Overview

Portfolio Management Fundamentals Course Overview

This course offers a guide to understanding portfolio management—what it is as a process and what portfolio managers do in their roles. By introducing concepts linearly and logically, this course will first help you establish your knowledge of the portfolio management process by focusing on the firm-side, answering questions like – what is a traditional versus non-traditional portfolio manager, what are their strategies, and what are their investment approaches? This knowledge will enable you to understand how portfolio managers differ from three key perspectives: stakeholders, risk tolerance, and investment goals. We then understand what portfolio managers do in their roles by examining how portfolios are constructed, discussing how client mandates are formed, and lastly, demonstrating how a portfolio manager’s performance is measured. After completing this course, you will have a better understanding of what one of the most sought-after roles on the buy-side entails and be in a much more well-informed position to gauge whether or not a career in portfolio management might be for you. Topics explored include:

Topics explored include:

- What Is Portfolio Management

- Portfolio Manager Profiles

- Traditional versus Non-Traditional Portfolio Management

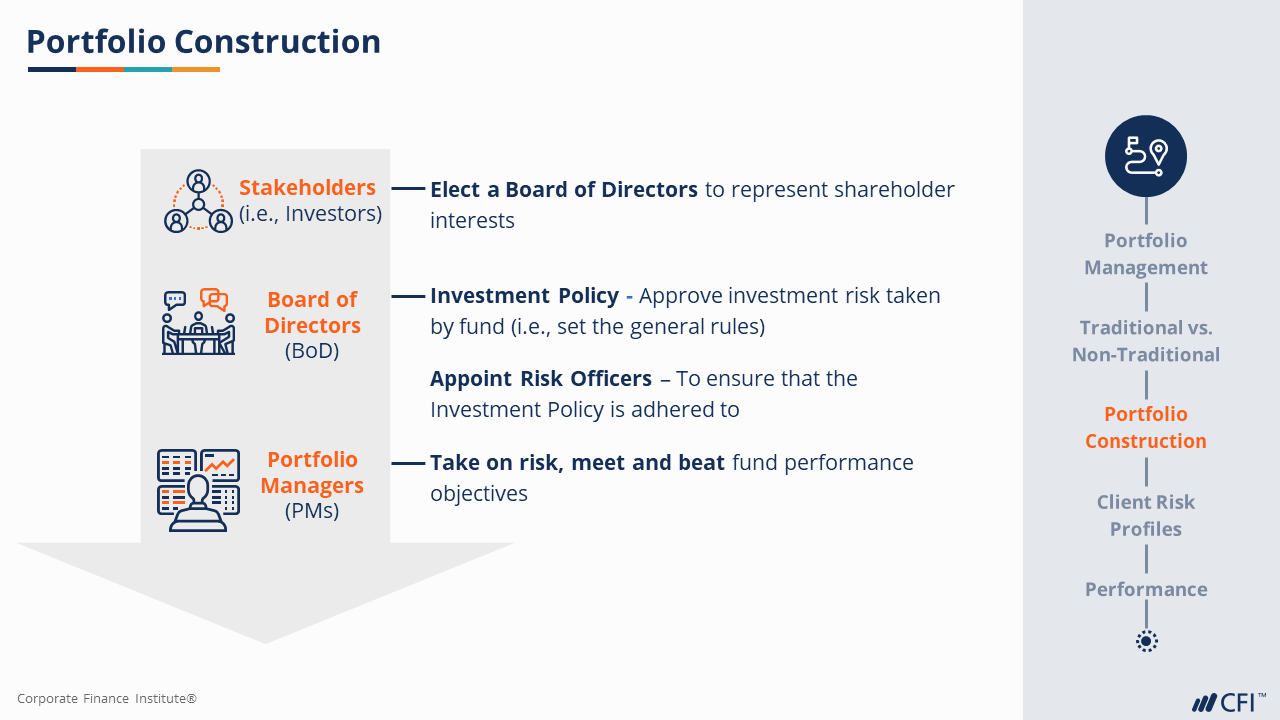

- Portfolio Construction

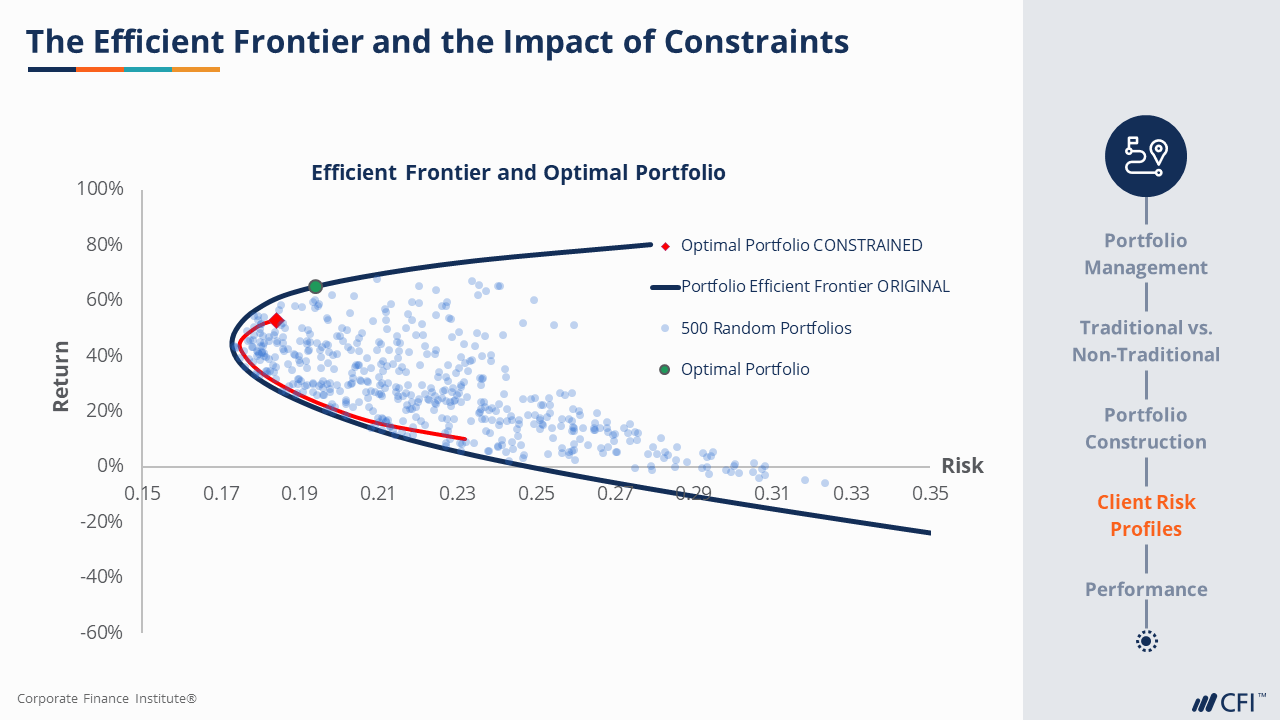

- Understanding Client Risk Profiles

- How Fund Performance is Measured

Portfolio Management Fundamentals Learning Objectives

After completing this course, you will be able to:- Describe what portfolio management is as an activity, and be able to articulate what a portfolio manager does and how this role differs from other popular capital markets roles (ex., equity research, sales & trading)

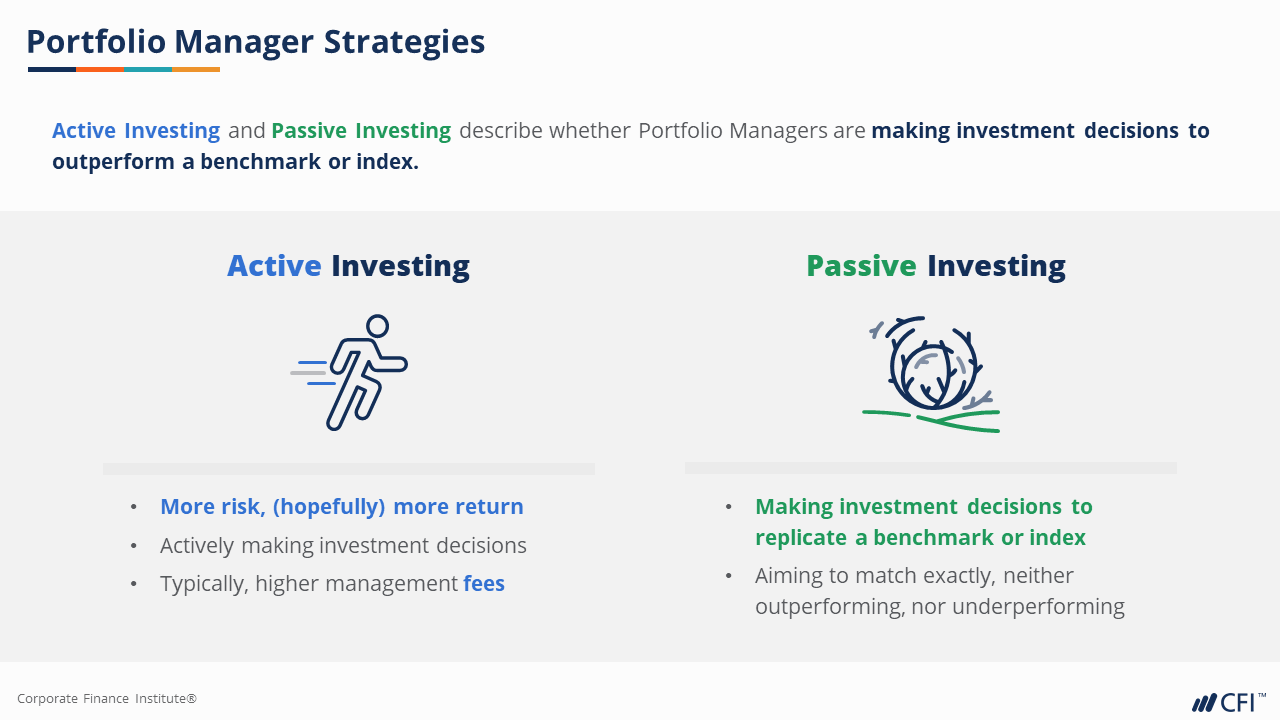

- Characterize traditional versus non-traditional asset managers in terms of their stakeholders, risk tolerance, and investment goals

- Explain the portfolio construction process and how each of the parties – stakeholders (investors), board of directors, and portfolio managers – are involved.

- Articulate how client risk profiles impact portfolio construction.

- Illustrate how fund performance is analyzed and measured by explaining the core concepts of performance attribution and performance versus benchmark at the portfolio manager level.

Who Should Take This Course?

This introductory portfolio management course is perfect for anyone and everyone interested in pursuing a career as a portfolio manager. Whether you are about to undergo your first job search as a new graduate of an academic institution, or you are ready to transition career paths after gaining professional work experience in a related or unrelated field, this course will help you establish a strong understanding of what portfolio management, what portfolio managers do, and whether this career path could be a great fit for you.Prerequisite Courses

Recommended courses to complete before taking this course.

Portfolio Management Fundamentals

Level 1

43min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Traditional vs Non-Traditional

Who Is Portfolio Management For

Conclusion

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Capital Markets & Securities Analyst (CMSA®) Certification

- Skills Learned Trading strategies used in the finance and capital markets

- Career Prep Work in capital markets, whether on the buy-side or the sell-side