Personal Budget Spreadsheet

A helpful tool for determining current financial status and planning future spending

What is a Personal Budget Spreadsheet?

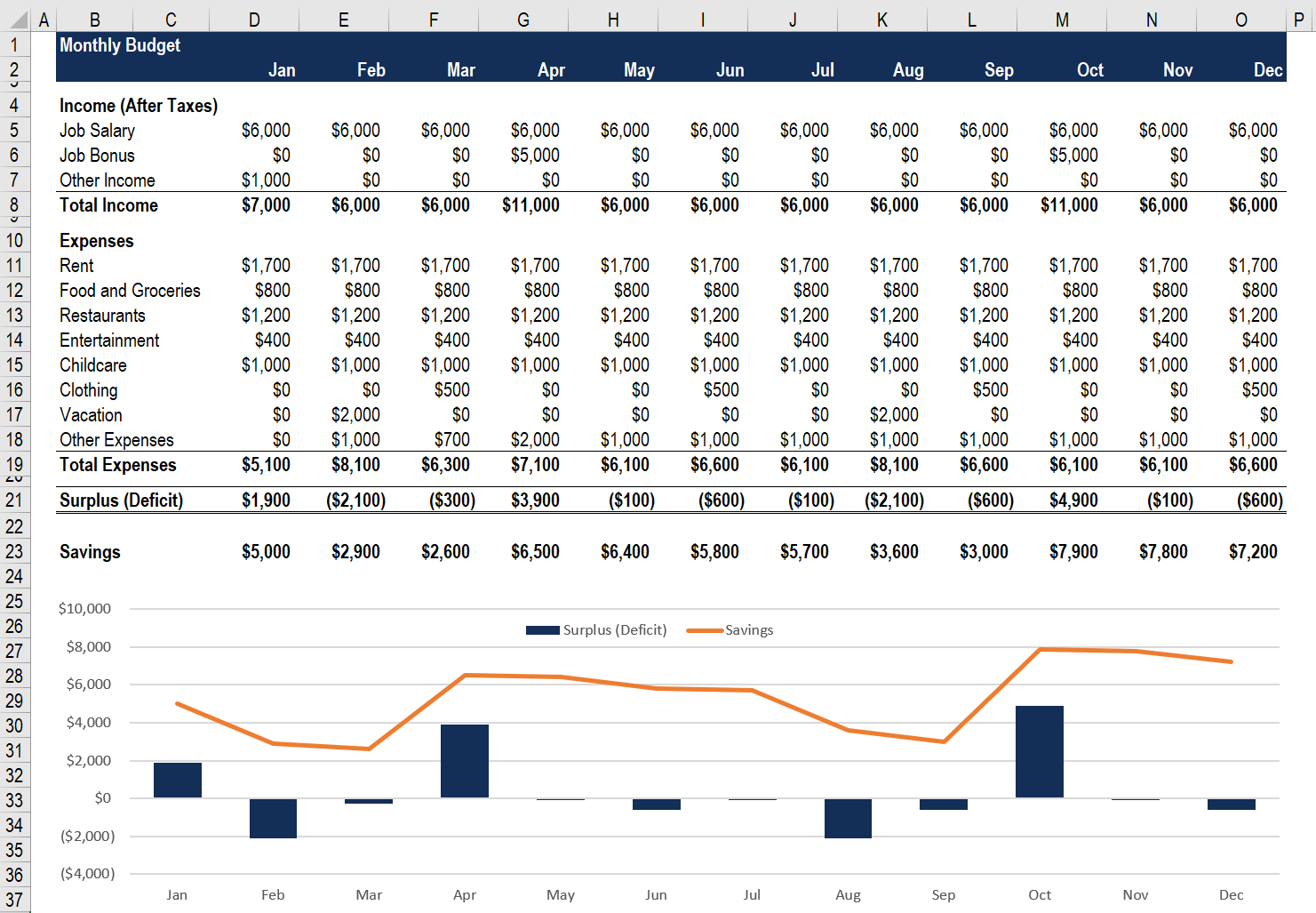

A personal budget spreadsheet offers an individual a way to determine the state of his finances and help him or her plan spending over the course of a period of usually a month or a year. It may very well be everyone’s best friend as it is the most helpful tool for organizing one’s finances in order to avoid falling into a debt hole. With a budget spreadsheet, money is managed, and every expense is allotted enough amount without exhausting the coffers.

How to Use a Budget Spreadsheet

There are many ways different people use budget spreadsheets. Some find it effective wherein they are actually able to track their expenditure, while some others don’t, which may be caused by several factors.

Here, let us learn how to use the budget spreadsheet the easiest way.

1. Put together all sources of income, as well as all expenses.

It depends on the number of sources of your income and if there is anyone else in the house who will help with the expenditure. A personal budget spreadsheet should be separate from the budget spreadsheet for the household. Couples can add up their individual sources of income to come up with the final income amount. The same process is followed in computing for expenditure.

2. Create savings goals.

After the total expenditure’s been deducted from the total income, check if there is any money left over. If there is, make a plan of what to do with the remainder instead of spending all of it on random things. For example, you may want to set a part of it aside for traveling or for an emergency fund. You can also indicate how much of the money left over you will allocate to each of the spending categories.

3. Come up with budget amounts.

After the first two steps, it is important to also create a budget for other necessities such as groceries, shopping, or date night. For couples, it is important to be open to one another and include what hobbies or crafts you want to spend on.

How to Create a Budget Spreadsheet

Budget spreadsheets can help an individual track his spending and plan his future expenditure. That is why creating one is of utmost importance. So how do we create a budget spreadsheet? Here’s how to make a really simple one that is good for beginners:

- Firstly, making one requires a desktop or laptop computer with MS Excel already installed.

- Run the Excel program on the computer and open a new file or spreadsheet.

- Put in the necessary details on the spreadsheet in order for it to calculate the figures involved in the file. Basic budget spreadsheets are often labeled with Income and Expenditure, which will be totaled by the file itself.

- Indicate the months that are included in the duration of the budget. If it applies for half a year, write January to June on every cell along one row.

- Then, type Income on one cell a row below the different months of the year. Under the category should be the types of income that you expect to receive each month.

- After the types of income, skip one cell and then write Expenditure, under which are the different types of expenses like shopping, groceries, bills, and others.

- After they’ve been put on the spreadsheet, you can begin writing down the calculation or formula which Excel will use at a later date once you need to see the total.

- Choose the part of the spreadsheet where you can write the total.

- Click the Menu button and click Autosum. Highlight the cells that you need to include in the Autosum by clicking on them and dragging them.

- Step 9 should be repeated with the Expenditure.

Free Budget Spreadsheets on the Internet

If figuring out how to make a budget spreadsheet is too much work, then here are some free budget spreadsheet programs that can be downloaded from the internet.

1. Household budgeting spreadsheet

The household budgeting spreadsheet is user-friendly and can be used even by beginners or first-timers. It comes with different features that are not complicated but help put the budget in order.

2. Williams Budgeting Sheet

The Williams Budgeting spreadsheet is effective for monthly budgets, and it comes with a written manual on how to use it, as well as a video tutorial for a better understanding of the program.

3. Free monthly budget templates

They are simple and easy to use wherein the user can input every purchased item and create a category under which these are placed. What makes the budget templates awesome is its feature that can compare the amount spent with the original budget.

4. Google Sheets budget spreadsheets

Under Google Sheets budgets are Best-Personal-Budget-Planner, Simple Budget Planner, and Yearly Budget Template.

5. CFI’s Free Budget Spreadsheet

CFI’s free budget templates can simply be downloaded for free and used with MS Excel, as well as with other spreadsheet software that works with Excel. They can also compare actual spending with the original budget.

Download CFI’s Personal Finance Budget Template

Click the button below to download our free Personal Finance Budget template!

More Resources

Thank you for reading CFI’s guide to Personal Budget Spreadsheet. To keep learning and developing your knowledge of financial analysis, we highly recommend the additional resources below: