Investment-Grade Bonds

A bond classification used to denote bonds that carry a relatively low credit risk compared to other bonds

What are Investment-Grade Bonds?

An investment-grade bond is a bond classification used to denote bonds that carry a relatively low credit risk compared to other bonds. There are three major credit rating agencies (Standard & Poor’s, Moody’s, and Fitch) that provide ratings on bond. Each credit rating agency sets a minimum bond rank to be classified as investment-grade:

- Standard & Poor’s denotes bonds rated BBB- or higher as investment grade.

- Moody’s denotes bonds rated Baa3 or higher as investment grade.

- Fitch denotes bonds rated BBB- or higher as investment grade.

Summary

- An investment-grade bond is a bond classification used to denote bonds that carry a relatively low credit risk compared to other bonds.

- Investment-grade bonds, historically, have had low default rates (low credit risk).

- Yields for investment-grade bonds are lower than that of non-investment-grade bonds.

Understanding Investment-Grade Bonds

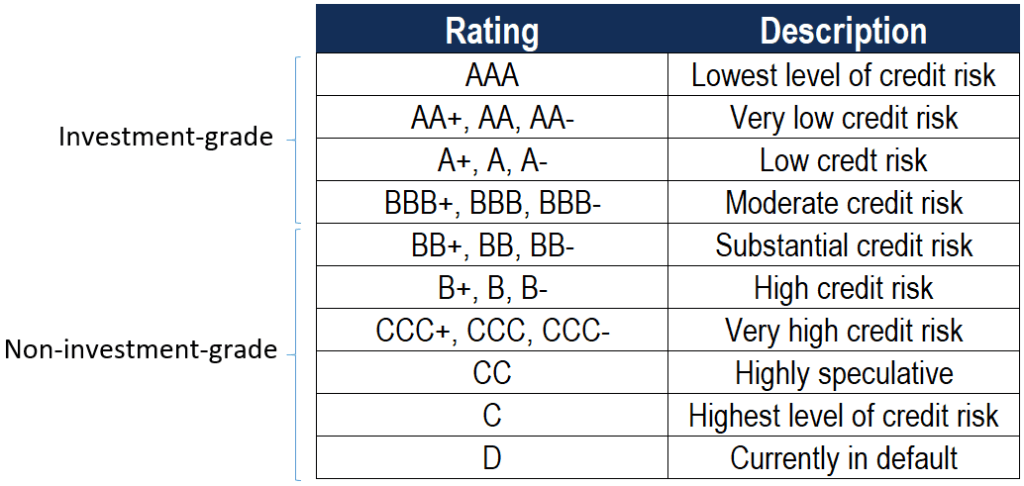

An understanding of credit ratings is extremely important as they convey information regarding the credit risk of a bond. In other words, the credit rating imposed on a bond denotes the likelihood of the bond defaulting. Of the credit ratings, bonds can be investment-grade or non-investment grade. For example, the bond ratings for Standard & Poor’s (S&P) are provided below:

As such, the credit risk of investment-grade bonds ranges from the lowest level of credit risk to moderate credit risk – investment-grade bonds are generally likely to meet payment obligations. Bonds that are not investment-grade are called junk bonds, high-yield bonds, or non-investment-grade bonds.

Default Rates for Global Corporate Bonds

In the 2018 Annual Global Corporate Default and Rating Transition Study by S&P Global, information regarding the global default rates of certain bond ratings can be found.

Historically, investment-grade bonds witness a low default rate compared to non-investment grade bonds. For example, S&P Global reported that the highest one-year default rate for AAA, AA, A, and BBB-rated bonds (investment-grade bonds) were 0%, 0.38%, 0.39%, and 1.02%, respectively. It can be contrasted with the maximum one-year default rate for BB, B, and CCC/C-rated bonds (non-investment-grade bonds) of 4.22%, 13.84%, and 49.28%, respectively. Therefore, institutional investors generally adhere to a policy of limiting bond investments to only investment-grade bonds due to their historically low default rates.

Example of Investment-Grade Bonds

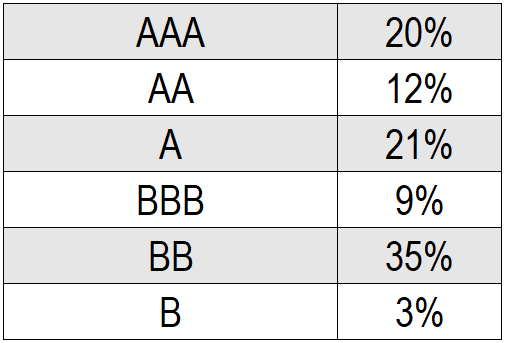

An investor is looking to invest in a floating rate fund. His criterion is that the bonds in the fund must majority (>50%) consist of investment-grade bonds. The fund follows the credit rating system of S&P and shows the following credit allocation of the fund:

Does the floating rate fund satisfy the criteria of being comprised of majority investment-grade bonds?

In the credit rating system by S&P, bonds that are rated BBB- or higher are considered investment-grade. Therefore, the floating rate fund above shows 62% of its fund invested in investment-grade bonds. Therefore, the floating rate fund satisfies the investor’s criterion.

Implications of Credit Rating on Bond Yields

The higher rated the bond, the lower the bond yield. Bond yield refers to the return realized on a bond. As such, investment-grade bonds will always provide a lower yield than non-investment grade bonds. It is due to investors demanding a higher yield to compensate for the higher credit risk in holding non-investment-grade bonds.

For example, an investor may demand a yield of 3% for a 10-year bond rated AAA (investment-grade) due to the extremely low credit risk but demand a yield of 7% for a 10-year bond rated B (non-investment-grade) due to the higher implied credit risk associated with the bond.

Additional Resources

Thank you for reading CFI’s guide on Investment-Grade Bonds. To keep learning and advancing your career, the following resources will be helpful: