Corporate Strategy

Learn about the 4 pillars

What is Corporate Strategy?

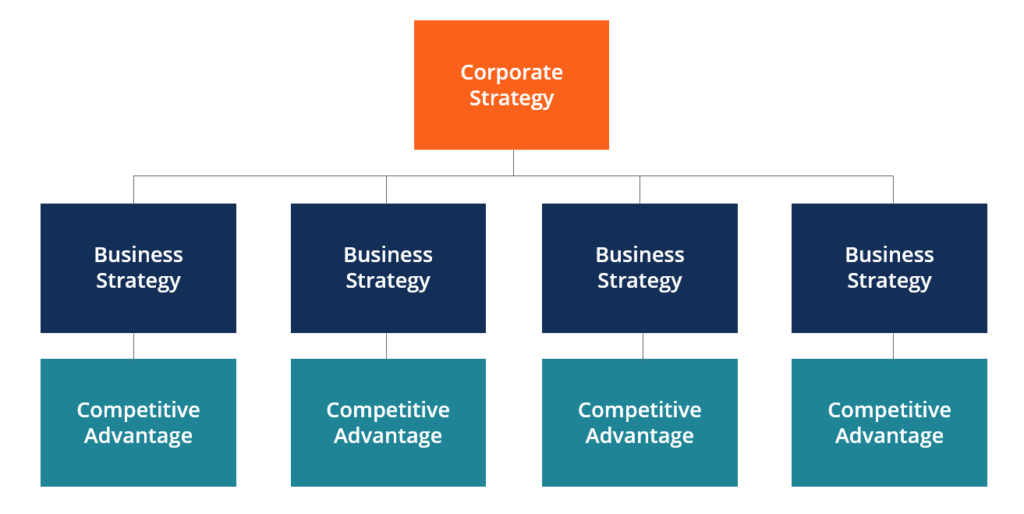

Corporate Strategy takes a portfolio approach to strategic decision-making by looking across all of a firm’s businesses to determine how to create the most value. In order to develop a corporate strategy, firms must look at how the various businesses they own fit together, how they impact each other, and how the parent company is structured in order to optimize human capital, processes, and governance.

Corporate Strategy builds on top of business strategy, which is concerned with the strategic decision-making for an individual business.

Learn more in CFI’s Corporate & Business Strategy Course.

What are the Components of Corporate Strategy?

There are several important components of corporate strategy that leaders of organizations focus on. The main tasks of corporate strategy are:

- Allocation of resources

- Organizational design

- Portfolio management

- Strategic tradeoffs

In the following sections, this guide will break down the four main components outlined above.

1. Allocation of Resources

The allocation of resources at a firm focuses mostly on two resources: people and capital. In an effort to maximize the value of the entire firm, leaders must determine how to allocate these resources to the various businesses or business units to make the whole greater than the sum of the parts.

Key factors related to the allocation of resources are:

- People

- Identifying core competencies and ensuring they are well distributed across the firm

- Moving leaders to the places they are needed most and add the most value (changes over time, based on priorities)

- Ensuring an appropriate supply of talent is available to all businesses

- Capital

- Allocating capital across businesses so it earns the highest risk-adjusted return

- Analyzing external opportunities (mergers and acquisitions) and allocating capital between internal (projects) and external opportunities

2. Organizational Design

Organizational design involves ensuring the firm has the necessary corporate structure and related systems in place to create the maximum amount of value. Factors that leaders must consider include the role of the corporate head office (centralized vs. decentralized approach) and the reporting structure of individuals and business units, such as vertical hierarchy and matrix reporting.

Key factors related to organizational design are:

- Head office (centralized vs decentralized)

- Determining how much autonomy to give business units

- Deciding whether decisions are made top-down or bottom-up

- Influence on the strategy of business units

- Organizational structure (reporting)

- Determine how large initiatives and commitments will be divided into smaller projects

- Integrating business units and business functions such that there are no redundancies

- Allowing for the balance between risk and return to exist by separating responsibilities

- Developing centers of excellence

- Determining the appropriate delegation of authority

- Setting governance structures

- Setting reporting structures (military / top-down, matrix reporting)

3. Portfolio Management

Portfolio management looks at the way business units complement each other, their correlations, and decides where the firm will “play” (i.e., what businesses it will or won’t enter).

Corporate Strategy related to portfolio management includes:

- Deciding what business to be in or to be out of

- Determining the extent of vertical integration the firm should have

- Managing risk through diversification and reducing the correlation of results across businesses

- Creating strategic options by seeding new opportunities that could be heavily invested in if appropriate

- Monitoring the competitive landscape and ensuring the portfolio is well balanced relative to trends in the market

4. Strategic Tradeoffs

One of the most challenging aspects of corporate strategy is balancing the tradeoffs between risk and return across the firm. It’s important to have a holistic view of all the businesses combined and ensure that the desired levels of risk management and return generation are being pursued.

Below are the main factors to consider for strategic tradeoffs:

- Managing risk

- Firm-wide risk is largely dependent on the strategies it chooses to pursue

- True product differentiation, for example, is a very high-risk strategy that could result in a market leadership position or total ruin

- Many companies adopt a copycat strategy by looking at what other risk-takers have done and modifying it slightly

- It’s important to be fully aware of strategies and associated risks across the firm

- Some areas might require true differentiation (or cost leadership) but other areas might be better suited to copycat strategies that rely on incremental improvements

- The degree of autonomy business units have is important in managing this risk

- Generating returns

- Higher risk strategies create the possibility of higher rates of return. The examples above of true product differentiation or cost leadership could provide the most return in the long run if they are well executed.

- Swinging for the fences will lead to more home runs and more strikeouts, so it’s important to have the appropriate number of options in the portfolio. These options can later turn into big bets as the strategy develops.

- Incentives

- Incentive structures will play a big role in how much risk and how much return managers seek

- It may be necessary to separate the responsibilities of risk management and return generation so that each can be pursued to the desired level

- It may further help to manage multiple overlapping timelines, ranging from short-term risk/return to long-term risk/return, and ensure there is appropriate dispersion

When evaluating strategic tradeoffs, leadership may also consider a blue ocean growth strategy that opens entirely new markets with limited competition, rather than reallocating resources only within existing industries.

Learn more in CFI’s Corporate & Business Strategy Course.

Summary

Corporate Strategy is different than business strategy, as it focuses on how to manage resources, risk, and return across a firm, as opposed to looking at competitive advantages.

Leaders responsible for strategic decision-making must consider numerous factors, including resource allocation, organizational design, portfolio management, and strategic trade-offs.

By optimizing all of the above factors, a leader can create a portfolio of businesses that is worth more than the sum of its parts.

For more reading on strategy, check out the Harvard Business Review resources.

Additional Resources

Thank you for reading CFI’s introductory guide to corporate strategy. To keep learning and advancing your career as a financial analyst, these additional CFI resources and guides will be a big help: