Qualified Dividend

A dividend that is taxed at the long-term capital gains rate rather than the ordinary income rate

What is a Qualified Dividend?

A qualified dividend is a dividend that is taxed at the long-term capital gains rate rather than the ordinary income rate.

Summary

- A qualified dividend is taxed at the long-term capital gains rate.

- The main difference between a qualified dividend versus an ordinary dividend is that a qualified dividend is taxed at a rate ranging from 0% to 20%, while an ordinary dividend is taxed at a rate ranging from 10% to 37%.

- Qualified dividends were introduced through the passage of the Jobs and Growth Tax Relief Reconciliation Act of 2003.

Criteria for a Dividend to be “Qualified”

Criteria for a dividend to be taxed at the long-term capital gains rate:

1. The dividend must be paid by a United States corporation or by a foreign corporation that meets certain established requirements (incorporated in a U.S. possession, located in a country with an income tax treaty with the U.S., and whose stock is readily tradable on an established U.S. stock market).

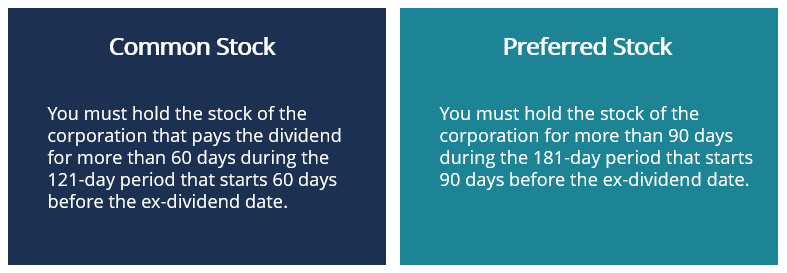

2. A certain holding period must be met depending on the type of stock (common or preferred):

For example, Company A declares an ex-dividend date of March 3, 2020. The 121-day period for the common stock of Company A would start on January 3, 2020 (60 days before the ex-dividend date) and end on May 3, 2020. If you purchase common shares of Company A on February 27, 2020, and subsequently sell the holdings on April 2, 2020, you would have only held the shares of Company A for 35 days within the 121-day period. The dividends received by Company A would not be considered qualified.

3. The dividends are not listed under “Dividends that are not qualified dividends.” See the list of dividends not considered qualified dividends on page 20 of Publication 550 – Investment Income and Expenses by the Internal Revenue Service.

For example, dividends paid by real estate investment trusts (REITs) and master limited partnerships (MLPs) are automatically exempt from consideration as qualified dividends.

Unqualified Dividends vs. Qualified Dividends

Dividends paid out of earnings of a company are either classified as unqualified or qualified. An unqualified dividend is also sometimes called an ordinary dividend.

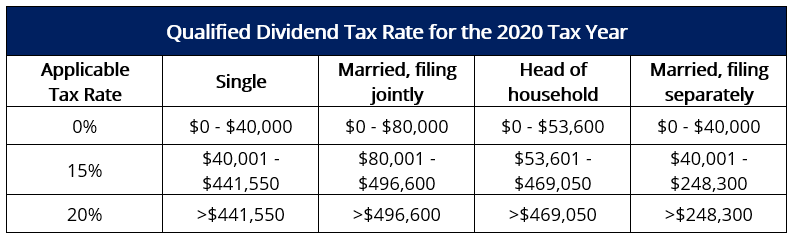

The main difference between a qualified dividend versus an ordinary dividend is that a qualified dividend is taxed at a rate ranging from 0% to 20%, depending on the income bracket. This compares to taxes paid on unqualified dividends, which are taxed as ordinary income and ranges from 10% to 37%.

Qualified dividends were introduced through the passage of the Jobs and Growth Tax Relief Reconciliation Act of 2003 and aimed to remedy a prevalent issue with the U.S. tax code at the time – companies opting to conduct share buybacks in lieu of paying out dividends.

It was due to share buybacks being taxed at the capital gains tax rate, which was lower than the ordinary income tax rate faced by ordinary dividends. The establishment of qualified dividends was to incentivize companies to pay out dividends to shareholders by lowering the applicable tax rate for dividends.

Qualified Dividend Tax Rate – 2020 Tax Year

The following shows the qualified dividend tax rate for the 2020 tax year:

Practical Example

Information:

- John is single and with an annual taxable income of $30,000.

- On January 13, 2020, John purchased 1,000 common shares of ABC Company.

- ABC Company is an American company headquartered in California and pays dividends that are not considered unqualified, according to the IRS.

- ABC Company pays $1 in dividends per common share once a year and with an ex-dividend date of March 20, 2020.

- On April 8, 2020, John sold all his shares in ABC Company.

Question 1: Determine whether John has met the holding period requirement for a dividend to be considered qualified.

Answer: The 121-day period for ABC Company is from January 20, 2020 (60 days before the ex-dividend date of March 20, 2020) to May 20, 2020 (121-day period). John meets the holding period requirement, as he’s held his shares for 79 days within the 121-day period (from January 20, 2020-April 8, 2020).

Question 2: Will the dividends paid out by ABC Company be considered qualified or unqualified?

Answer: The criteria for a dividend to be qualified have been met. (1) ABC Company is a United States-based corporation, (2) the holding period requirement was met, and (3) the dividends are not considered unqualified by the IRS.

Question 3: What is the applicable tax rate for the dividends received by ABC Company?

Answer: John is single and with an annual taxable income of $30,000. The applicable tax rate for the dividends by ABC Company would be 0%.

Additional Resources

CFI offers the Financial Modeling & Valuation Analyst (FMVA®) certification program for those looking to take their careers to the next level. To keep learning and developing your knowledge base, please explore the additional relevant resources below: