Value Added

The enhancement made by the company to its product or service

What is Value Added?

Value added is the extra value created over and above the original value of something. It can apply to products, services, companies, management, and other areas of business. In other words, it is an enhancement made by a company/individual to a product or service before offering it for sale to the end customer.

Value can be added to a product, service, process, or an entire business. Value can be added by providing better or extra services in the form of after-sales services and better customer support. Value can also be added by improving a product in some way, or by including extras with the product. For example, a retail seller of computers can add value by including software or computer accessories with the basic product – the computer.

Companies with strong branding can add value to their products or services simply by using the company’s logo to sell a product.

Gross Value Added (GVA)

Gross Value Added (GVA) helps to measure the contribution to an economy of an individual sector, region, industry, or producer. In other words, GVA helps to measure the gross value added by a particular product, service, or industry. GVA is important because it helps to calculate Gross Domestic Product, which is a key indicator of the state of the nation’s total economy.

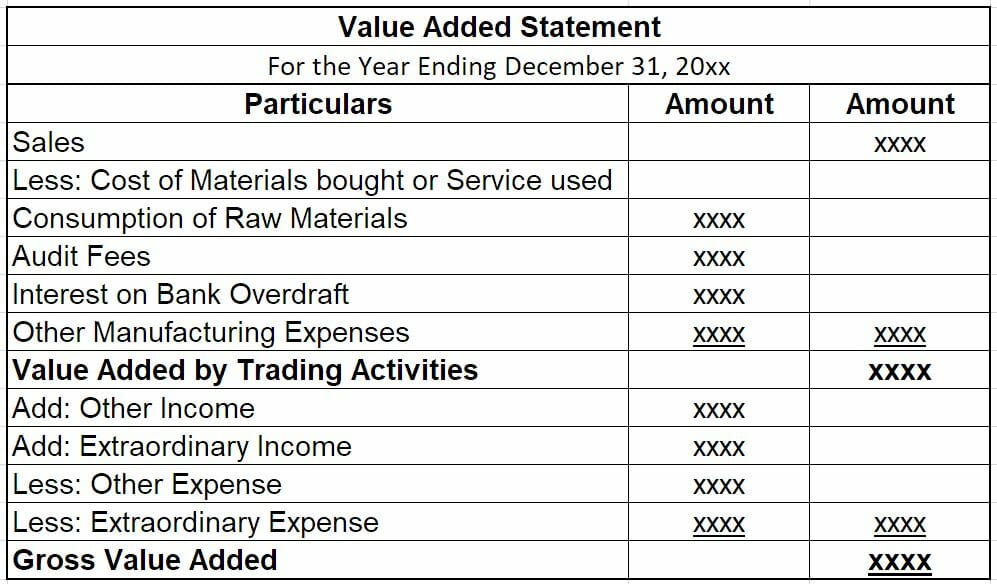

GVA can be calculated using the Value Added Statement (VAS).

Net Value Added can be calculated by subtracting Depreciation from Gross Value Added.

Economic Value Added

Economic Value Added (EVA) can be defined as the incremental difference between a company’s rate of return and its cost of capital. Economic Value-Add is used to measure the value that a company generates from the funds invested in it.

Where:

- NOPAT – Net Operating Profit After Tax is the profit generated by a company through its operations, after adjusting for taxes but before adjusting for financing costs and noncash costs.

- CE – Capital Employed is the amount of cash that is invested in the business.

- WACC – Weighted Average Cost of Capital is the minimum rate of return expected by the provider of capital – the investors in the business.

EVA helps to quantify the cost of investing capital in a project. It also helps to assess whether the project is generating enough cash to be considered a good investment. EVA indicates the performance of a company on the basis of where and how the company creates wealth.

In order to assess EVA, a lot of financial modeling is required to project future cash flows and discount them back to the present using the WACC. Modeling is an advanced form of financial analysis – to learn more, check out CFI’s online financial modeling courses.

Download the Free Template

Value Added Template

Download the free Excel template now to advance your finance knowledge!

Market Value Added

Market Value Added (MVA) can be defined as the difference between the market value of a business and the capital invested by both the shareholders and debt holders.

MVA indicates a company’s capacity to increase shareholder value over time. A high MVA indicates effective management and strong operational capabilities, whereas a low MVA can indicate that the value of management’s actions and investments is less than the value of capital contributed by the company’s investors.

Cash Value Added

Cash Value Added (CVA) helps to measure the amount of cash a company generates through its operations. CVA gives investors an idea of the company’s ability to generate cash from one financial period to another.

Ways to Add Value for Customers

- Customer’s perspective – To understand what customers from the target market want from the product or service of the company. Doing business according to customers’ expectations is something that many businesses miss out or fall short on.

- Improving customer satisfaction – To get the customer’s feedback through things, such as surveys, about the product or service, and then continue working to enhance customer satisfaction delivered with the product or service.

- Customer experience – To provide customers with not only a satisfactory product or service but also with satisfactory after-sales services to create a memorable experience for the customer.

- Marketing – To implement a marketing strategy after well-informed market research about what customers expect and what is the best way to make the product or service available to customers.

Other Resources

Thank you for reading CFI’s guide to Value Added. To continue developing your career as a financial professional, take a look at the following additional CFI resources, which discuss various aspects of business costing: