Wage Expense

The cost incurred by an organization to compensate employees and contractors for work performed over a specific time period

What is a Wage Expense?

Wage expense refers to the cost incurred by an organization to compensate employees and contractors for work performed over a specific time period.

Summary

- Wage expense is a type of variable-rate cost.

- There are three main types of wage expenses: (1) times wages, (2) piece wages, and (3) contract wages.

- Wage expense is typically combined with other expenses on the income statement.

Wage Expense vs. Salary Expense

The difference between wages and salaries is often poorly understood. Understanding the difference between wage expense and salary expense allows an analyst to better forecast the costs of an organization.

- Wage expense is a variable-rate cost, which depends on the type of wage (e.g., a time wage, piece wage, or contract wage).

- Salary expense is a fixed-rate cost and depends on each employee’s salary contract terms.

Example: The following illustrates the amount paid to an employee by an organization over the past three months. Is it an example of wage expense or salary expense?

Answer: Given the variable nature of the payment each month, the above is an example of wage expense.

Types of Wage Expenses

There are three main types of wage expenses:

- Time wages are based on the amount of time worked – for example, an hourly wage of $10.

- Piece wages are based on the number of units produced – for example, a piece wage of $5 per widget produced.

- Contract wages are based on the number of completed works under a contract – for example, a wage of $10,000 per house built under a development contract.

Practical Example

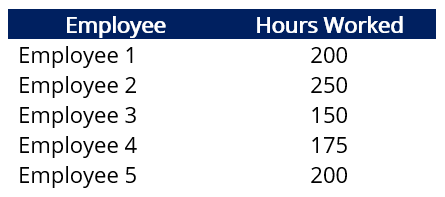

Background Information: A company currently employs five individuals. Employees 1 and 2 are each paid $6,000 per month, while Employees 3, 4, and 5 are paid $15 per hour. The following shows the number of hours worked by each employee for the month of January:

Question: Determine the wage expense and salary expense for the month of January.

Answer: Employees 1 and 2 are each paid $6,000 per month (salary). The salary expense for the month of January is $12,000. Employees 3, 4, and 5 are paid $15 per hour. In aggregate, they worked 525 hours. The wage expense for the month of January is 525 x $15 = $7,875.

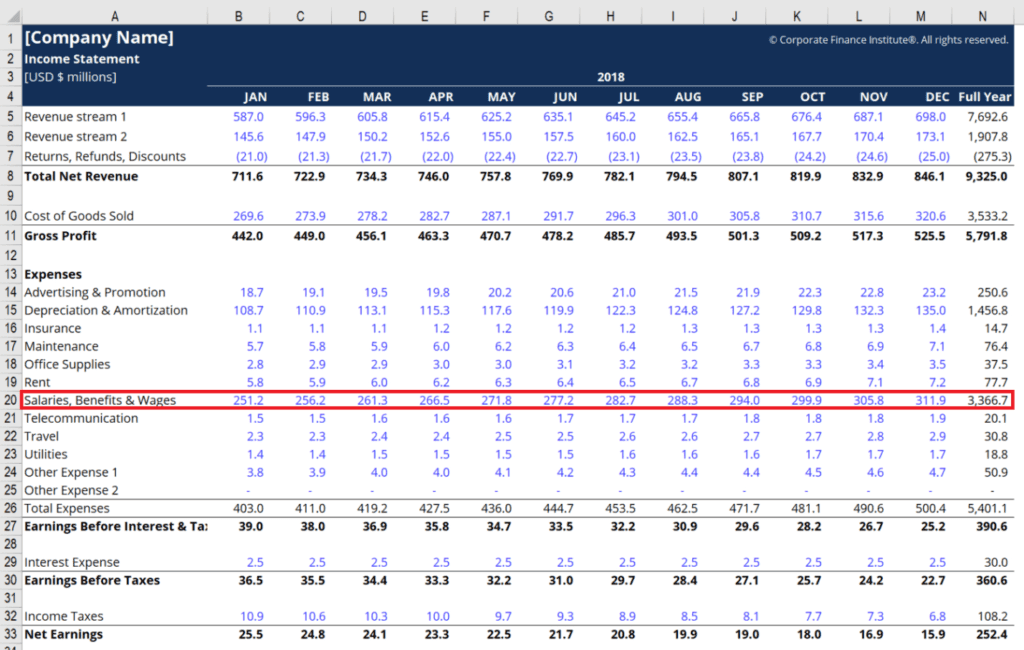

Wage Expense on the Income Statement

Wage expense on the income statement is typically combined with similar expenses, as shown below.

For companies that produce goods (i.e., manufacturing companies), a portion of their wage expense may be aggregated into costs of goods sold (COGS) on the income statement. As you may recall, COGS refers to direct costs related to the production of goods, which include the cost of materials, labor, and manufacturing overhead.

As an example, assume that a manufacturing company incurred a wage expense of $200,000 for the fiscal year 2020. Of the $200,000, 25% relate to wages for factory workers while the remaining relate to wages for workers at the head office.

In such a scenario, only $150,000 would be classified as wage expense on the company’s income statement. The remaining $50,000 would be aggregated into COGS (assuming the products produced by the factory workers are sold in the same year).

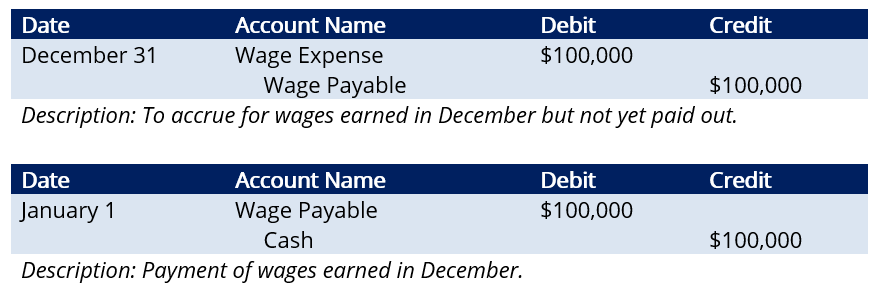

Accrual Method of Accounting for Wage Expense

Companies commonly prepare financial statements on an accrual basis. Below, we illustrate the journal entries for wage expense.

Background Information: Company A pays its employees on the first day of the next month. For example, wages for work done in the month of December are paid on the first day of January.

Question: Wages for employees in the month of December totaled $100,000. What would be the relevant journal entries?

Answer:

Related Readings

CFI offers the Financial Modeling & Valuation Analyst (FMVA®) certification program for those looking to take their careers to the next level. To keep learning and developing your knowledge base, please explore the additional relevant resources below: