Cash Conversion Ratio

The ratio of the cash flow of a company to its net profit

What is the Cash Conversion Ratio (CCR)?

The Cash Conversion Ratio (CCR), also known as cash conversion rate, is a financial management tool used to determine the ratio of a company’s cash flows to its net profit. In other words, it is a comparison of how much cash flow a company generates compared to its accounting profit.

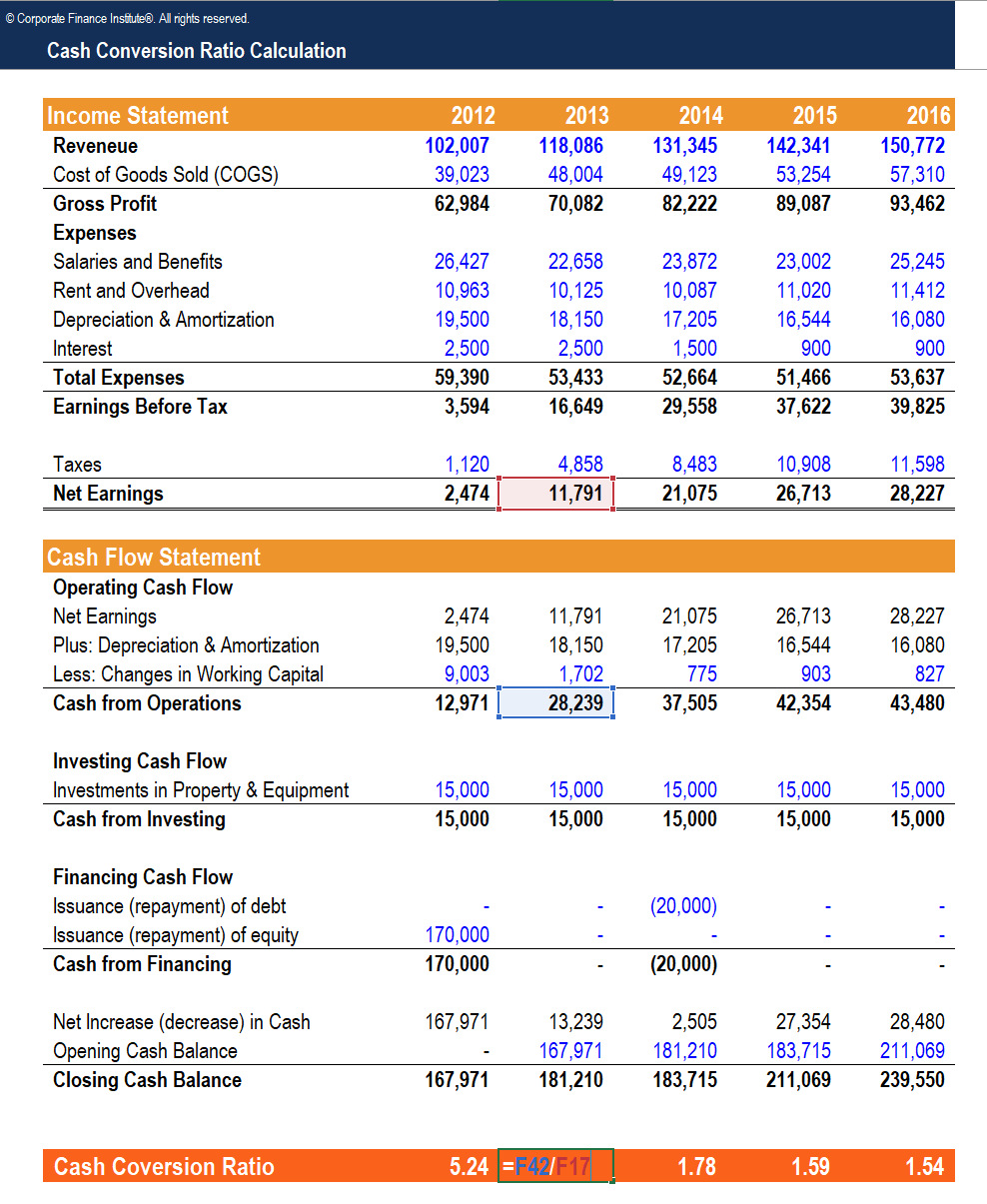

Understanding Cash Conversion Ratio Calculations

When calculating CCR, cash flow is the center of the equation. It is used to determine all cash generated in a given financial period – often quarterly or annually, depending on the company’s accounting cycles.

Cash Flow is generally broken down into three categories:

- Operating activities – Cash generated from the operation of the business

- Investing activities – Covers all purchases and sales of long-term investments and assets

- Financial activities – Covers all transactions related to raising (or repaying) capital

In this case, we want Cash Flow from Operations, or Free Cash Flow (which is equal to operating cash flow minus capital expenditures).

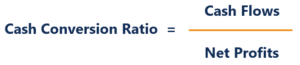

Once cash flow is determined, the next step is dividing it by the net profit. That is the profit after interest, tax, and amortization. Below is the cash conversion ratio formula.

The resulting ratio from this calculation can be either a positive value or a negative value. It can be summarized as: if the ratio is anything above 1, it means that the company possesses excellent liquidity, while anything below 1 implies a weak CCR. Anything negative suggests the company is incurring losses.

Download CFI’s Free Cash Conversion Ratio Template

Key Takeaways

Below are some of the takeaways from calculating the Cash Conversion Ratio of a given company.

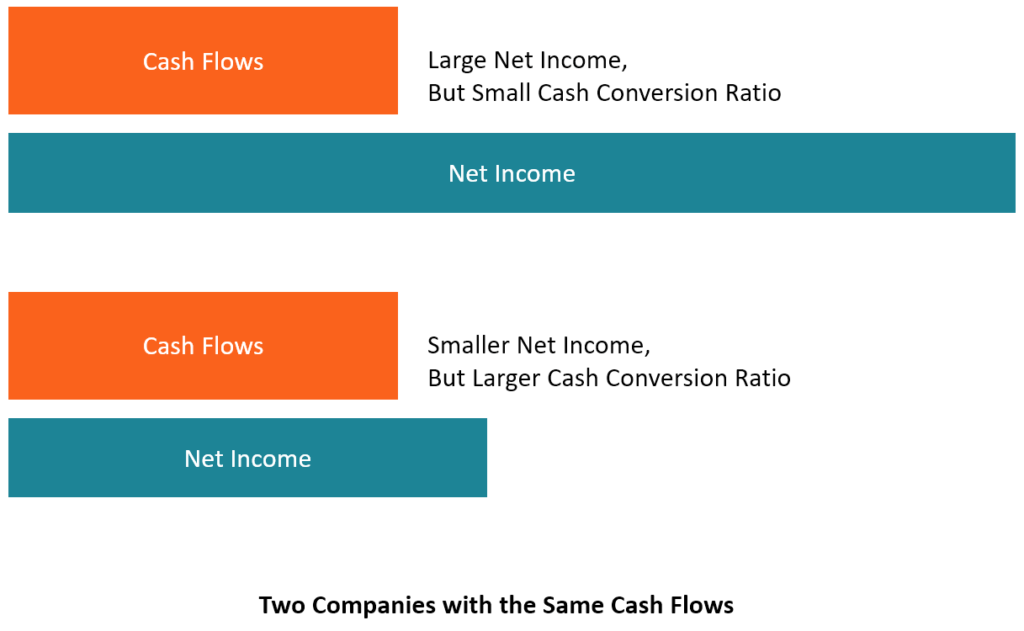

1. CCR is a quick way to determine the disparity between a company’s cash flow and net profit

A high cash conversion ratio indicates that the company has excess cash flow compared to its net profit. For mature companies, it is common to see a high CCR because they tend to earn considerably high profits and have accumulated large amounts of cash.

In contrast, companies in the start-up or growth stage tend to have low or even negative cash flows due to the required amount of capital invested in the business. In early stages, companies often find themselves earning negative profits until they reach a break-even point, thus the CRR of these companies would also be negative or low.

2. It is a tool for management decisions

While a high CRR could be a good sign for liquidity, having too much excess cash might imply that the company is not utilizing its resources in the most effective way. The company should consider re-investing in profitable projects or expanding its operations to further enhance the profitability of the business.

When the ratio is low or negative, it could be an indication that the company needs to adjust its operations and start figuring out which activities are sinking its income or whether it needs to expand its market share or increase sales in favor of revamping cash flows.

3. It is an investing indicator tool

To investors, what matters is whether a given company is generating enough cash flow to provide a solid return per share. Thus, significant investment opportunities will offer a higher ratio, while a weak investment will show a lower ratio.

However, some companies may dubiously try to alter the ratio, especially the cash flow part, to attract investors. That’s why proper scrutiny of the books of accounts should be conducted first before making an investment decision based on CCR.

Terms Related to Cash Conversion Ratio

There are familiar terms that look similar to the cash conversion ratio, but they carry a different meaning. They include:

Cash conversion cycles (CCC)

CCC is used for measuring management effectiveness by determining how fast a company can convert cash inputs into cash flows over a given production and sales period.

Conversion cycle

In portfolio management, it is used to determine the number of the common shares which a company has been receiving at a specific time of conversion of each convertible security. That is the ratio of per value of convertible bond divided by the conversion price of equity.

Other resources

Thank you for reading CFI’s guide to Cash Conversion Ratio. To keep advancing your career, the additional CFI resources below will be useful: