- What is Cost of Goods Manufactured (COGM)?

- How to Calculate Cost of Goods Manufactured

- Example Calculation: Cost of Goods Manufactured (COGM) Formula

- Breaking Down the COGM Formula

- Determining Direct Materials Used

- Determining Direct Labor and Manufacturing Overhead

- Linking COGM to COGS

- Final Cost of Goods Manufactured (COGM) Formula

- Why is COGM Important for Companies?

- Download CFI’s Free Cost of Goods Manufactured (COGM) Template

- Additional Resources

- Cost of Goods Manufactured FAQs

How to Calculate Cost of Goods Manufactured (COGM)

COGM is the total cost incurred to manufacture products and transfer them into finished goods inventory for retail sale.

What is Cost of Goods Manufactured (COGM)?

Cost of Goods Manufactured (COGM) represents the total production costs incurred by a company to produce goods during a specific accounting period. This includes direct materials, direct labor, and manufacturing overhead. COGM is essential in inventory management and is used to calculate the cost of goods sold (COGS) on the income statement.

It’s a key accounting term for manufacturing businesses looking to monitor and manage production costs and improve profitability.

How to Calculate Cost of Goods Manufactured

The basic formula for cost of goods manufactured is:

COGM = Beginning WIP Inventory + Total Manufacturing Costs – Ending WIP Inventory

Where:

- Total Manufacturing Costs = Direct Materials + Direct Labor + Manufacturing Overhead

Each element of the equation for the cost of goods manufactured plays a key role in understanding the total manufacturing cost for a given period.

Example Calculation: Cost of Goods Manufactured (COGM) Formula

Suppose a company that manufactures furniture incurs the following costs:

- Direct Materials: $100,000

- Direct Labor: $50,000

- Manufacturing Overhead: $60,000

- Beginning WIP Inventory: $10,000

- Ending WIP Inventory: $30,000

With this information, we can solve for COGM:

COGM = 10,000 + 100,000 + 50,000 + 60,000 – 30,000 = $190,000*

Breaking Down the COGM Formula

To calculate the total cost of goods manufactured, it’s essential to understand how each component contributes to the formula. This section breaks down each element (from raw materials to overhead costs) and outlines how they work together to reflect total manufacturing costs for a specific accounting period. By clearly defining each input, businesses can more accurately assess production efficiency and profitability.

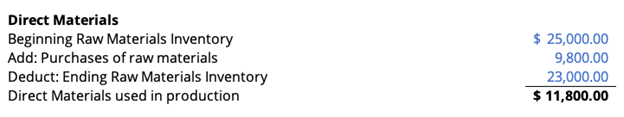

Determining Direct Materials Used

To determine the actual direct materials used by the company for production, we must consider the Raw Materials Inventory. Raw materials inventory refers to the inventory of materials waiting to be used in production. Raw materials inventory can include both direct and indirect materials. Beginning and ending balances must also be used to determine the amount of direct materials used. The example below shows this calculation.

The direct materials used in production is then transferred to the WIP Inventory account to calculate COGM.

Determining Direct Labor and Manufacturing Overhead

Determining how much direct labor was used in dollars is usually straightforward for most companies. With time logs and timesheets, companies just take the number of hours worked multiplied by the hourly rate.

For information on calculating manufacturing overhead, refer to CFI’s guide to job order costing.

Linking COGM to COGS

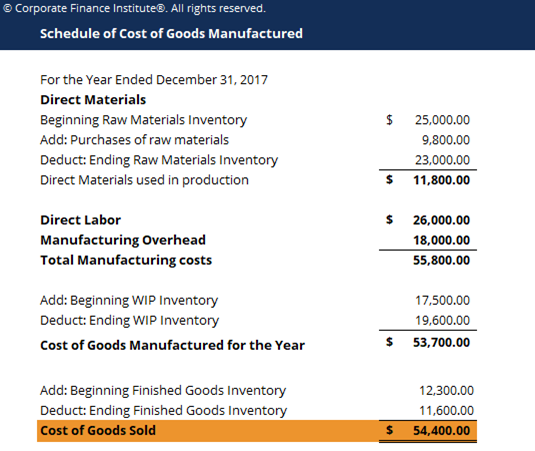

Once all the individual parts are calculated and used to figure out the total cost of goods manufactured for the year, this COGM value is then transferred to a final inventory account called the Finished Goods Inventory account, and used to calculate the Cost of Goods Sold.

Finished Goods Inventory, as the name suggests, contains any products, goods, or services that are fully ready to be delivered to customers in final form. Beginning and ending balances must also be considered, similar to Raw materials and WIP Inventory.

Finished Goods Inventory Calculation:

Beginning Balance + COGM – COGS = Ending Balance

With all the pieces together, we can construct a full schedule of Cost of Goods Manufactured and Cost of Goods Sold.

Final Cost of Goods Manufactured (COGM) Formula

Here’s a structured view of how to build a full COGM and COGS schedule:

| Schedule of Cost of Goods Manufactured

For the Year Ended December 31, 20XX |

| Direct Materials

Beginning Raw Materials Inventory ADD: Purchases of raw materials DEDUCT: Ending Raw Materials Inventory EQUALS: Direct Materials Used in Production |

| Direct Labor |

| Manufacturing Overhead |

| Total Manufacturing Costs (Direct Materials + Direct Labor + Manufacturing OH)

ADD: Beginning WIP Inventory DEDUCT: Ending WIP Inventory EQUALS: Cost of Goods Manufactured for the Year ADD: Beginning Finished Goods Inventory DEDUCT: Ending Finished Goods Inventory EQUALS: Cost of Goods Sold |

Why is COGM Important for Companies?

In general, having the schedule for Cost of Goods Manufactured is important because it gives companies and management a general idea of whether production costs are too high or too low relative to the sales they are making.

For example, if a company earned $1,000,000 in sales revenue for the year and incurred $750,000 in Cost of Goods Sold, they might want to look at ways to reduce their manufacturing costs to increase their gross margin percentage.

Comparatively, if another company earned $800,000 in sales revenue and incurred only $400,000 in COGS, even though the company’s sales were lower, their gross margin percentage is much higher, which makes the latter company substantially more profitable.

Therefore, by having a general picture of what the company is incurring in terms of manufacturing costs in all its specific components of materials, labor, and overhead, management can examine these areas more thoroughly to make any necessary adjustments or changes to maximize the company’s net income.

Download CFI’s Free Cost of Goods Manufactured (COGM) Template

Click the button below to download our free Cost of Goods Manufactured (COGM) template.

Additional Resources

Thank you for reading CFI’s guide to Cost of Goods Manufactured and How to Calculate COGM. To keep learning and advancing your career, the following resources will be helpful:

- Cost of Goods Sold

- Marginal Cost Formulas

- Variable Cost Ratio

- COGM Template

- See all Accounting resources

Cost of Goods Manufactured FAQs

What is the difference between COGS and COGM?

COGM refers to the cost of producing goods, while COGS includes COGM plus inventory adjustments to reflect goods sold during the period.

What costs are included in manufacturing overhead?

Factory rent, depreciation, utilities, indirect labor, and maintenance costs are all included in manufacturing overhead.

How does COGM support financial reporting?

COGM feeds into COGS on income statements and impacts gross profit, net income, and budgeting.