Capitalization Rate

The percentage rate of return on a property based on its income

What is Capitalization Rate (Cap Rate)?

Capitalization rate (or Cap Rate for short) is commonly used in real estate and refers to the rate of return on a property based on the net operating income (NOI) that the property generates. In other words, the capitalization rate is a return metric that is used to determine the potential return on investment or payback of capital.

Learn more in CFI’s Real Estate Modeling Course.

Cap Rate Formula

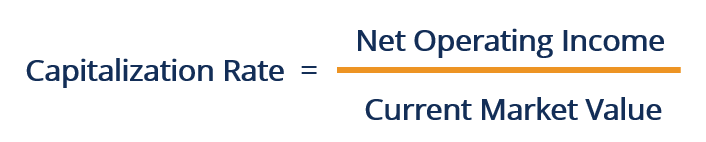

The cap rate is calculated by taking the net operating income of the property in question and dividing it by the market value of the property. The resulting cap rate value is then applied to the property an investor wants to purchase in order to obtain the current market value based on its annual income. The formula for calculating the capitalization rate is as follows:

Where:

- Net Operating Income is the annual income generated by the property after deducting all expenses that are incurred from operations, including managing the property and paying taxes.

- Current Market Value is the value of the asset on the marketplace.

Why is the Capitalization Rate Important?

The capitalization rate (cap rate) helps compare investment opportunities. It can help an investor make a decision on whether to buy or not to buy.

-

A higher cap rate (e.g., 10%) is generally more attractive than a lower one (e.g., 3%), if all else is equal.

-

The cap rate indicates how long it takes to recover an investment: a 10% cap rate means about 10 years to recover.

- Different cap rates reflect different risk levels: Low cap rate = lower risk. High cap rate = higher risk.

-

There is no “optimal” cap rate—it depends on the investor’s risk tolerance. For example, a property in a desirable suburban area typically has a lower cap rate due to high market value (lower risk). A property in a run-down city area tends to have a higher cap rate due to lower market value (higher risk).

It is important to note that cap rates should not be the sole basis for investment decisions. While cap rates are a useful starting point, they should be combined with a broader financial and strategic analysis to make sound real estate investment decisions.

How Investors Use the Cap Rate

Investors can use the cap rate in the following two main ways:

1. When Buying

One of the applications of the cap rate is when evaluating potential investments to buy, and the tool can be a good indicator of the return you can expect on an investment. Using the cap rate on a number of potential investments can help analyze how the investments perform, and which one fits your investment goals. With the cap rate, you can compare properties according to a specific percentage, rather than make a decision based on the fluctuating market rents and property prices.

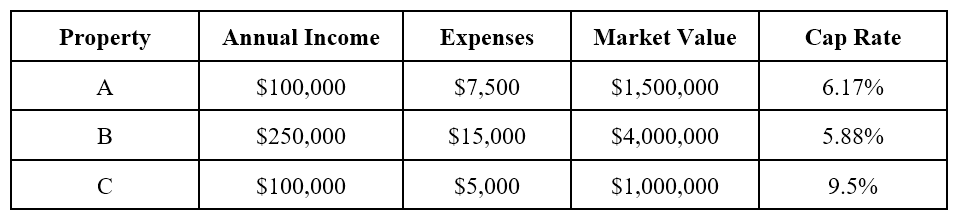

For example, assume that an investor is considering acquiring one of three listed properties. An investor can first obtain the net operating incomes for all three properties in order to calculate their cap rates.

One should also consider the recurring expenses of the properties and their periodic rents, to see if there are opportunities for reducing the expenses or increasing the rents. It can be achieved when the recurring expenses are too high per square feet of space, or the periodic rents are below the market rates vis-à-vis what other comparable properties charge.

2. When Selling

An investor can also use the cap rate to find the current market value of a property they intend to sell based on the market value of recently sold properties in the same location. The first step when calculating the market value is to find properties that are similar to the one being sold in terms of size, type, and location.

The next step is to find their listing values, as well as their net operating income. The information can be obtained from the real estate website where such properties are listed or by contacting the real estate agents who sold the properties. The investor can then use the net operating incomes and market values of each of the comparable properties to get the average cap rate.

Practical Example: Cap Rate in Real Estate

John is an investor looking to buy an investment property. From taking real estate courses, he remembers that the capitalization rate is an effective metric in evaluating real estate properties. John identifies three properties with their respective expenses, annual income, and market values:

After doing the calculations for the properties above, John realizes that Property C returns the highest cap rate.

In a simple world, John may base his purchase on the rate alone. However, it is just one of many metrics that can be used to assess the return on commercial real estate property.

Although the cap rate gives a good idea of a property’s theoretical return on investment, it should be used in conjunction with other metrics, such as the gross rent multiplier, among many others. Therefore, other metrics should be used in conjunction with the capitalization rate to gauge the attractiveness of a real estate opportunity.

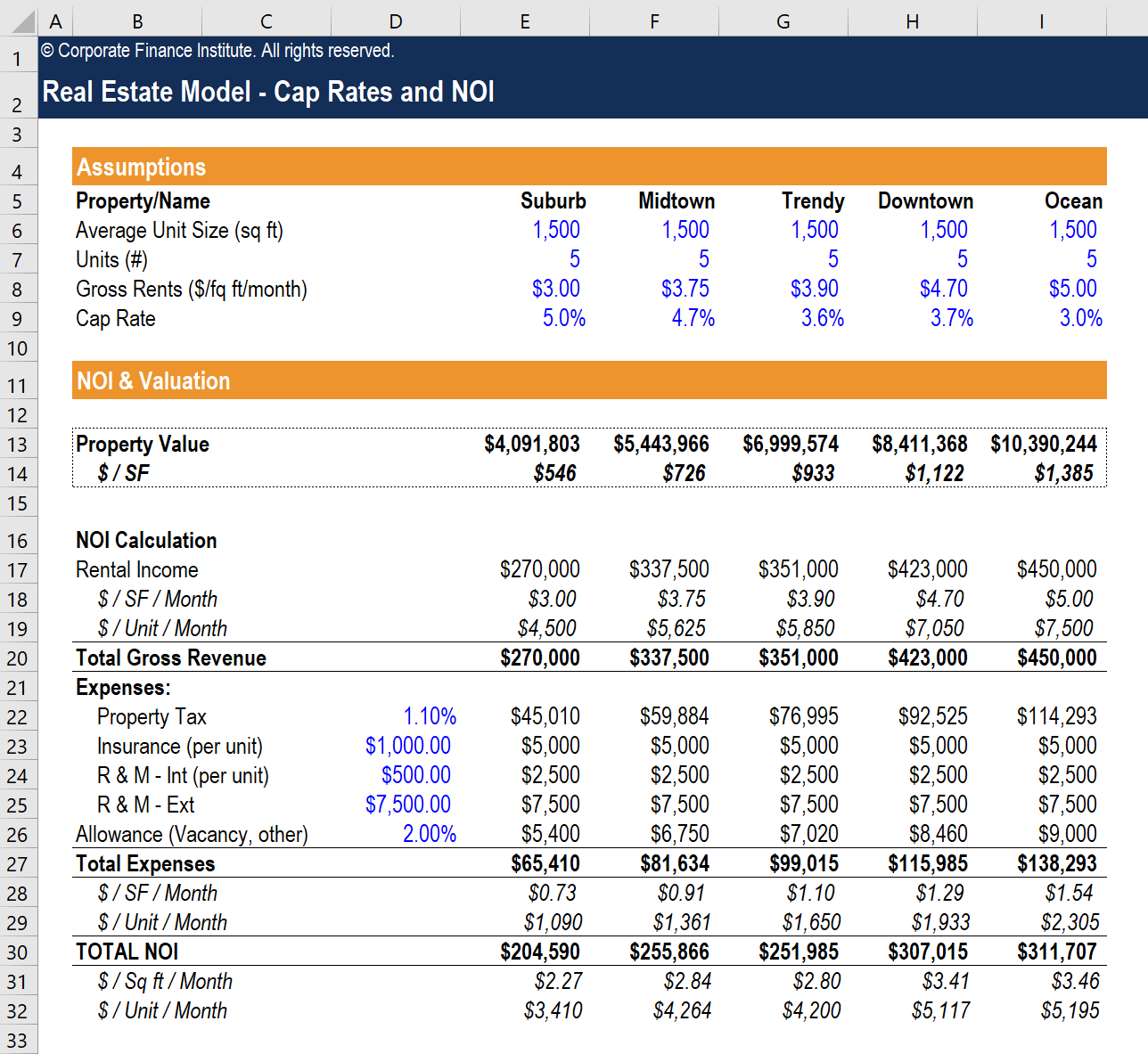

Real Estate Modeling Course

If you want to learn all about how to calculate net operating income, capitalization rates, and even how to build a financial model for a development project, check out CFI’s Real Estate Financial Modeling Course. The program will teach you how to build a model in Excel from scratch.

Cap Rate Summary

- The capitalization rate is a profitability metric used to determine the return on investment of a real estate property.

- The formula for the capitalization rate is calculated as net operating income divided by the current market value of the asset.

- The capitalization rate can be used to determine the riskiness of an investment opportunity – a high capitalization rate implies higher risk, while a low capitalization rate implies lower risk.

- The capitalization rate should be used in conjunction with other metrics, and investors should never base a purchase on the capitalization rate of a property alone.

Additional Resources

Thank you for reading CFI’s guide to Capitalization Rate. To keep advancing your career, the additional resources below will be useful: