- What Is Return on Assets?

- What Is the ROA Formula?

- How to Calculate Return on Assets

- Download the Free Template

- What Is a Good ROA?

- Video Example of Return on Assets in Financial Analysis

- Who Uses the Return on Assets Ratio?

- Company Management

- Credit Analysts and Lenders

- Equity Research Analysts

- Value-Oriented Stock Investors

- Private Equity and Venture Capital Firms

- Competitors and Industry Watchers

- Why Return on Assets Matters

- Recap: Return on Assets and ROA Formula

- Frequently Asked Questions About Return on Assets

- Additional Resources

Return on Assets (ROA): Formula, Calculation, and Financial Analysis

The ability of a company to generate returns on its total assets

What Is Return on Assets?

Return on assets (ROA) is a profitability ratio that measures how efficiently a company generates profit from its total assets, calculated by dividing net income by total assets. A higher ROA indicates a company is more effective at converting its asset investments into earnings. For example, an ROA ratio of 15% means the company generates 15 cents of profit for every dollar of assets it owns.

Key Takeaways

- Return on assets is a profitability ratio that reveals how efficiently a company converts its assets into profit.

- The ROA formula is ROA = Net Income / Average Total Assets. This formula shows how much profit a company generates for every dollar of assets.

- Investors, lenders, equity analysts, and internal management all use ROA in evaluating a company’s efficiency, creditworthiness, and investment potential.

What Is the ROA Formula?

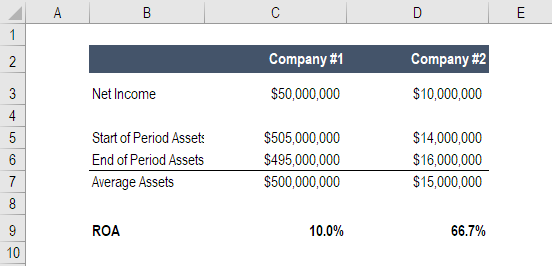

The return on assets formula divides net income by total assets, with the result expressed as a percentage:

ROA = (Net Income / Average Total Assets) x 100

Where:

- Net Income equals net earnings for the period (typically annual)

- Average Total Assets = (Beginning Total Assets + Ending Total Assets) / 2

For single-period analysis, you can use ending assets:

ROA = Net Income / Ending Total Assets

Using average assets provides a more accurate measure when asset levels change significantly during the period. Many financial analysts prefer the average assets approach for year-over-year comparisons.

How to Calculate Return on Assets

Suppose a business reports net income of $10 million and $50 million in total assets on the balance sheet. Follow these steps to calculate ROA:

Step 1: Identify net income = $10 million

Step 2: Identify total assets = $50 million

Step 3: Apply the formula

- ROA = Net Income / Total Assets

- ROA = ($10 million / $50 million) × 100

- ROA = 20%

This company generates $0.20 in net income for every dollar of assets invested. An ROA of 20% is considered strong performance in most industries.

Download the Free Template

What Is a Good ROA?

A good return on assets ratio depends heavily on industry characteristics, but general benchmarks include:

- Below 5%: Typical for asset-intensive businesses like utilities, airlines, and manufacturing.

- 5% to 10%: Average performance for many established companies.

- 10% to 20%: Strong performance indicating efficient asset utilization.

- Above 20%: Excellent performance, common in asset-light businesses like software and consulting.

Capital-intensive industries naturally show lower ROAs because they require substantial investment in property, plant, and equipment to generate revenue. A utility company with an ROA of 4% may be performing well for its sector, while a technology company with the same ROA would be underperforming.

Always compare ROA against industry peers rather than across different sectors. A manufacturing company’s 6% ROA should be evaluated against other manufacturers, not against software companies achieving 25% ROAs.

Video Example of Return on Assets in Financial Analysis

Who Uses the Return on Assets Ratio?

Return on assets is used by investors, analysts, lenders, and management teams to evaluate business performance and make financial decisions. Each group examines ROA from a different perspective to assess operational efficiency, creditworthiness, or investment potential.

Company Management

Internal management teams, especially those in asset-heavy industries, track ROA to monitor operational efficiency, set performance targets, and guide capital allocation decisions. Department heads often have ROA-linked incentives to encourage asset efficiency across the organization.

Credit Analysts and Lenders

Banks and credit rating agencies examine ROA when evaluating company creditworthiness. A business that steadily generates earnings from its asset base demonstrates capacity to service debt obligations.

Equity Research Analysts

Equity analysts use ROA to assess management effectiveness and compare investment opportunities within the same industry. Analysts look for companies that generate strong returns relative to their asset base, which often signals competitive advantages or operational excellence.

Value-Oriented Stock Investors

Value investors favor ROA when evaluating asset-heavy businesses, so they can see that management generates proportional returns — not accumulating assets with no profit growth.

Private Equity and Venture Capital Firms

Private equity firms scrutinize the return on assets ratio of target companies to identify operational improvement opportunities. Low ROA relative to industry peers indicates inefficiencies that can be addressed post-acquisition. PE firms also track ROA to measure portfolio company performance after implementing operational changes.

Competitors and Industry Watchers

Companies benchmark their ROA against competitors to gauge relative efficiency and identify best practices worth adopting across their own operations.

Why Return on Assets Matters

The return on assets ratio reveals how efficiently a company converts its investments into profit. ROA enables investors and managers to assess operational performance, compare companies within the same industry, and identify whether a business model is asset-intensive or asset-light.

Key Benefits of ROA in Financial Analysis

- Measures profitability per dollar of assets: A higher ROA demonstrates that a business is more efficient at converting its resource base into earnings.

- Enables industry-specific comparisons: Companies in different industries vary significantly in asset requirements, making cross-industry ROA comparisons misleading.

- Identifies business model characteristics: The ROA ratio signals how much asset investment a business model requires.

Recap: Return on Assets and ROA Formula

Return on assets (ROA) measures how efficiently a company generates profit from its total assets. You can calculate return on assets using the formula: ROA = Net Income / Average Total Assets. A higher ROA indicates better asset utilization, though what constitutes a “good” ROA varies significantly by industry.

Frequently Asked Questions About Return on Assets

What is the ROA formula?

The ROA formula is: ROA = Net Income / Average Total Assets. Net income comes from the income statement, while average total assets equals the sum of beginning and ending total assets from the balance sheet divided by two. The result is expressed as a percentage to show how many cents of profit a company generates per dollar of assets.

How do you calculate return on assets?

To calculate return on assets, divide net income by average total assets, then multiply by 100 to express as a percentage. For example, if a company has net income of $10 million and average total assets of $50 million, the ROA equals 20% ($10M / $50M × 100). This means the company generates $0.20 in profit for every dollar of assets.

What is a good ROA ratio?

A good ROA depends on the industry. Asset-intensive businesses like utilities and manufacturing typically show ROAs below 5%. Companies in the 5-10% range demonstrate average performance, while 10-20% indicates strong efficiency. ROAs above 20% are excellent, commonly seen in asset-light businesses like software and consulting. Always compare ROA against industry peers rather than across different sectors.

Additional Resources

Thanks for reading CFI’s guide to Return on Assets and the ROA Formula. To keep learning and become a world-class financial analyst, these additional CFI resources will be a big help: