Dividend Payout Ratio

The amount of dividends paid to shareholders in relation to the company's total net income

What is the Dividend Payout Ratio (DPR)?

The Dividend Payout Ratio (DPR) is the amount of dividends paid to shareholders in relation to the total amount of net income the company generates. In other words, the dividend payout ratio measures the percentage of net income that is distributed to shareholders in the form of dividends.

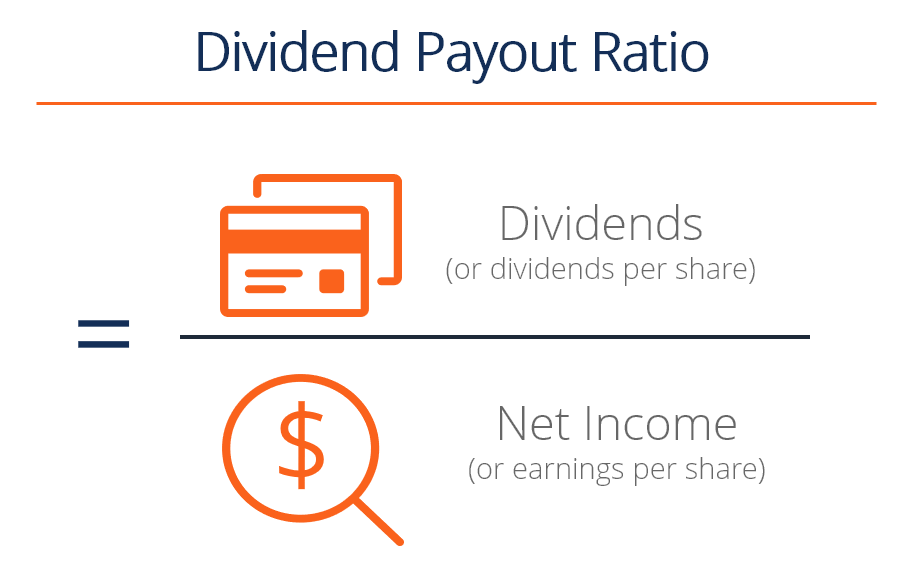

Dividend Payout Ratio Formula

There are several formulas for calculating DPR:

1. DPR = Total Dividends / Net Income

2. DPR = 1 – Retention Ratio (the retention ratio, which measures the percentage of net income that is kept by the company as retained earnings, is the opposite, or inverse, of the dividend payout ratio)

3. DPR = Dividends Per Share / Earnings Per Share

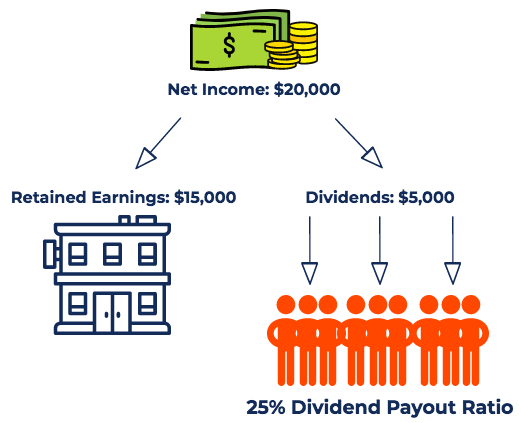

Example of the Dividend Payout Ratio

Company A reported a net income of $20,000 for the year. In the same time period, Company A declared and issued $5,000 of dividends to its shareholders. The DPR calculation is as follows:

DPR = $5,000 / $20,000 = 25%

Therefore, a 25% dividend payout ratio shows that Company A is paying out 25% of its net income to shareholders. The remaining 75% of net income that is kept by the company for growth is called retained earnings.

Download CFI’s Free Dividend Payout Ratio Template

How to Interpret the Dividend Payout Ratio

The dividend payout ratio helps investors determine which companies align best with their investment goals. When shareholders invest in a company, return on their investment comes from two sources: dividends and capital gains. The two sources of return are related as follows:

- A high DPR means that the company is reinvesting less money back into its business, while paying out relatively more of its earnings in the form of dividends. Such companies tend to attract income investors who prefer the assurance of a steady stream of income to a high potential for growth in share price.

- A low DPR means that the company is reinvesting more money back into expanding its business. By virtue of investing in business growth, the company will likely be able to generate higher levels of capital gains for investors in the future. Therefore, these types of companies tend to attract growth investors who are more interested in potential profits from a significant rise in share price, and less interested in dividend income.

The dividend payout ratio is not intended to assess whether a company is a “good” or “bad” investment. Rather, it is used to help investors identify what type of returns – dividend income vs. capital gains – a company is more likely to offer the investor.

Looking at a company’s historical DPR helps investors determine whether or not the company’s likely investment returns are a good match for the investor’s portfolio, risk tolerance, and investment goals. For example, looking at dividend payout ratios can help growth investors or value investors identify companies that may be a good fit for their overall investment strategy.

The DPR can also be used to gauge a company’s level of maturity, as follows:

- Younger, more rapidly growing companies are more likely to report a low DPR as they reinvest most of their earnings into the business for expansion and future growth.

- More mature, established companies, with a steadier but probably slower growth rate, are more likely to have a relatively high DPR as they do not feel the need to commit a high percentage of their earnings to business expansion. Blue chip stocks, such as Coca-Cola or General Motors, often have relatively higher dividend payout ratios.

Keep in mind that average DPRs may vary greatly from one industry to another. Many high-tech industries tend to distribute little to no returns in the form of dividends, while companies in the utility industry generally distribute a large portion of their earnings as dividends. Real estate investment trusts (REITs) are required by law to pay out a very high percentage of their earnings as dividends to investors.

Key Takeaways

In summary, here are the key points you need to know about the DPR:

- The dividend payout ratio is the amount of dividends paid to investors proportionate to the company’s net income.

- There isn’t an optimal dividend payout ratio, as the DPR of a company depends heavily on the industry it operates in, the nature of its business, and the maturity and business plan of the company.

- Fast-growing companies usually report a relatively lower dividend payout ratio as earnings are heavily reinvested into the company to provide further growth and expansion.

- Slower-growing, more mature companies, ones that have relatively less room for expanding their market share through large capital expenditures, usually report a higher dividend payout ratio.

- Income-oriented investors typically look for high dividend payout ratios in choosing companies to invest in.

Additional Resources

Thank you for reading CFI’s guide to Dividend Payout Ratio. To keep learning and advancing your career, the following CFI resources will be helpful: