Staggered Board

A board that consists of different classes of directors

What is a Staggered Board of Directors?

A staggered board of directors, also known as a classified board, refers to a board that consists of different classes of directors. In a staggered board of directors, only one class is open to elections each term. It is different from a normal board of directors, where all directors are elected at once.

What is a Board of Directors?

The board of directors (BoD) is a group of individuals who represent shareholders. The board of directors holds the ultimate decision-making authority and oversees the activities of a company. The BoD is not to be confused with the top officers of the company, who focus on the day-to-day running of the company. A board’s powers are determined by government regulations and by the company’s constitution and bylaws.

The major responsibilities of the board of directors include:

- Appointing, evaluating, and compensating the top officers of the company

- Providing strategic direction for the company

- Upholding a fiduciary responsibility to represent and protect shareholders’ interests

- Developing a policy-based governance system

- Monitoring company performance and evaluating the outcome of strategic decisions

- Assessing risks faced by the company and establishing a risk management plan

Understanding How a Staggered Board Works

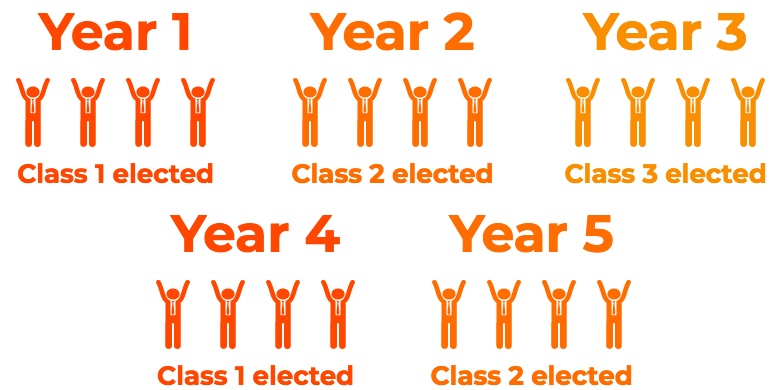

A staggered board of directors consists of directors who are grouped into classes – Class 1, Class 2, Class 3, etc. Each class holds a certain percentage of the total number of positions. During elections, only one class is open, hence the name – “staggered” board. A staggered board is commonly practiced in U.S. corporate law and is a valuable takeover defense strategy against hostile takeovers.

Example of a Staggered Board

For example, Company A is using a staggered board of directors to govern the company. The board consists of 12 directors who each serve a 3-year term. Four directors are placed into each class, resulting in Class 1, Class 2, and Class 3. In addition, elections are held every year. Therefore, the staggered board for Company A would look as follows:

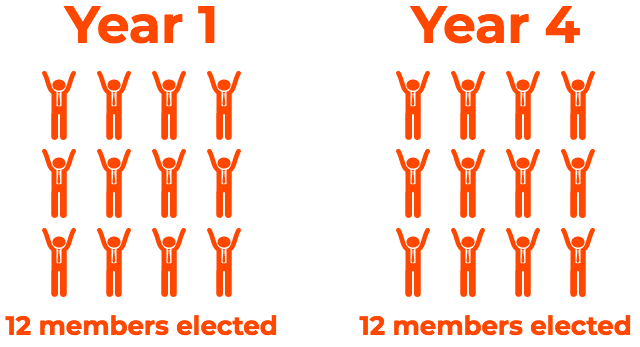

Now, compare this to another company, Company B, which uses a normal board of directors consisting of 12 directors who each serve a 3-year term:

Staggered Board as a Takeover Defense

A staggered board is a very important takeover defense. Let us determine the implications for a potential hostile takeover of both Company A and Company B.

Hostile Takeover on Company A

Company C thinks that it can run Company A more efficiently, and thus attempts a takeover. To gain control of Company A, Company C will need a board majority. In a staggered board, Company C will only be able to take over four seats per election. If Company C manages to take over all the seats in that election, the company will fail to achieve a board majority, only acquiring four out of the 12 total seats. Therefore, it will take Company C an additional year to acquire a board majority and take over the target company.

Hostile Takeover on Company B

Company C thinks that it can run Company B more efficiently, and thus attempts a takeover. To gain control of Company B, Company C will need a board majority. In a normal board, Company C will potentially be able to take over 12 seats per election. Therefore, Company C will be able to secure a board majority and swiftly take over Company B.

The additional time required to control Company A serves as a takeover defense for rapid takeovers. It gives an opportunity for the rest of the board to fend off the hostile takeover.

Learn more about takeovers in CFI’s M&A Financial Modeling Course.

Other Resources

CFI offers the Financial Modeling & Valuation Analyst (FMVA)™ certification program for finance professionals looking to take their careers to the next level. To keep learning and advancing your career, the following CFI resources will be helpful: