Sovereign Wealth Fund (SWF)

The surplus money that a country accrues over time

What is a Sovereign Wealth Fund (SWF)?

A sovereign wealth fund (SWF), also known as a social wealth fund, is the surplus money that a country accrues over time. The government-backed pool of funds is mostly funded from a country’s foreign exchange reserves.

Other sources of funds for an SWF account include:

- Bank reserves

- Surplus revenue from industries that deal with natural resources (e.g., the oil sector)

- Trade surpluses

- The unutilized funds from the government budget

- Government transfer payments

Summary

- A sovereign wealth fund refers to an invested pool of money owned by the state and used primarily to cushion a country from economic shocks.

- The funds in a country’s SWF can come from numerous sources, including surplus from foreign reserves, revenue from exported natural resources, budgeting surpluses, and bank reserves.

- Among the leading SWFs in the world include Norway’s Government Pension Fund Global, the Abu Dhabi Investment Authority, and the China Investment Corporation.

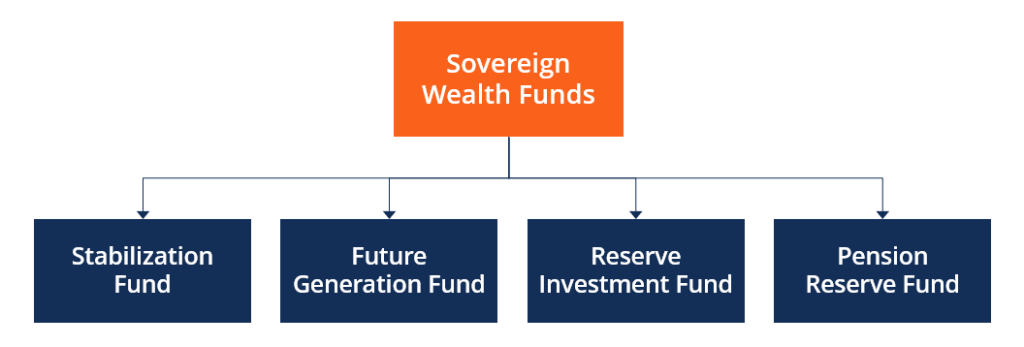

Types of Social Wealth Funds

There are several categories of social wealth funds, namely:

1. Stabilization Funds

Stabilization funds are also known as rainy day funds. They consist of funds set aside by a government to shield the country from economic shocks. Economic shocks are unforeseen events, which cause drastic changes in economic growth. The unforeseen events include:

- Unexpected tax rises or cuts to welfare benefits

- A financial crisis, which can trigger a decline in the central bank’s ability to lend or give credit

- A rapid increase in unemployment rates

- An unforeseen breakthrough in technology

- A sharp rise in prices of gas, oil, and similar natural resources

- Political turmoil

For example, one of Russia’s SWFs is a stabilization fund. As one of the biggest exporters of gas and oil, the country is certainly exposed to financial risks, which can arise from fluctuations in the prices of the resources. Thus, its stabilization fund is primarily used to mitigate the economy from financial problems triggered by a drastic decline in oil or gas prices.

2. Future Generation Fund

A future generation fund is an intergenerational savings fund. Many countries set up this type of fund so that they have enough money to cater to the emerging costs of the elderly population. It helps to ease pressure on the government’s budget in the years to come.

3. Reserve Investment Fund

A reserve investment fund differs from other types of SWFs in that the funds are set aside for investment purposes. The account’s primary goal is to generate funds that can be put into long-term investments with high yields.

4. Pension Reserve Fund

A pension reserve fund is money set aside to finance a country’s pension system. With such a system in place, the burden of paying pensions doesn’t fall entirely on the government’s budget. Despite its significance, not every country has a pension reserve fund. It is more common in countries that have increasing elderly populations and low rates of birth.

Conditions of Investing in a Sovereign Wealth Fund

As can be expected, a sovereign wealth fund account is used to hold a substantial amount of money. The investments that can be made using such funds differ from one type of fund to another and between countries. Similarly, there aren’t any restrictions on when the state can dissolve or create another SWF. It all depends on their economic needs.

Top Sovereign Wealth Funds Globally

Currently, there are numerous SWFs in the world today. Among the SWFs that rank at the top are:

1. Norway’s Government Pension Fund Global

The Government Pension Fund Global SWF also goes by the name “Oil Fund.” It was created back in 1990, and it now holds assets worth more than $1 trillion. The Norwegian fund is intended to channel Norway’s revenue generated from its petroleum industry and invest it in other forms of assets.

To date, the fund’s main source of money comes from the taxes paid by different oil companies, particularly those that want to acquire licenses to explore oil.

2. Abu Dhabi Investment Authority (ADIA)

The Abu Dhabi Investment Authority was initiated and still owned by the Emirate of Abu Dhabi. In the 1970s, the Emirate of Abu Dhabi realized that they were generating a lot of surplus money from the oil industry and oil reserves.

Then in 1976, the ADIA social wealth fund was created with the primary goal of reinvesting excess revenue into other platforms on behalf of the government. The fund currently holds close to $900 billion, and grows at about 10% compounded every year.

3. China Investment Corporation

The China Investment Corporation was designed to reinvest a part of the country’s foreign exchange reserves. Although the precise number of assets held by the fund remains unknown, its value is estimated to be nearly $800 billion.

In 2017, the fund was used to purchase a 45% stake of a New York-based office building worth $2.3 billion.

The Bottom Line

A sovereign wealth fund refers to a pool of income that a country uses to diversify its investment portfolio. The majority of countries with SWFs have funded them with just a few commodities as their primary revenue stream. The Middle Eastern nations, which rely heavily on the income generated by their oil industries, are a great example.

More Resources

In order to help you become a world-class financial analyst and advance your career to your fullest potential, these additional resources will be very helpful: