High Net Worth Individual (HNWI)

An individual with a net worth of a minimum of $1,000,000 in highly liquid assets, such as cash and cash equivalents

Who is a High Net Worth Individual (HNWI)?

A high net worth individual (HNWI) refers to an individual with a net worth of a minimum of $1,000,000 in highly liquid assets, such as cash and investible assets.

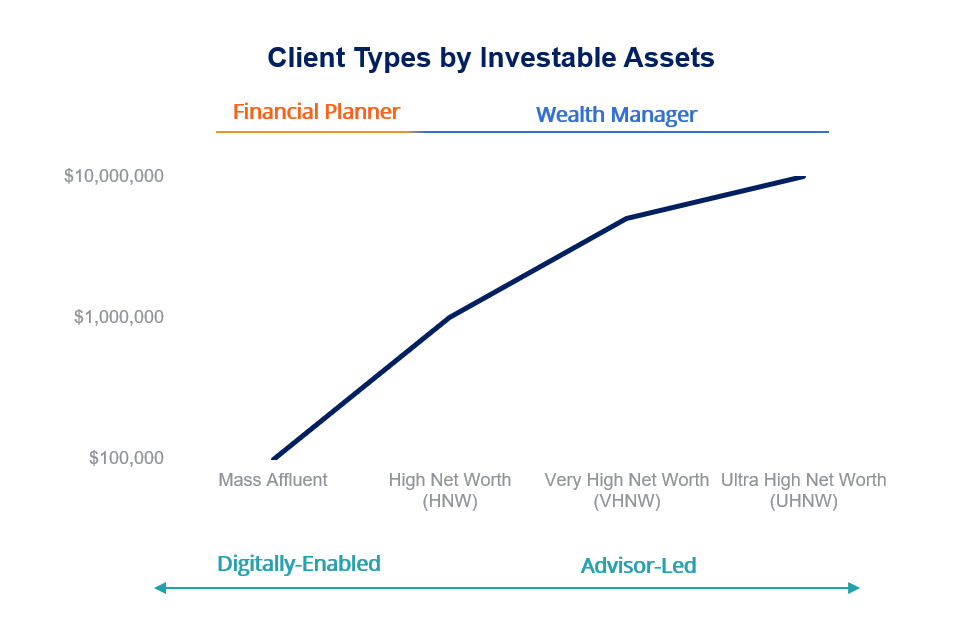

Individuals with less than $1,000,000 but more than $100,000 are called mass affluent investors. A very high net worth individual is a person with at least $5,000,000. On the other hand, an ultra-high net worth individual owns a minimum of $10,000,000 in investable assets, excluding personal assets and property (e.g., primary residence, consumer durables, and collectibles).

Classifying the type of investor varies between financial institutions and countries, and they are not set-in-stone figures but general guidelines.

Key Highlights

- A high net worth individual (HNWI) is a wealthy person with at least $1 million in liquid assets.

- HNWIs often receive special treatment from financial institutions because of the business they bring in.

- Private wealth management represents the capital management of corporations, institutional investors, and HNWIs who contribute financial means to be invested into capital markets to generate returns.

- HNWIs often receive special treatment from financial institutions because of the business they bring in.

What is Private Wealth Management?

The term “high net worth individual” is extensively used in the world of private wealth management. In other words, it represents the management of assets of private entities, including HNWIs or accredited investors, where investors contribute capital for management to financial institutions, such as investment banks. It implies investing capital to generate returns (profits) and taking a risk.

Investment banks, independent financial advisors, and specific funds cultivate a close working relationship with wealthy clients to understand their goals and define investment strategies.

Private wealth management includes:

- Portfolio management

- Estate planning

- Mortgage planning

- Assets protection

- Tax management

What are the Privileges of High Net Worth Individuals?

High net worth individuals are offered special treatment (exclusive services) by financial institutions, e.g., unlimited spending or luxury hotel upgrades, 24-hour concierge service, etc.

The privileges are as follows:

- Invest in reputable private equity and hedge funds

- Take part in pre-IPO placements

- Take part in pre-ICO sales of particular ventures

- Access a community of angel investors and pursue an opportunity to become a shareholder in high-quality startups.

Importantly, financial institutions adhere to different standards for HNWI qualification, meaning they require an individual to hold a certain amount of liquid assets or depository accounts in the bank to be treated as an HNWI.

HNWIs are highly solicited by private wealth managers because the more money a person owns, the more management of capital it would be for a bank to preserve and multiply the invested money. The more work there is, the more the profit would be for the bank.

Additional Resources

Financial Planning & Wealth Management Professional (FPWMP®) Certification

Aggressive Investment Strategy

Introduction to Financial Planning and Wealth Management: Industry and Careers

This course will help you gain a strong understanding of Wealth Management and Financial Planning from two key perspectives: industry and careers.

• Develop a comprehensive understanding of where the industry is today, where it’s going, and what could be in it for you should you decide to pursue a career in it.

• Identify the key career paths from a holistic, region-agnostic point of view.

• Explain what each role’s day-to-day is and what skills an exceptional advisor in the role demonstrates.