- What Is a Corporation in Business?

- Incorporation: How a Corporation Is Formed

- What Are the Common Types of Corporations?

- How Do Corporations Work?

- What Are the Advantages and Disadvantages of Incorporation?

- How Does a Corporation Dissolve?

- Frequently Asked Questions

- What is a corporation in simple terms?

- What makes a business a corporation?

- What is the difference between a corporation and an LLC?

- What is the difference between a company and a corporation?

- More Information and Next Steps

- Additional Resources

What Is a Corporation?

A corporation is a legal business structure that operates independently of its owners, offering limited liability and the ability to own assets, pay taxes, and enter into contracts.

What Is a Corporation in Business?

A corporation is a legal entity created by individuals, stockholders, or shareholders, with the purpose of operating a business for profit. A corporation, by definition, exists as a separate legal structure from its owners and is recognized under state laws. This separation provides limited liability protection, meaning the corporation (not its owners) is responsible for debts and legal obligations.

A legally incorporated business can:

- Enter into contracts

- Own property and assets

- Remit federal and state taxes

- Sue or be sued

- Raise capital through issuing stock

- Operate continuously, regardless of ownership changes

Corporations are commonly chosen for their ability to scale, attract investors, and limit personal liability for their owners.

Incorporation: How a Corporation Is Formed

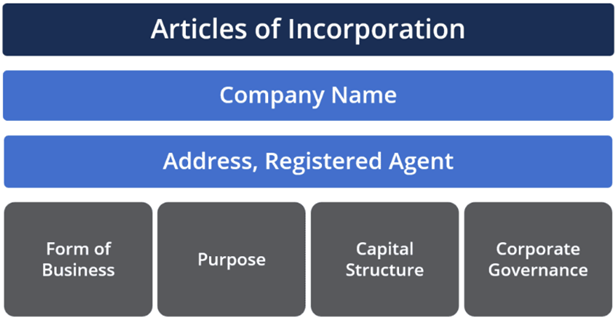

The process of incorporation involves filing Articles of Incorporation with a state agency, paying registration fees, and defining the business’s legal structure. Key details typically include:

- Business name and physical location

- Primary purpose of the corporation

- Number and type of stock issued

- Identification of directors and officers

Once incorporated, a corporation becomes a separate entity, responsible for its own taxes and obligations. This structure enables businesses to grow, raise funds, and operate with a professional governance framework.

What Are the Common Types of Corporations?

A corporation can be formed by a single shareholder or by a group of investors pursuing a shared goal. Depending on the business model, it may be registered as either a for-profit or non-profit organization.

- For-profit corporations are designed to generate income and distribute profits to shareholders.

- Non-profit corporations support charitable, educational, religious, or scientific causes. Instead of issuing dividends, they reinvest surplus revenue into their mission.

Comparison Table: Types of Corporations

| C Corporation | Large or growing businesses | Double taxation | Unlimited shareholders (U.S. or foreign) | Easier to raise capital, grant employee stock options |

| S Corporation | Small U.S.-based businesses | Pass-through taxation | Max 100 U.S. shareholders | Avoids double taxation, retains limited liability |

| Non-Profit | Charitable or social orgs | Tax-exempt (IRS 501(c)(3)) | No shareholders; governed by the board | Eligible for grants, donations, tax-deductible funding |

Businesses can choose from several corporate structures depending on their goals, tax treatment, and ownership model. The most common types include:

1. C Corporation

C Corporation is the most common form of incorporation among businesses. Owners receive profits and are taxed at the individual level, while the corporation itself is taxed as a business entity.

- Taxation: Subject to double taxation — once at the corporate level and again when dividends are distributed to shareholders.

- Shareholder rules: No limits on number or type of shareholders; allows foreign and institutional ownership.

- Structure: Governed by a board of directors and operated by corporate officers.

- Common use cases: Public companies, venture-backed startups, multinational firms.

This structure offers flexibility for raising capital by issuing stock and is often favored by businesses seeking outside investment.

2. S Corporation

S Corporation is created in the same way as a C Corporation but is different in owner limitation and tax purposes. An S Corporation consists of up to 100 shareholders and is not taxed as separate — instead, the profits/losses are shouldered by the shareholders on their personal income tax returns.

- Taxation: Pass-through taxation — income and losses are reported on shareholders’ personal tax returns.

- Shareholder rules: Limited to 100 shareholders, all of whom must be U.S. citizens or residents.

- Structure: Operates like a C Corp, with a board of directors and corporate officers.

- Common use cases: Family-owned businesses, small professional firms, closely held companies.

S Corps can be a smart choice for small business owners who want legal protection without double taxation.

3. Non-Profit Corporation

Commonly used by charitable, educational, and religious organizations to operate without generating profits. A non-profit is exempt from taxation. Any contributions, donations, or revenue received are retained in the entity to spend on operations, expansion, or future plans.

- Taxation: Exempt from federal income tax under IRS section 501(c)(3), if qualifications are met.

- Ownership rules: No shareholders; governed by a board of directors.

- Structure: Must follow strict governance and reporting guidelines.

- Common use cases: Charities, religious groups, educational foundations, advocacy organizations.

Profits generated by a non-profit must be reinvested in the organization’s mission — not paid out to shareholders.

How Do Corporations Work?

Corporations are owned by shareholders who invest money in exchange for stock. Each share typically gives its owner one vote in important company matters, including the election of the board of directors. The board is responsible for overseeing big-picture decisions and appointing officers — like the CEO, CFO, or vice presidents — to handle daily operations.

Shareholders don’t run the business’ day-to-day operations, but they can be elected to the board. This setup separates ownership from management, which allows shareholders to invest in the company without needing to be involved in its daily activities.

Board members are expected to act in the best interest of the company and its shareholders. To stay organized and legally compliant, corporations follow key governance practices like:

- Holding regular annual meetings

- Following established corporate bylaws

- Meeting state legal requirements

- Issuing stock and tracking ownership through a cap table

This structure helps ensure the business is well-managed and accountable to its owners.

What Are the Advantages and Disadvantages of Incorporation?

Incorporating your business brings significant benefits — but also comes with some trade-offs. Below, we break down the key pros and cons to help you understand how forming a corporation compares to other business structures like partnerships or sole proprietorships.

Advantages

Corporations offer a number of structural and financial benefits that can help your business grow, raise capital, and reduce personal risk.

- Separate legal entity – Independent from its owners and considered a legal entity that may conduct business, own properties, enter into binding contracts, borrow money, sue and be sued, and pay taxes.

- Unlimited life – Stockholders, shareholders, or members are the owners of a corporation, and it is managed by a board of directors. Their death or inability to perform their duties does not affect the continuity of this legal entity; only changes in the company’s charter will enable it to either be extended or liquidated.

- Limited liability – Company owners are only liable for the amount they invested. Creditors and lenders have no claim to the owners’ personal assets for payments owed by the shareholders.

- Easy transfer of ownership shares – Publicly held corporations do not require approval from other stockholders to sell the stocks or shares of individual owners. Stocks or shares can be easily traded in the market, regardless of their volume.

- Competent management – Investors or owners may not directly handle day-to-day business operations. They vote for the board of directors who eventually hires a professional management team.

- Source of capital – Corporations can source funds from selling stocks and issuing bonds.

Disadvantages

While incorporating provides legal and financial benefits, it can also involve higher costs, more paperwork, and tax complexities.

- Incorporation costs – It is costlier to go through the process of incorporation than to form a sole proprietorship or partnership.

- Double taxation – Two taxes are remitted, from the corporate earnings and from payments of dividends to shareholders.

- Documentation – Aside from incorporation documents, companies must file annual reports and tax returns, as well as maintain detailed accounting records, licenses, and other important documents.

How Does a Corporation Dissolve?

While corporations can exist indefinitely, there are times when the business needs to close. This is called dissolution, and it can happen voluntarily or involuntarily, depending on the situation.

What Is Dissolution?

Dissolution is the legal process of shutting down a corporation. It includes settling debts, distributing any remaining assets, and officially ending the business with the state.

- Voluntary dissolution happens when the company’s owners or board decide to close the business. For example, if the company has completed its purpose, wants to restructure, or merge with another business.

- Involuntary dissolution happens when outside parties, like creditors or the government, force the company to close. This often happens due to unpaid taxes, legal violations, or financial trouble.

What Happens to the Corporation’s Assets?

Once a corporation is set to dissolve, the liquidation process begins:

- A person or team is appointed to handle the closure.

- Business assets are sold to raise cash.

- That money is used to pay off any debts the company owes.

- Any leftover funds are given to shareholders, based on how much ownership they hold.

- Final paperwork is submitted to the state to officially close the business.

Even during closure, shareholders are generally not personally responsible for the company’s debts, unless they’ve personally guaranteed a loan or committed fraud.

Frequently Asked Questions

What is a corporation in simple terms?

A corporation is a legal business structure that exists separately from its owners. It can enter contracts, own assets, pay taxes, and be held liable without exposing its shareholders to personal financial risk.

What makes a business a corporation?

A business becomes a corporation when it is legally incorporated by filing articles of incorporation with the state. This gives it a separate legal identity and allows it to issue stock, raise capital, and provide limited liability to its owners.

What is the difference between a corporation and an LLC?

The main difference is how they’re taxed and managed. A corporation has shareholders and a board of directors and may face double taxation. An LLC is more flexible, with pass-through taxation and fewer formal requirements.

What is the difference between a company and a corporation?

“Company” is a general term for a business, while a “corporation” refers to a specific legal structure that is incorporated under state law. All for-profit corporations are companies, but not all companies are corporations.

More Information and Next Steps

Understanding how corporations work is just one part of building a strong foundation in business and finance. Whether you’re exploring different business structures or preparing to launch a company, it’s important to know how corporations compare to other entities and how they fit into the broader legal and financial landscape.

If you’re looking to build deeper knowledge in financial analysis, corporate structure, and valuation, CFI’s certification programs are designed to help you take the next step.

Recommended Learning Paths:

- Financial Modeling Courses

- Valuation Courses

- Financial Modeling & Valuation Analyst (FMVA®) Certification

- Financial Planning & Analysis Professional (FPAP™) Certification

Additional Resources

Explore more free learning materials from CFI: