Profitability Ratios

Measures of a company's earning power

Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.

What are Profitability Ratios?

Profitability ratios are financial metrics used by analysts and investors to measure and evaluate the ability of a company to generate income (profit) relative to revenue, balance sheet assets, operating costs, and shareholders’ equity during a specific period of time. They show how well a company utilizes its assets to produce profit and value to shareholders.

A higher ratio or value is commonly sought-after by most companies, as this usually means the business is performing well by generating revenues, profits, and cash flow. The ratios are most useful when they are analyzed in comparison to similar companies or compared to previous periods. The most commonly used profitability ratios are examined below.

What are the Different Types of Profitability Ratios?

There are various profitability ratios that are used by companies to provide useful insights into the financial well-being and performance of the business.

All of these ratios can be generalized into two categories, as follows:

A. Margin Ratios

Margin ratios represent the company’s ability to convert sales into profits at various degrees of measurement.

Examples are gross profit margin, operating profit margin, net profit margin, cash flow margin, EBIT, EBITDA, EBITDAR, NOPAT, operating expense ratio, and overhead ratio.

B. Return Ratios

Return ratios represent the company’s ability to generate returns to its shareholders.

Examples include return on assets, return on equity, cash return on assets, return on debt, return on retained earnings, return on revenue, risk-adjusted return, return on invested capital, and return on capital employed.

What are the Most Commonly Used Profitability Ratios and Their Significance?

Most companies refer to profitability ratios when analyzing business productivity, by comparing income to sales, assets, and equity.

Six of the most frequently used profitability ratios are:

#1 Gross Profit Margin

Gross profit margin – compares gross profit to sales revenue. This shows how much a business is earning, taking into account the needed costs to produce its goods and services. A high gross profit margin ratio reflects a higher efficiency of core operations, meaning it can still cover operating expenses, fixed costs, dividends, and depreciation, while also providing net earnings to the business. On the other hand, a low profit margin indicates a high cost of goods sold, which can be attributed to adverse purchasing policies, low selling prices, low sales, stiff market competition, or wrong sales promotion policies.

Learn more about these ratios in CFI’s financial analysis courses.

#2 EBITDA Margin

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It represents the profitability of a company before taking into account non-operating items like interest and taxes, as well as non-cash items like depreciation and amortization. The benefit of analyzing a company’s EBITDA margin is that it is easy to compare it to other companies since it excludes expenses that may be volatile or somewhat discretionary. The downside of EBTIDA margin is that it can be very different from net profit and actual cash flow generation, which are better indicators of company performance. EBITDA is widely used in many valuation methods.

#3 Operating Profit Margin

Operating profit margin – looks at earnings as a percentage of sales before interest expense and income taxes are deduced. Companies with high operating profit margins are generally more well-equipped to pay for fixed costs and interest on obligations, have better chances to survive an economic slowdown, and are more capable of offering lower prices than their competitors that have a lower profit margin. Operating profit margin is frequently used to assess the strength of a company’s management since good management can substantially improve the profitability of a company by managing its operating costs.

#4 Net Profit Margin

Net profit margin is the bottom line. It looks at a company’s net income and divides it into total revenue. It provides the final picture of how profitable a company is after all expenses, including interest and taxes, have been taken into account. A reason to use the net profit margin as a measure of profitability is that it takes everything into account. A drawback of this metric is that it includes a lot of “noise” such as one-time expenses and gains, which makes it harder to compare a company’s performance with its competitors.

#5 Cash Flow Margin

Cash flow margin – expresses the relationship between cash flows from operating activities and sales generated by the business. It measures the ability of the company to convert sales into cash. The higher the percentage of cash flow, the more cash available from sales to pay for suppliers, dividends, utilities, and service debt, as well as to purchase capital assets. Negative cash flow, however, means that even if the business is generating sales or profits, it may still be losing money. In the instance of a company with inadequate cash flow, the company may opt to borrow funds or to raise money through investors in order to keep operations going.

Managing cash flow is critical to a company’s success because always having adequate cash flow both minimizes expenses (e.g., avoid late payment fees and extra interest expense) and enables a company to take advantage of any extra profit or growth opportunities that may arise (e.g. the opportunity to purchase at a substantial discount the inventory of a competitor who goes out of business).

#6 Return on Assets

Return on assets (ROA), as the name suggests, shows the percentage of net earnings relative to the company’s total assets. The ROA ratio specifically reveals how much after-tax profit a company generates for every one dollar of assets it holds. It also measures the asset intensity of a business. The lower the profit per dollar of assets, the more asset-intensive a company is considered to be. Highly asset-intensive companies require big investments to purchase machinery and equipment in order to generate income. Examples of industries that are typically very asset-intensive include telecommunications services, car manufacturers, and railroads. Examples of less asset-intensive companies are advertising agencies and software companies.

Learn more about these ratios in CFI’s financial analysis courses.

#7 Return on Equity

Return on equity (ROE) – expresses the percentage of net income relative to stockholders’ equity, or the rate of return on the money that equity investors have put into the business. The ROE ratio is one that is particularly watched by stock analysts and investors. A favorably high ROE ratio is often cited as a reason to purchase a company’s stock. Companies with a high return on equity are usually more capable of generating cash internally, and therefore less dependent on debt financing.

#8 Return on Invested Capital

Return on invested capital (ROIC) is a measure of return generated by all providers of capital, including both bondholders and shareholders. It is similar to the ROE ratio, but more all-encompassing in its scope since it includes returns generated from capital supplied by bondholders.

The simplified ROIC formula can be calculated as: EBIT x (1 – tax rate) / (value of debt + value of + equity). EBIT is used because it represents income generated before subtracting interest expenses, and therefore represents earnings that are available to all investors, not just to shareholders.

Video Explanation of Profitability Ratios and ROE

Below is a short video that explains how profitability ratios such as net profit margin are impacted by various levers in a company’s financial statements.

Financial Modeling (Going beyond profitability ratios)

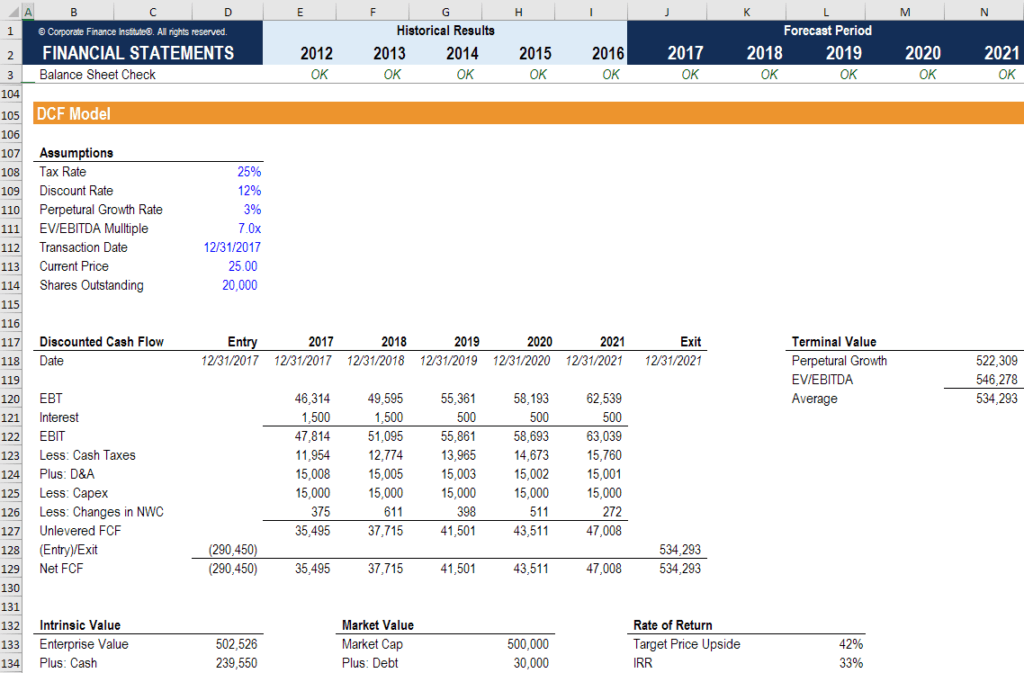

While profitability ratios are a great place to start when performing financial analysis, their main shortcoming is that none of them take the whole picture into account. A more comprehensive way to incorporate all the significant factors that impact a company’s financial health and profitability is to build a DCF model that includes 3-5 years of historical results, a 5-year forecast, a terminal value, and that provides a Net Present Value (NPV) of the business.

In the screenshot below, you can see how many of the profitability ratios listed above (such as EBIT, NOPAT, and Cash Flow) are all factors of a DCF analysis. The goal of a financial analyst is to incorporate as much information and detail about the company as reasonably possible into the Excel model.

To learn more, check out CFI’s financial modeling courses online!

Additional Resources

Thank you for reading this guide to analyzing and calculating profitability ratios. CFI is on a mission to help you advance your career. With that goal in mind, these additional CFI resources will help you become a world-class financial analyst:

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in