Essential Skills for FP&A Managers

FP&A professionals analyze financial data, create forecasts, develop budgets to ensure financial alignment with the overall business strategy and help the company’s leadership team make data-driven decisions.

There are many different job roles and focus areas within the finance industry. One area of focus in the finance industry with multiple job positions is FP&A, or financial planning and analysis. One coveted and lucrative job position in the FP&A field is the role of an FP&A manager.

What is FP&A?

As we already mentioned, FP&A stands for financial planning and analysis, which is the process of planning, budgeting and forecasting, scenario modeling, and performance reporting to help companies make informed business decisions and sustain good financial health. While FP&A is more than just accounting, accounting is foundational to the process of FP&A. Thus, you’ll need to be good with numbers to work as an FP&A professional.

Large companies have a hierarchy of FP&A professionals, starting with the Director or VP of FP&A, followed by the FP&A manager. Both the Director or VP of FP&A and the FP&A manager typically report to a company’s Chief Financial Officer (CFO).

Skills Needed to Be an FP&A Manager

There are various skills that you’ll need to master to be an effective FP&A manager. Some of the most important skills that FP&A managers need to have include the following:

Budgeting

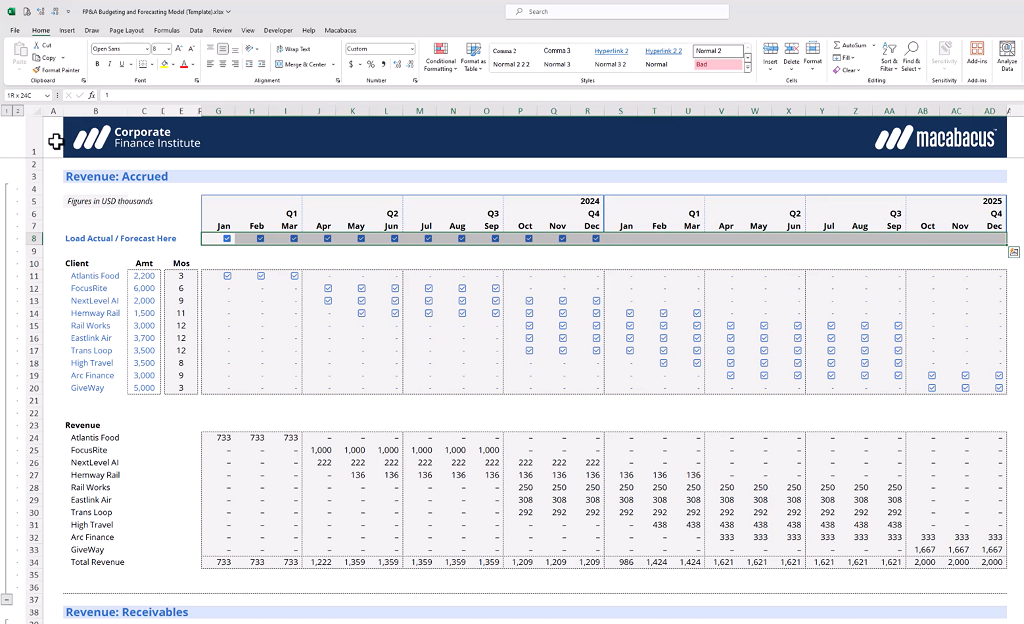

Knowing how to create budgets is vital as an FP&A manager, as one of the top responsibilities as an FP&A manager is to craft monthly, quarterly, and annual budgets and use those budgets to help plan what metrics your company is expected to hit. The budgets you would need to craft as an FP&A manager should be based on the company’s past financial performance, growth forecasts, and analysis of current company financial trends and market conditions.

Forecasting

Forecasting is another major skill and component of FP&A management. FP&A managers use past and present trends and company financial data to forecast where certain areas of a business will stand financially. FP&A managers also monitor where different areas within a business are in terms of achieving those forecasts at any given time. That way, if the business starts to trend in a negative direction, the FP&A manager will notice and immediately take action before things get out of hand.

Communication and Collaboration

FP&A managers often communicate and work with various departments and individuals within an organization so that they can always have their fingers on the pulse of where each department stands financially. FP&A managers must also continuously communicate and collaborate with the FP&A analysts underneath them. As a result, it’s imperative that FP&A managers develop their communication and collaboration skills.

Leadership

Because there are FP&A roles underneath the FP&A manager position, it’s important that anyone interested in becoming an FP&A manager develop their leadership skills.

Financial Analysis

Arguably the most important skill for an FP&A manager to have is the ability to analyze data on a company’s financial performance and determine what that data says about the company’s financial health. When conducting financial analysis, it’s also important that FP&A managers can use the information that they learned to make educated forecasts and assist with decision-making.

FP&A Manager Responsibilities

There are many tasks that FP&A managers are responsible for. Some of these tasks include the following:

- Evaluating the financial health of a company

- Providing financial analysis and reports on key performance indicators

- Creating internal reports to support the company’s decision-making process

- Identifying when and how companies can optimize their assets and investments

- Collaborating with other departments within the organization to prepare accurate budgets

- Building and maintaining financial models and forecasts

- Analyzing historical data and conducting financial analysis

- Reporting on variance analysis and pipeline analysis

- Reviewing forecasts and budgets created by FP&A analysts and suggesting changes

- Working with department heads to figure out each department’s likely revenue and expenses over the next several years

- Speaking with other FP&A managers to consolidate their forecasts

- Interpreting instructions from the Director/VP of FP&A, CFO, and CEO and making sure FP&A analysts follow them

- Recruiting and training new hires

- Improving on processes created by FP&A analysts

- Creating forecasts and analyzing historical data

FP&A Role Hierarchy

There are several different FP&A roles within a finance company. These FP&A roles range from entry-level to top-level executives. The hierarchy of standard FP&A job titles from the highest-paying role to the lowest-paying role includes the following:

Director or VP of FP&A

As the highest-ranking FP&A position, the Director or VP of FP&A typically reports directly to the Chief Financial Officer (CFO). As the highest-ranking FP&A position, the Director or VP of FP&A also supervises all FP&A functions.

Additional duties of the Director or VP of FP&A include developing a top-level strategy for managing corporate finances and reviewing team performance. The Director or VP of FP&A also assesses reports for new growth opportunities and shares insights, recommendations, risks, and rewards with executives and shareholders.

The typical yearly salary for a Director or VP of FP&A is $145,000 to $200,000. Most Directors or VPs of FP&A have 10-15 years of corporate finance experience.

FP&A Manager

The FP&A manager role is typically the second highest FP&A position a person can get after the Director or VP of FP&A role. As we’ve already stated, the FP&A manager role is responsible for leading the team of FP&A analysts and Senior FP&A analysts. FP&A managers must also work closely with executives to support important company decision-making. On top of all this, FP&A managers must still create, build, and evaluate budgets, forecasts, and models.

FP&A managers have a typical yearly salary of $70,000 to $150,000. FP&A managers also usually have five to 10 years of corporate finance experience.

Senior FP&A Analyst

While more experienced and developed in their skills than junior-level FP&A analysts, senior FP&A analysts still have a large amount of standard finance work duties. The focus typically just shifts more toward business forecasting, financial modeling, and planning. Senior FP&A analysts even work with the executive team to make recommendations and support decision-making.

Additional responsibilities of senior FP&A analysts include conducting scenario analysis to decide on future growth plans and forecasts and building predictive budgets. Senior FP&A analysts must also perform variance analysis on budgets and forecasts to identify areas that need improvement. In addition, Senior FP&A analysts create internal reports for company executives and make recommendations to company employees in leadership.

Senior FP&A analysts make approximately $65,000 to $125,000 a year. Senior FP&A analysts typically have an MBA and three to five years of corporate finance experience.

FP&A Analyst

A regular FP&A analyst is a junior to intermediate-level position. Standard FP&A analysts are responsible for gathering data and building financial models. Regular FP&A analysts are also responsible for tracking, analyzing, and evaluating financial activities and creating monthly reports for department heads.

FP&A analysts also evaluate return on investments and examine ratios such as the debt-to-equity ratio. FP&A analysts also identify cost-cutting opportunities and financial and operational risks.

Start Your Journey to Becoming an FP&A Professional with CFI FP&A Courses

Now that you know all there is to know about how to become an FP&A manager, along with other FP&A roles, it’s time to start your FP&A journey. This means educating yourself further on the FP&A industry.

Here at CFI, we have numerous online courses and certifications that will teach you about the field of FP&A and provide you with the skills you need to learn to become an FP&A professional. You can start with our course on how to conduct headcount forecasting and analysis like an FP&A professional here.

Additional Resources

Best FP&A Certifications: Further Your Career in Financial Planning and Analysis

How to Get Promoted and Reach the Next Level

Top 15 Leadership Courses for Finance Professionals in 2025

Top Fintech Courses and Certifications to Launch Your Career

Role Based Learning Paths for FP&A Analyst

The following role based learning paths have been curated to help you pursue a career in this field.