Overview

Behavioral Finance Course Overview

Behavioral finance is the study of the influence of psychology on the behavior of financial practitioners. In the course, you will learn about the wide range of decision-making biases and information processing errors that influence our financial decision-making. We’ll start the course with what behavioral finance is and its impacts on financial markets. We will then explore the most common self-deception biases, cognitive biases, and emotional biases. We will discuss their causes and potential measures you can take to manage them. We’ll finish the course by discussing loss aversion and herding bias.

Behavioral Finance Learning Objectives

Upon completing this course, you will be able to:- Understand what behavioral finance is, how it differs from modern finance, and how it impacts financial markets

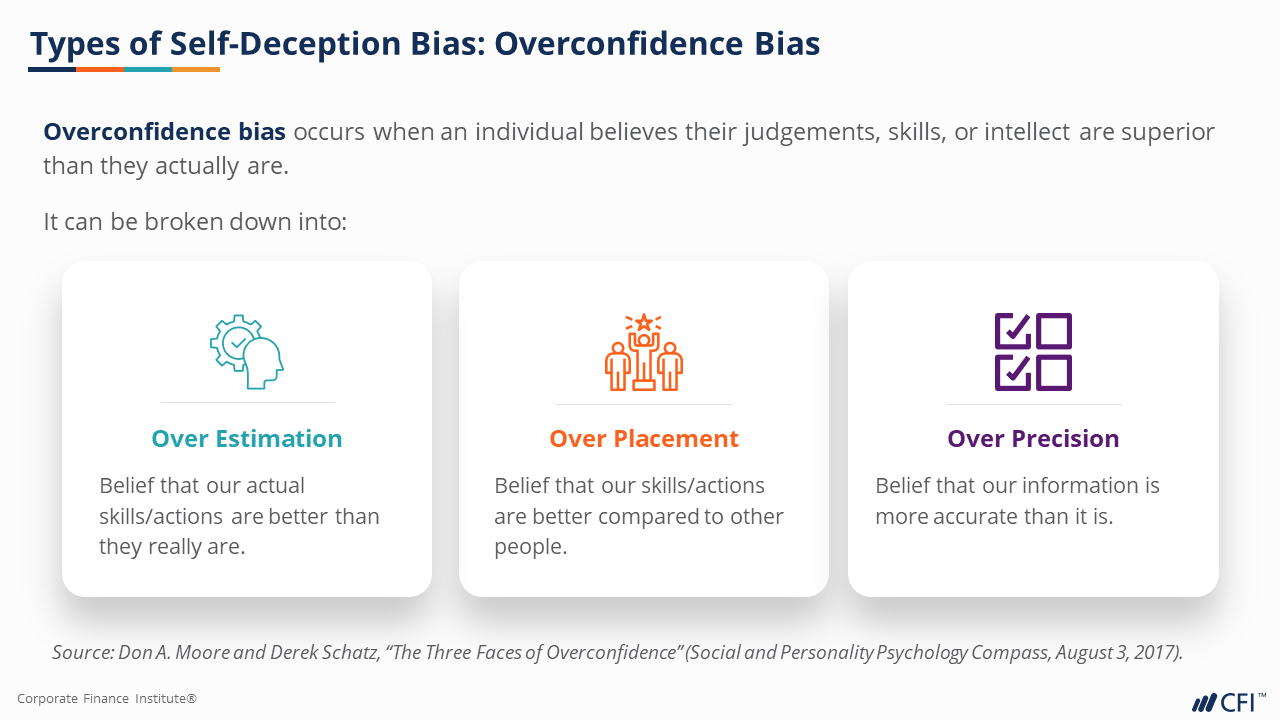

- Describe the most common self-deception biases, their causes, and potential measures you can take to prevent them

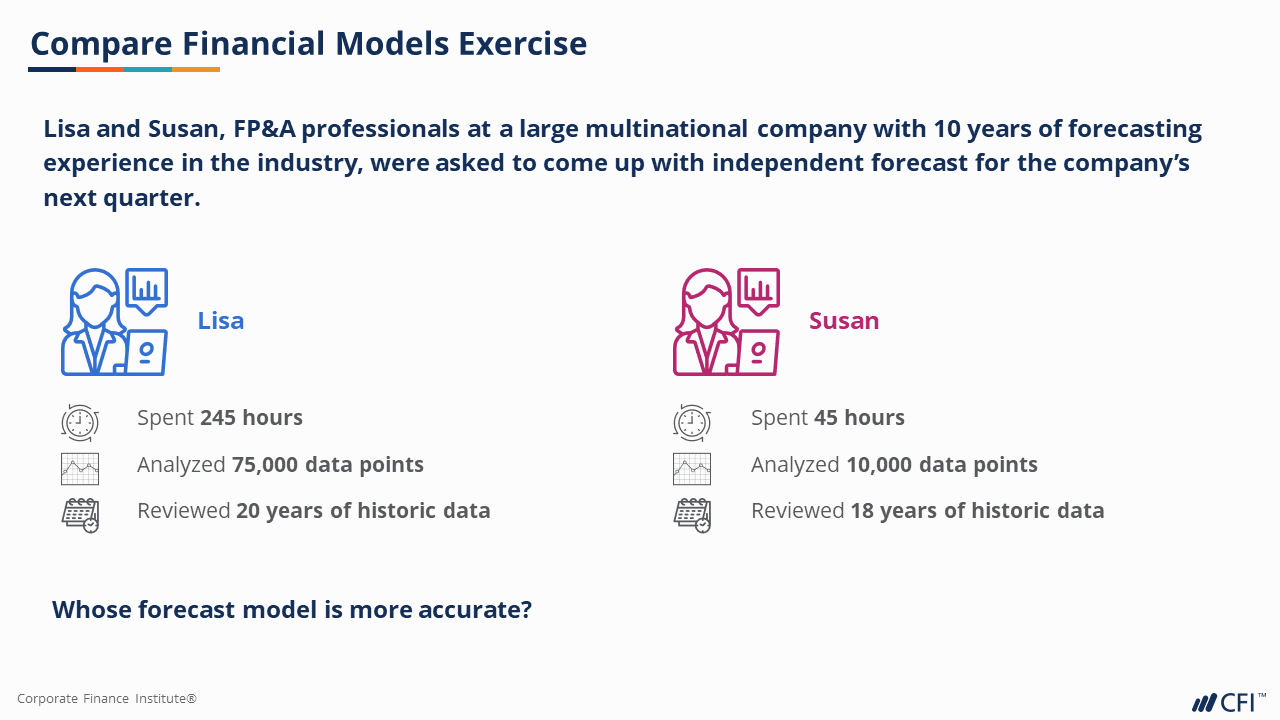

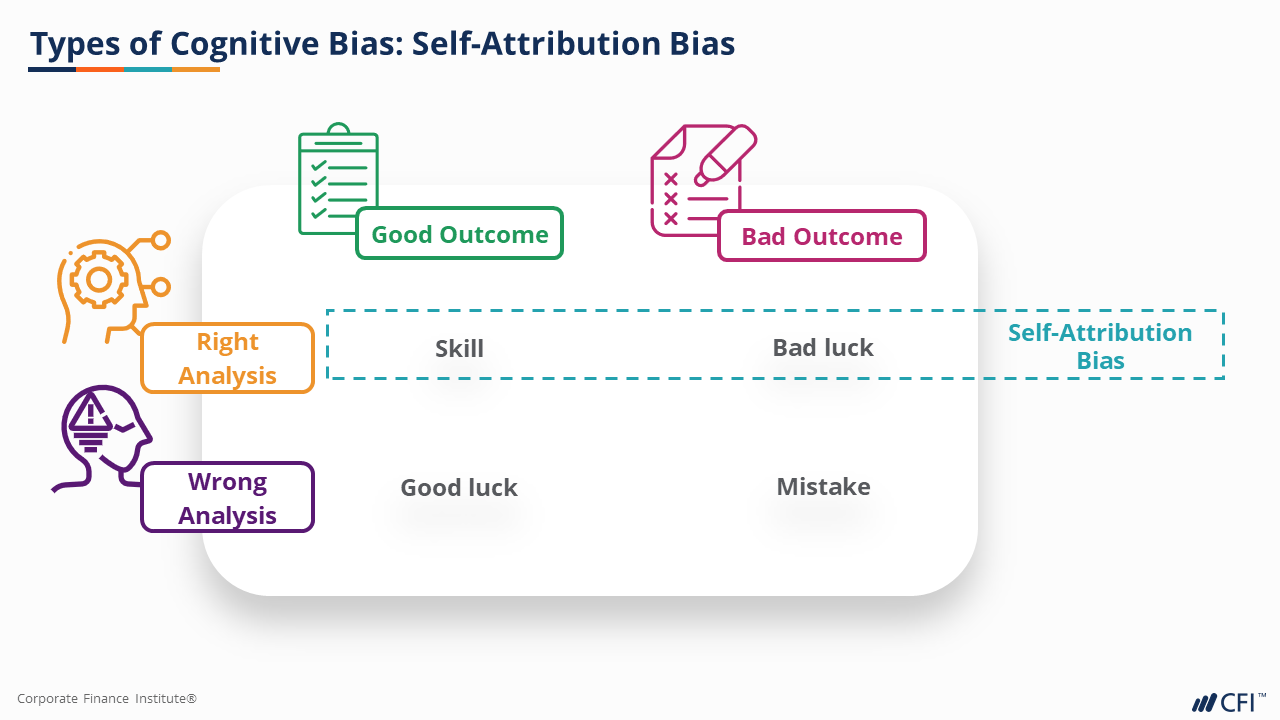

- Understand cognitive biases and explore their root causes with real-life examples

- List the most common emotional biases and discuss their causes with examples

- Understand loss aversion and other biases that contribute to its effect

- Study the herding bias and other social factors that distort decision-making

Who Should Take This Course?

This Behavioral Finance course is perfect for anyone who wants to be well-rounded in their analysis. This course is designed to equip anyone who desires to begin a career in fixed income, equity, sales and trading, or other areas of finance.Prerequisite Skills

Recommended skills to have before taking this course.

- Logical thinking

Behavioral Finance

Level 1

1h 59min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Introduction

Self Deception Biases

Cognitive Biases

Emotional Biases

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Capital Markets & Securities Analyst (CMSA®) Certification

- Skills Learned Trading strategies used in the finance and capital markets

- Career Prep Work in capital markets, whether on the buy-side or the sell-side

Financial Planning & Wealth Management Professional (FPWMP®) Certification

- Skills Learned Financial Learning, Business Development, Investment Management, Practice Management, Relationship Management

- Career Prep Financial Planner, Investment Advisor, Portfolio Manager