

A variation, the operating asset turnover ratio, focuses only on operating assets, or assets directly involved in daily operations, by excluding non-operating items like vacant land. It provides a clearer measure of revenue generation efficiency. A higher ratio reflects stronger performance, but again, it should only be compared against industry peers.

Both ratios highlight how well a company utilizes resources to drive sales.