Currency Swap Contract

The exchange of interest payments and principal amounts in certain cases, denominated in different currencies

What is a Currency Swap Contract?

A currency swap contract (also known as a cross-currency swap contract) is a derivative contract between two parties that involves the exchange of interest payments, as well as the exchange of principal amounts in certain cases, that are denominated in different currencies.

Although currency swap contracts generally imply the exchange of principal amounts, some swaps may require only the transfer of the interest payments.

Breaking Down Currency Swap Contracts

A currency swap consists of two streams (legs) of fixed or floating interest payments denominated in two currencies. The transfer of interest payments occurs on predetermined dates. In addition, if the swap counterparties previously agreed to exchange principal amounts, those amounts must also be exchanged on the maturity date at the same exchange rate.

Currency swaps are primarily used to hedge potential risks associated with fluctuations in currency exchange rates or to obtain lower interest rates on loans in a foreign currency. The swaps are commonly used by companies that operate in different countries.

For example, if a company is conducting business abroad, it would often use currency swaps to retrieve more favorable loan rates in its local currency, as opposed to borrowing money from a foreign bank.

For example, a company may take a loan in the domestic currency and enter a swap contract with a foreign company to obtain a more favorable interest rate on the foreign currency that is otherwise unavailable.

How Do Currency Swap Contracts Work?

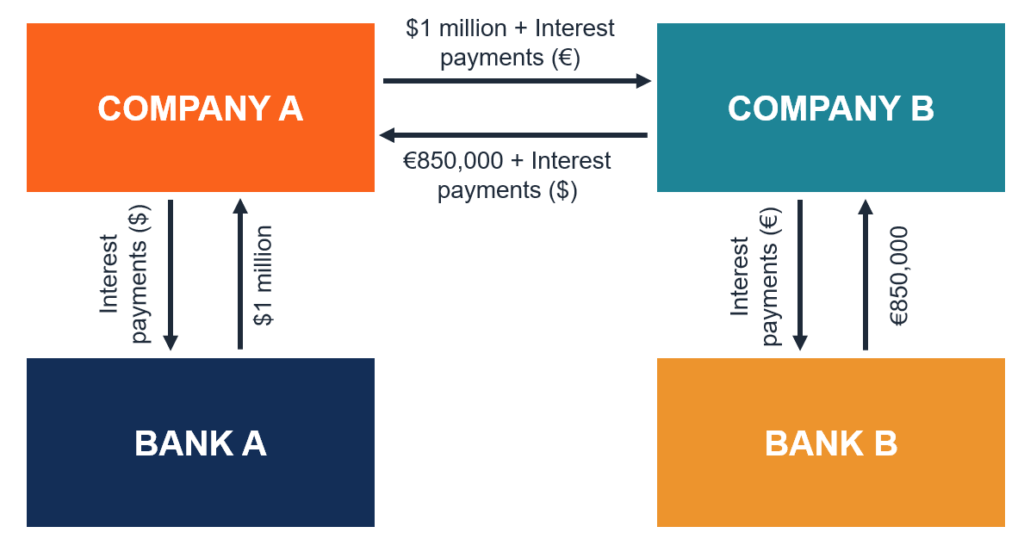

In order to understand the mechanism behind currency swap contracts, let’s consider the following example. Company A is a US-based company that is planning to expand its operations in Europe. Company A requires €850,000 to finance its European expansion.

On the other hand, Company B is a German company that operates in the United States. Company B wants to acquire a company in the United States to diversify its business. The acquisition deal requires US$1 million in financing.

Neither Company A nor Company B holds enough cash to finance their respective projects. Thus, both companies will seek to obtain the necessary funds through debt financing. Company A and Company B will prefer to borrow in their domestic currencies (which can be borrowed at a lower interest rate) and then enter into a currency swap agreement with each other.

The currency swap between Company A and Company B can be designed in the following manner.

Company A obtains a credit line of $1 million from Bank A with a fixed interest rate of 3.5%. At the same time, Company B borrows €850,000 from Bank B with a floating interest rate tied to the 6-month Euro Interbank Offered Rate (EURIBOR) or another widely used benchmark, such as the Euro Short-Term Rate (€STR), plus any applicable spread. The companies decide to create a swap agreement with each other.

According to the agreement, Company A and Company B must exchange the principal amounts ($1 million and €850,000) at the beginning of the transaction. In addition, the parties must exchange the interest payments semi-annually.

Company A must pay Company B the floating rate interest payments denominated in euros, while Company B will pay Company A the fixed interest rate payments in US dollars. On the maturity date, the companies will exchange back the principal amounts at the same rate ($1 = €0.85).

Types of Currency Swap Contracts

Similar to interest rate swaps, currency swaps can be classified based on the types of legs involved in the contract. The most commonly encountered types of currency swaps include the following:

- Fixed vs. Float: One leg of the currency swap represents a stream of fixed interest rate payments, while another leg is a stream of floating interest rate payments.

- Float vs. Float (Basis Swap): The float vs. float swap is commonly referred to as a basis swap. In a basis swap, both swaps’ legs represent floating interest rate payments.

- Fixed vs. Fixed: Both streams of currency swap contracts involve fixed interest rate payments.

For example, when conducting a currency swap between USD to CAD, a party that decides to pay a fixed interest rate on a CAD loan can exchange that for a fixed or floating interest rate in USD. Another example would be concerning the floating rate. If a party wishes to exchange a floating rate on a CAD loan, they would be able to trade it for a floating or fixed rate in USD as well.

The interest rate payments are calculated on a quarterly or semi-annually basis.

How a Currency Swap is Priced

Pricing is typically expressed as a value based on a benchmark reference rate plus or minus a spread, which reflects the credit risk between the exchanging parties. Depending on the currency, this benchmark may be the Secured Overnight Financing Rate (SOFR) for U.S. dollars, the Euro Interbank Offered Rate (EURIBOR) for euros, the Sterling Overnight Index Average (SONIA) for British pounds, or other widely used market rates.

The spread stems from credit risk, which represents the premium added to compensate for the likelihood that a party may not fully repay its debt with interest.

Additional Resources

Thank you for reading CFI’s guide on Currency Swap Contract. To keep learning and advancing your career, the following CFI resources will be helpful: