Negative Convexity

Occurs when a bond's duration increases in conjunction with an increase in yield

What is Negative Convexity?

Negative convexity occurs when a bond’s duration increases in conjunction with an increase in yield. The bond price will drop as the yield grows. When interest rates fall, bond prices rise; however, a bond with negative convexity diminishes in value as interest rates decline.

In order to fully understand negative convexity, it is important to first understand convexity, bond prices, bond yields, interest rates, and bond duration.

Summary

- Negative convexity occurs when a bond’s duration increases in conjunction with an increase in yields.

- Convexity is the measure of the curvature in the relationship between a bond’s yield and its price. Convexity illustrates how, as interest rates change, the duration of a bond fluctuates.

- The relationship between bond prices and interest rates is negative.

Convexity

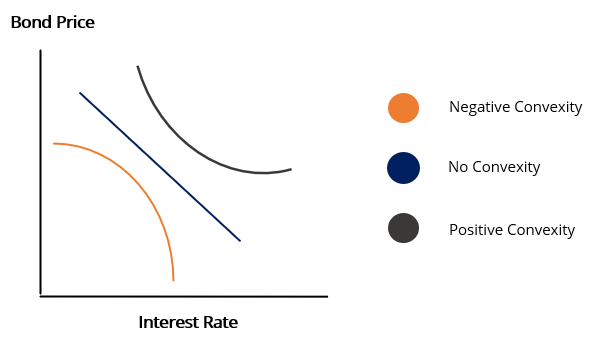

Convexity is the measure of the curvature in the relationship between a bond’s yield and its price. It illustrates how, as interest rates change, the duration of a bond fluctuates.

Bond Prices and Interest Rates

There is a negative link or relationship between bond prices and interest rates:

- As interest rates grow or rise, bond prices decrease or fall.

- When interest rates decrease or fall, bond prices grow.

The negative relationship can be attributed to the concept that as rates rise, the bond may lag in the earnings it offers a potential investor.

Bond Yields and Interest Rates

- As interest rates rise, bonds entering the market will have higher yields, as they are issued at new, higher rates.

- As rates increase, investors demand a greater yield from the bonds they purchase. Hence, when interest rates rise, issuers of such instruments should also raise their yields to remain competitive.

Bond Duration

Bond duration helps in measuring how much a bond’s price changes as interest rates fluctuate. Given a high duration, a bond’s price will move in the inverse direction of interest rate fluctuations to a greater degree. The opposite is also true; a lower duration means that the bond price will display less movement.

Modified Duration

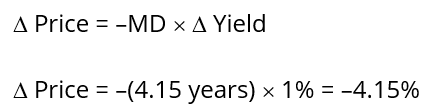

Following the assumption that a change in price remains constant with an increase or decrease in yield, the modified duration measures the degree of change in a bond’s price. The adjustment in the bond price according to the change in yield is convex. It helps in improving price change estimations.

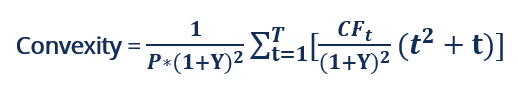

Bond Convexity Formula

Where:

- P: Bond price

- Y: Yield to maturity

- T: Maturity in years

- CFt: Cash flow at time t

Calculating Convexity

Here is an Excel example of calculating convexity:

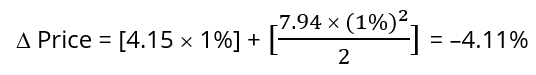

The results in our example demonstrate that a convexity of 7.94 can be used to predict the price change with a percentage change in yield that would be the following:

Using the Modified Duration

It shows that the price would decrease by $40.34.

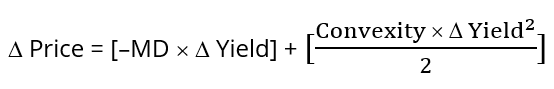

In order to properly take the convexity graph shape, as seen in the graph at the beginning of this article, the price change formula must be adjusted to:

Here is the Adjusted Price Change calculation:

It shows that the price will decrease by $39.95 and not by $40.34.

Conclusion

- The price of the bond with the modified duration is $902.44 with a 1% growth in yield.

- The price of the bond with modified duration and convexity is $902.82 at a 1% growth.

- The 0.99 difference in the price change is attributed to the non-linearity of the price yield curve.

Convexity as a Risk Management Tool

Convexity can be used to determine the risk level of a bond – the greater the convexity of the bond, the greater the sensitivity of its price to interest rate movements.

If two bonds are being analyzed for investment purposes and they have comparable yields and durations, the bond with the higher convexity is preferable in falling or stable interest rate environments, as the change in price is larger.

Reiterating Negative Convexity

Now, after gaining an understanding of convexity, we can return to our basis – negative convexity.

Convexity can be either negative or positive:

1. Positive convexity

It occurs when the duration and the yield of a bond decrease or increase together, thus they are positively correlated. The yield curve for bonds with positive convexities usually follows an upward movement.

2. Negative convexity

It occurs when there is an inverse relationship between the yield and the duration. It means that with a decline in duration, there is an increase in yield. Therefore, they are negatively correlated. The yield curve for a bond with a negative convexity usually follows a downward movement.

Related Readings

CFI is the official provider of the global Capital Markets & Securities Analyst (CMSA®) certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career, the additional CFI resources below will be useful: