- What Are Preferred Shares?

- Key Features of Preferred Shares

- Types of Preferred Shares

- 1. Cumulative Preferred Shares

- 2. Non-Cumulative Preferred Shares

- 3. Convertible Preferred Shares

- 4. Callable Preferred Shares

- 5. Participating Preferred Shares

- Comparison Table: Types of Preferred Shares

- How Preferred Shares Work in Practice

- Real-World Examples

- Case Study 1: JPMorgan Chase 2023 Preferred Share Issuance

- Case Study 2: Royal Bank of Canada (RBC) 2022 Series B

- Advantages & Disadvantages of Preferred Stock

- Advantages for Investors

- Advantages for Issuers

- Disadvantages for Investors

- Disadvantages for Issuers

- Quick Pros vs. Cons Table

- Valuation Methods for Preferred Shares

- A. Fixed-Rate Preferred Shares — Dividend Discount Model (DDM)

- B. Callable Preferred Shares — Yield-to-Call (YTC)

- C. Rate-Reset Preferred Shares — Projected Reset Rate

- How to Invest in Preferred Shares

- A. Primary Market (New Issuances)

- B. Secondary Market (Stock Exchange)

- C. Preferred Share ETFs and Funds

- Considerations Before Buying

- Key Takeaways

- Ready To Launch Your Career in Capital Markets?

Preferred Shares

A senior class of equity

What Are Preferred Shares?

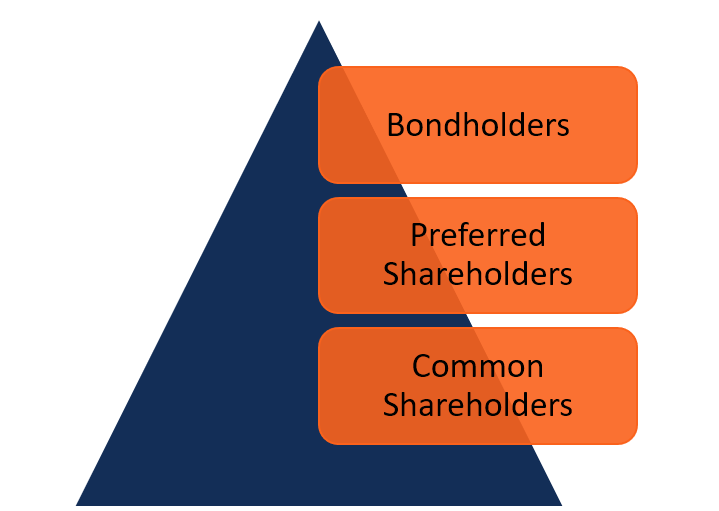

Preferred shares, also called preferred stock, are a unique class of equity ownership in a company, but with bond-like features such as fixed dividends. Investors buy preferred shares for steady dividend income and potentially higher yields. Preferred shareholders are also paid before common shareholders, but after debt holders, in the event of liquidation.

Companies issue preferred shares to raise capital without diluting voting control. This guide covers what preferred shares are, how they work in practice, real-world issuance examples, types, pros and cons, tax treatment, valuation, and how to invest.

Key Features of Preferred Shares

Preferred shares have a special combination of features that differentiate them from debt or common equity. Although the terms may vary, the following features are common:

- Preference in assets upon liquidation: The shares provide their holders with priority over common stockholders to claim the company’s assets upon liquidation.

- Dividend payments: The shares provide dividend payments to shareholders. The payments can be fixed or floating, based on an interest rate benchmark such as SOFR.

- Preference in dividends: Preferred shareholders have a priority in dividend payments over the holders of the common stock.

- Non-voting: Generally, the shares do not assign voting rights to their holders. However, some preferred shares allow their holders to vote on extraordinary events.

- Convertibility to common stock: Preferred shares may be converted to a predetermined number of common shares. Some preferred shares specify the date at which the shares can be converted, while others require approval from the board of directors for the conversion.

- Callability: The shares can be repurchased by the issuer on specified dates.

Key Features: Preferred Shares vs Common Shares

Dividend Payments Usually a fixed rate, but can be a floating rate, stated in terms of par value, based on a benchmark such as SOFR Vary based on company performance

Voting Rights Typically none Yes

Liquidation Priority Higher than common stockholders Lowest priority

Price Volatility Usually less volatile than common stock, but more volatile than bonds High volatility

Types of Preferred Shares

Preferred shares can be structured in various ways to meet the needs of both the issuer and the investor. Here are the main types, with practical explanations and examples.

1. Cumulative Preferred Shares

- Definition: Unpaid dividends accumulate until the issuer pays them in full before any common dividends are distributed.

- Investor Benefit: Protects income stream during periods when a company skips dividends.

- Example: A manufacturing company temporarily suspends dividends during a downturn. Holders of cumulative preferred shares later receive all missed payments once the company resumes payouts.

2. Non-Cumulative Preferred Shares

- Definition: If the issuer skips a dividend payment, it is lost — there is no accumulation.

- Investor Risk: Lower income protection in adverse conditions.

- Example: Many bank-issued preferreds are non-cumulative due to bank-specific regulatory requirements.

3. Convertible Preferred Shares

- Definition: Can be exchanged for a set number of common shares, often at the holder’s option.

- Investor Benefit: Offers upside potential if the company’s common stock price rises.

- Example: A tech company issues convertible preferreds with a conversion ratio of 5:1 if its common stock trades above $50 for 30 consecutive days.

4. Callable Preferred Shares

- Definition: Issuer has the right to redeem shares at a predetermined price after a set date.

- Investor Risk: Shares may be called when interest rates drop, forcing reinvestment at lower yields.

- Example: Utility companies often issue callable preferreds to refinance at cheaper rates if market conditions improve.

5. Participating Preferred Shares

- Definition: Provide additional dividends if the company exceeds specific profit thresholds, plus priority in liquidation.

- Investor Benefit: Combines income stability with some performance-based upside.

Example: Private equity-backed firms sometimes use participating preferreds in deal structures.

Comparison Table: Types of Preferred Shares

Cumulative

Non-Cumulative

Convertible

Callable

Participating

How Preferred Shares Work in Practice

When a company issues preferred shares, it typically sets:

- Par value (face value per share)

- Dividend rate (e.g., 5% annually)

- Payment schedule (quarterly, semi-annual)

- Special clauses such as convertibility into common shares or callability (issuer can redeem at a set price).

Dividends are paid before any common stock dividends. If dividends are cumulative, unpaid preferred dividends roll forward until paid in full. Non-cumulative preferreds don’t carry over unpaid dividends.

Example:

If ABC Bank issues $100 million in 5% preferred shares, each with a par value of $25, investors receive $1.25 per share annually (5% × $25), typically in quarterly installments of $0.3125.

Real-World Examples

Case Study 1: JPMorgan Chase 2023 Preferred Share Issuance

In March 2023, JPMorgan issued $500 million of non-cumulative preferred shares with a fixed dividend rate of 5.75%. The issuance allowed the bank to strengthen its Tier 1 capital ratio without diluting common shareholders’ voting rights.

- Type: Non-cumulative preferred stock, Series JJ

- Ticker: JPM PRJ (NYSE)

- Par Value: $25

- Dividend: 6.00% fixed, paid quarterly

- Call Date: March 1, 2028

- Purpose: Increase Additional Tier 1 capital under Basel III without voting dilution

- Source: SEC Prospectus

Case Study 2: Royal Bank of Canada (RBC) 2022 Series B

RBC issued CAD $350 million in rate-reset preferred shares, offering a 4.90% dividend for the first five years, after which the rate resets based on the Government of Canada five-year bond yield plus a 3.5% spread. This structure offers income stability initially and some protection against interest rate changes.

- Type: Non-cumulative 5-year rate-reset preferred shares, Series B

- Ticker: RY.PR.B (TSX)

- Par Value: CAD $25

- Initial Rate: 4.90% until August 24, 2027

- Reset Formula: GoC 5-year bond yield + 3.50% spread

- Call Date: At first reset date

- Purpose: Boost Tier 1 capital under OSFI Basel III rules

- Source: RBC Investor Relations

Advantages & Disadvantages of Preferred Stock

Understanding both the benefits and drawbacks of preferred stock is crucial for making informed investment or corporate financing decisions.

Advantages for Investors

- Stable Income: Fixed dividend payments provide predictable returns.

- Priority in Liquidation: Higher claim than common stockholders if the company is liquidated.

- Moderate Volatility: Less volatile than common stock, though often more volatile than bonds due to interest rate sensitivity and limited liquidity.

- Potential Tax Benefits: Preferred dividends receive favorable tax treatment compared to interest income in some jurisdictions. For example, qualified dividend rates for individuals in the U.S. or the dividends received deduction for corporations.

Advantages for Issuers

- No Voting Dilution: Preferred shareholders generally have no voting rights.

- Flexible Financing: Can be structured with features such as cumulative, callable, or convertible to suit investor demand.

- Attractive to Institutional Investors: Banks, insurers, and pension funds often favor preferreds for their income stability and tax or accounting benefits.

Disadvantages for Investors

- Limited Upside: Price appreciation is usually lower than common stock.

- Interest Rate Sensitivity: Prices might decline when interest rates rise.

- Call Risk: Callable shares may be redeemed early, especially in falling rate environments.

- Dividend Suspension Risk: Cumulative preferreds protect investors by accruing unpaid dividends, but payment may be delayed if the issuer faces financial stress. Non-cumulative dividends can be lost permanently.

Disadvantages for Issuers

- Fixed Dividend Obligation: Can strain cash flow during downturns, and dividend suspensions can hurt reputation and future funding costs.

- Potentially Higher Cost: Preferred dividend rates might be higher than interest on comparable debt.

- Credit Rating Impact: Large preferred issuances can affect leverage ratios. Rating agencies often classify preferreds as hybrid instruments (part equity, part debt), so the impact varies with structure.

Quick Pros vs. Cons Table

Investors Stable income, priority claim, moderate volatility, possible tax benefits Limited upside, interest rate risk, call risk, possible dividend suspension

Issuers No voting dilution, flexible financing, appeal to institutions Dividend obligation, higher cost than debt, impact on leverage

Valuation Methods for Preferred Shares

Preferred shares are usually valued based on the present value of their expected dividend payments. Because many preferreds have fixed dividends, they can be analyzed similarly to bonds, but with equity-specific adjustments.

A. Fixed-Rate Preferred Shares — Dividend Discount Model (DDM)

Formula:

P0 = D / r

Where:

- P0 = Current price of the preferred share

- D = Annual dividend per share

- r = Required rate of return (market yield)

Example:

A preferred share pays a $1.50 annual dividend. If investors require a 6% return:

P0 = 1.50 / 0.06 = $25.00

If market yields rise to 7%, the price falls:

P0 = 1.50 / 0.07 = $21.43

B. Callable Preferred Shares — Yield-to-Call (YTC)

For callable preferreds, investors often calculate Yield-to-Call instead of Yield-to-Maturity.

Formula:

YTC = IRR of (Price, Dividends until Call Date, Call Price)

- Callable at $25 in 5 years

- Pays $1.50 annually

- Current price $26.50

- YTC will be lower than the current yield because of the premium and early redemption.

C. Rate-Reset Preferred Shares — Projected Reset Rate

Rate-reset preferreds (common in Canada) adjust their dividend every reset period.

Formula:

New Dividend Rate = GoC 5-Year Yield at Reset + Spread

Example:

- GoC 5-Year Yield at Reset = 2.2%

- Spread = 3.50%

New Dividend Rate = 5.70% (applied to par value)

How to Invest in Preferred Shares

Preferred shares can be accessed through primary offerings, secondary markets, or pooled investment products.

A. Primary Market (New Issuances)

Preferreds are first sold through underwriters when issued. While institutions typically receive the bulk of allocations, some offerings may become available to retail investors through brokerage platforms.

- Pros: Potential to buy at par value during issuance, which avoids a secondary market premium.

- Cons: Limited availability for retail investors; often allocated to institutions first.

B. Secondary Market (Stock Exchange)

Most investors purchase preferreds on securities exchanges, such as the NYSE, TSX, or LSE, after issuance. Prices trade above or below par depending on interest rates, credit quality, and market demand.

- Ticker Conventions: Symbols vary by exchange. In the U.S., a JPMorgan preferred might appear as JPM-PRJ or JPM-J, while in Canada, Royal Bank issues are listed as RY.PR.B.

- Liquidity Note: Individual preferred shares can be less liquid than common stock, leading to wider bid-ask spreads.

C. Preferred Share ETFs and Funds

Exchange-traded funds and mutual funds provide diversified exposure to the preferred share market. Examples include the iShares Preferred and Income Securities ETF (PFF) in the U.S. and the BMO Laddered Preferred Share Index ETF (ZPR) in Canada.

- Pros: Diversification across issuers and sectors, greater liquidity than individual issues.

- Cons: Management fees and potential deviation from net asset value (NAV).

Considerations Before Buying

- Credit Quality: Review the issuer’s credit rating from agencies such as Moody’s, S&P, or Fitch.

- Dividend Structure: Understand whether payments are fixed, floating, or rate-reset.

- Call Provisions: Check when and at what price the issuer can redeem the shares.

- Tax Implications: Dividend taxation varies by jurisdiction. In the U.S., some preferreds qualify for lower tax rates than interest income, while in Canada, dividends may be eligible for the dividend tax credit.

Key Takeaways

Preferred shares are hybrid securities that combine features of stocks and bonds. They pay fixed or floating dividends that take priority over common stock, though after bond interest and other debt obligations. Investors are often drawn to them for their stable income, but they come with trade-offs such as limited capital appreciation and heightened sensitivity to interest rates.

Key variations, such as cumulative, convertible, and callable shares, affect the balance of risk, return, and flexibility for investors. Issuers use preferred shares to raise capital without diluting voting control.

Before investing, it’s important to evaluate factors such as dividend structure, the issuer’s credit rating, call provisions, and jurisdiction-specific tax treatment. Make sure you understand how preferred shares are structured, along with their benefits and risks, to determine if preferred shares align with your or your client’s income goals and portfolio strategy.

Ready To Launch Your Career in Capital Markets?

Explore CFI’s industry-leading programs and resources to build your skills:

- Capital Markets & Securities Analyst (CMSA)® Certification: A comprehensive path to mastering capital markets and asset management.

- Career Map: Discover roles across the buy-side and sell-side, including asset management and investment banking.

- Browse All CFI Courses: From beginner to advanced, choose courses that match your goals.

Start building a strong foundation today and set yourself apart in one of the most rewarding sectors in finance.

Additional Resources

Thank you for reading CFI’s guide to Preferred Shares. To help you advance your career, check out the additional CFI resources below: