Overview

3-Statement Modeling Course Overview

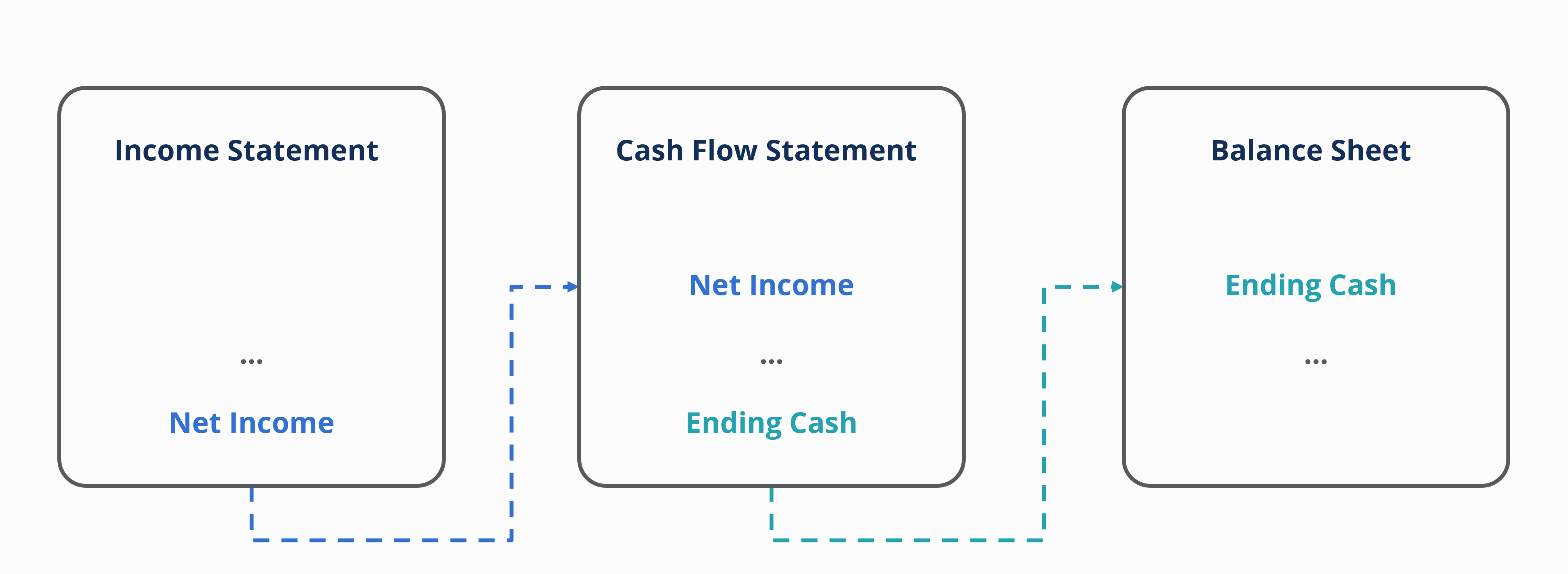

Being able to construct and balance a 3-Statement Modeling is a critical skill for many roles in accounting and finance. Including an income statement, cash flow statement, and balance sheet helps to assess the financial health of a business. Connecting the balance sheet correctly can also help by adding an error detection system to highlight issues with the financial model. This course discusses model circularity in detail beginning with the advantages and disadvantages of building circular models. We review the two circular loops in the model and walk through the necessary steps to install a circularity switch. Important figures from the financial statements are summarized on an attractive model dashboard. We also review important print settings used to format the model as a polished financial presentation.

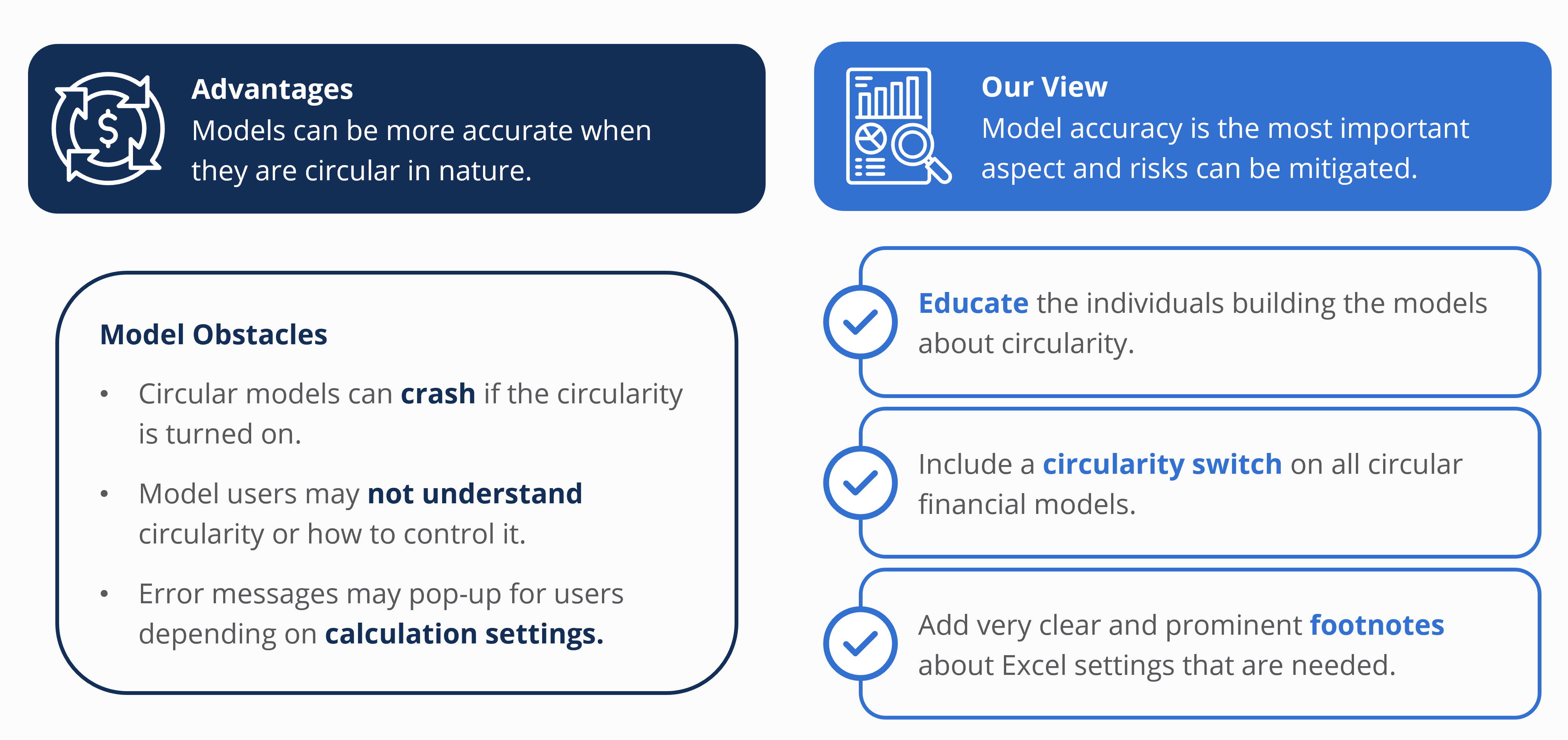

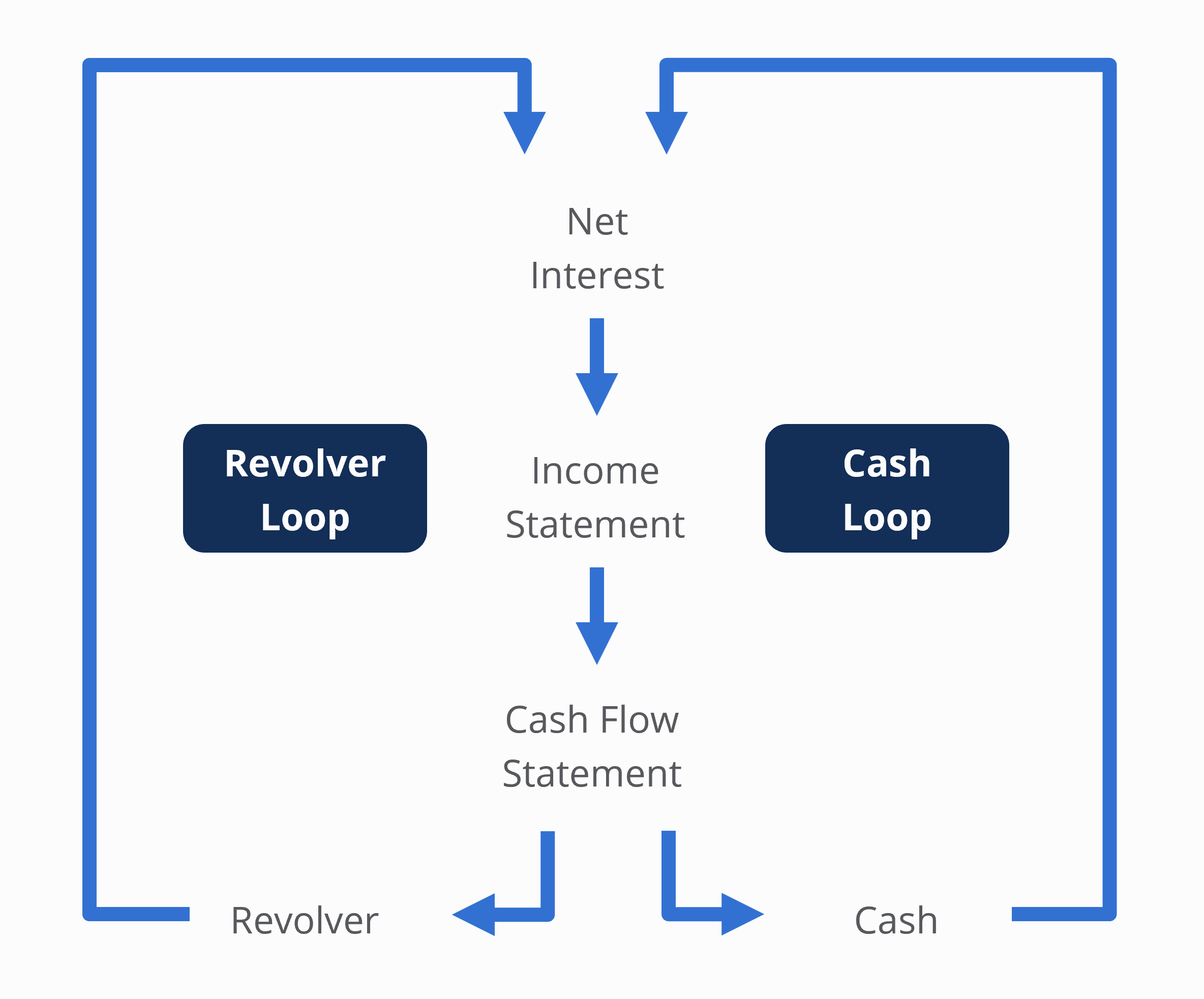

This course discusses model circularity in detail beginning with the advantages and disadvantages of building circular models. We review the two circular loops in the model and walk through the necessary steps to install a circularity switch. Important figures from the financial statements are summarized on an attractive model dashboard. We also review important print settings used to format the model as a polished financial presentation.

3-Statement Modeling Learning Objectives

Upon completing this course, you will be able to:- Review the best way to design 3-Statement Modeling, which have been prioritized for presentation and printing.

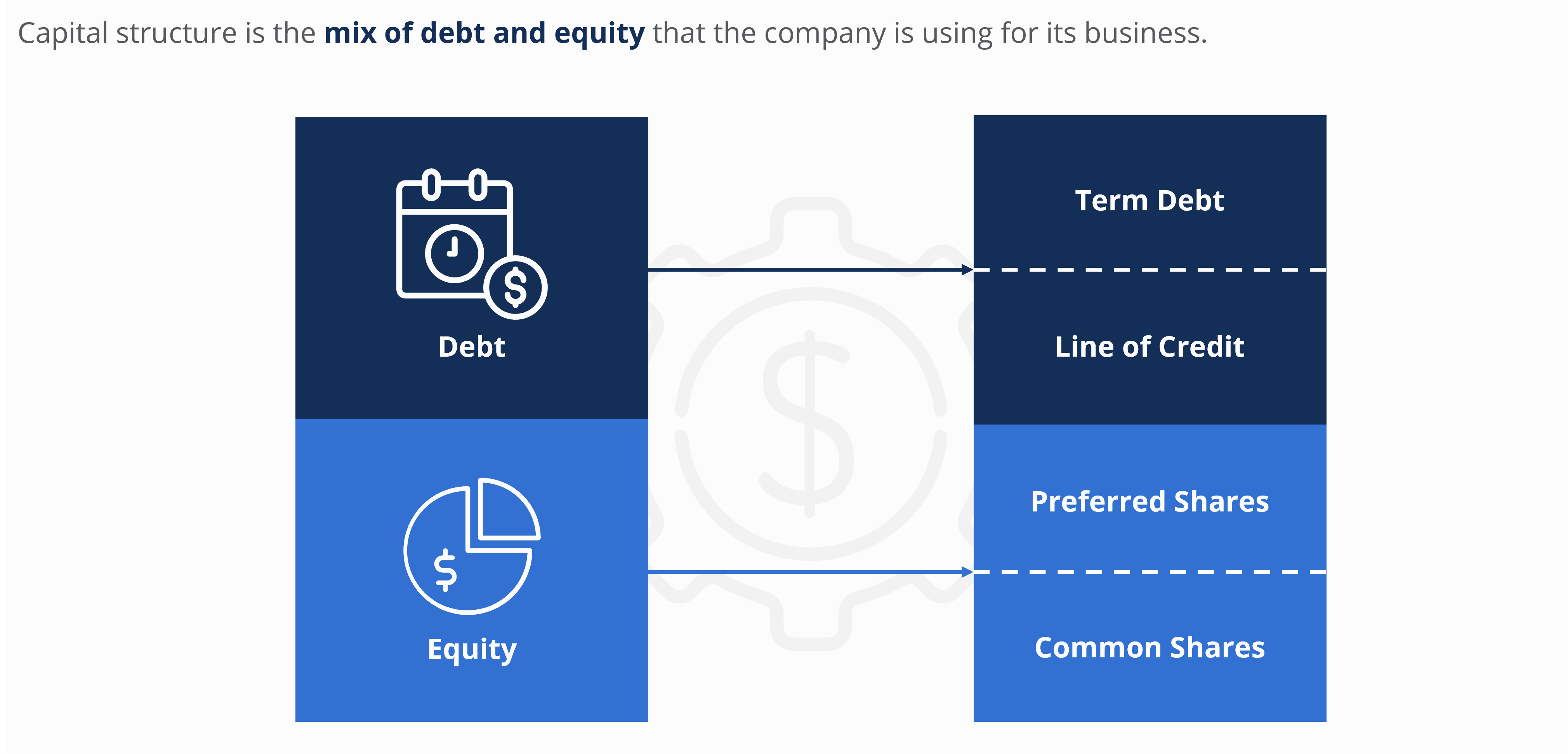

- Use separate corkscrews to build debt and equity schedules, including detailed instructions for installing a dynamic revolving line of credit.

- Understand the correct linkages between the three financial statements and how to use the balance sheet as an error detection system for the model.

- Discuss the two circular loops in the financial model and how to connect them to a circularity switch to reset the model when needed.

- Pull important figures from the financial statements into a rich dashboard with graphs highlighting critical model insights.

- Summarize model checks on the cover page with conditional formatting to alert the user to any areas of concern in the model.

Who Should Take This Course?

This course is most suitable for anyone working in investment banking, equity research, and private equity. The content may also be relevant for other financial modeling roles such as corporate development.

Prerequisite Courses

Recommended courses to complete before taking this course.

Prerequisite Skills

Recommended skills to have before taking this course.

- Excel

3-Statement Modeling

Level 4

3h 15min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Compact 3 Statement Model

Operational Schedules

Financial Statements

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Financial Modeling & Valuation Analyst (FMVA®) Certification

- Skills Learned Financial modeling and valuation, sensitivity analysis, strategy

- Career Prep Investment banking and equity research, FP&A, corporate development

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending

Investment Banking & Private Equity Modeling Specialization

- Skills You’ll Gain Accounting, Advanced Financial Modeling, Excel, Financial Statement Analysis, Forecasting, Valuation, and more.

- Great For Investment Banking, Private Equity, Equity Research, and more