Overview

Venture Debt Course Overview

This Venture Debt course explores key concepts for venture debt lenders. These lenders target companies in early growth stages that are considered too risky for traditional lending institutions. Venture debt lenders are uniquely positioned to help these companies achieve their goals while earning a lucrative return, creating a win-win scenario for both parties.

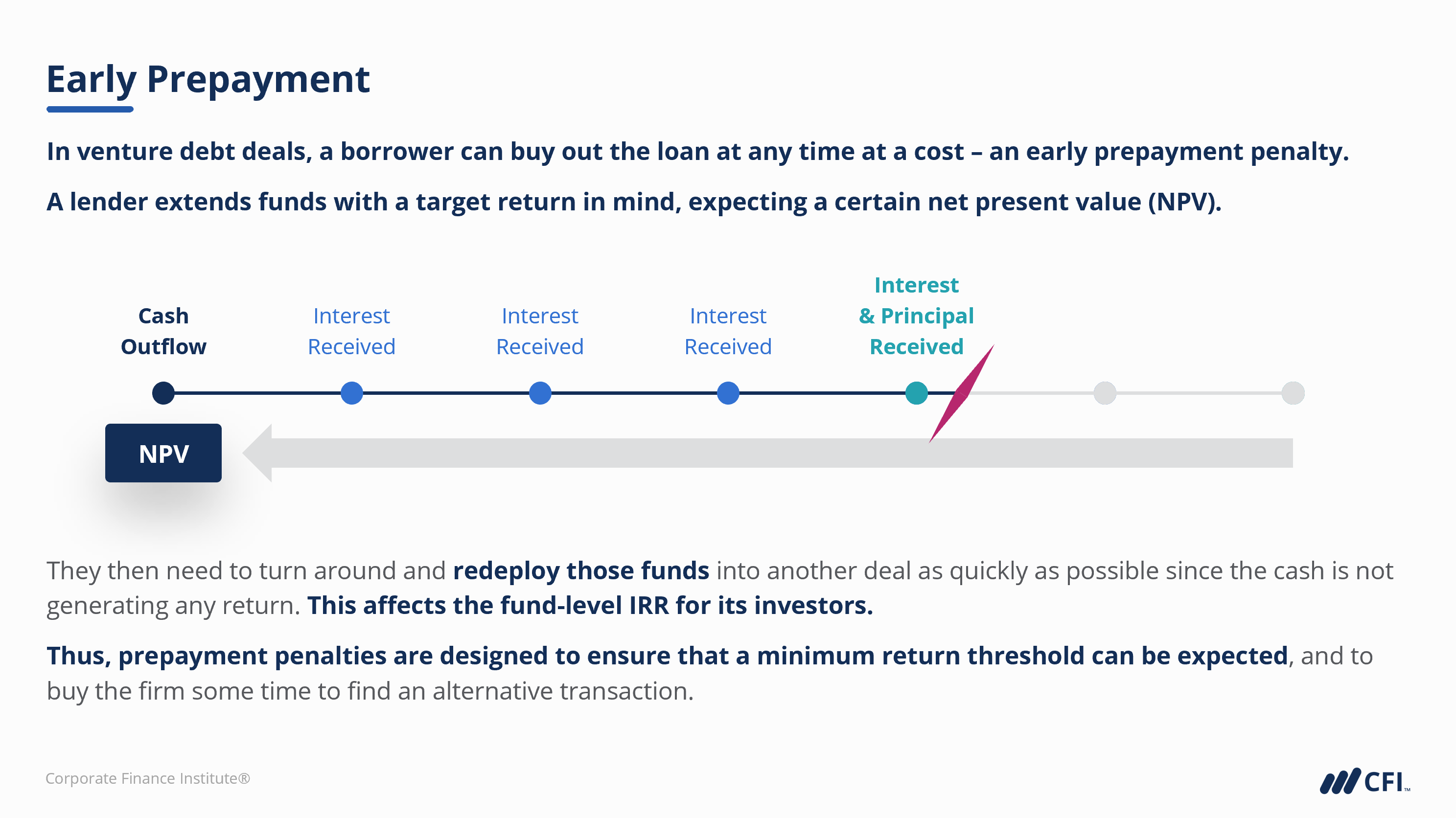

To lend to early-stage companies, venture debt lenders must consider different factors unique to this space. This course will dive into topics such as the early enterprise lifecycle, use cases for venture debt, the funding process, the use of warrants, and key venture analysis metrics before introducing and working through a venture debt risk rating model and an example term sheet.

Venture Debt Learning Objectives

Upon completing this course, you will be able to:

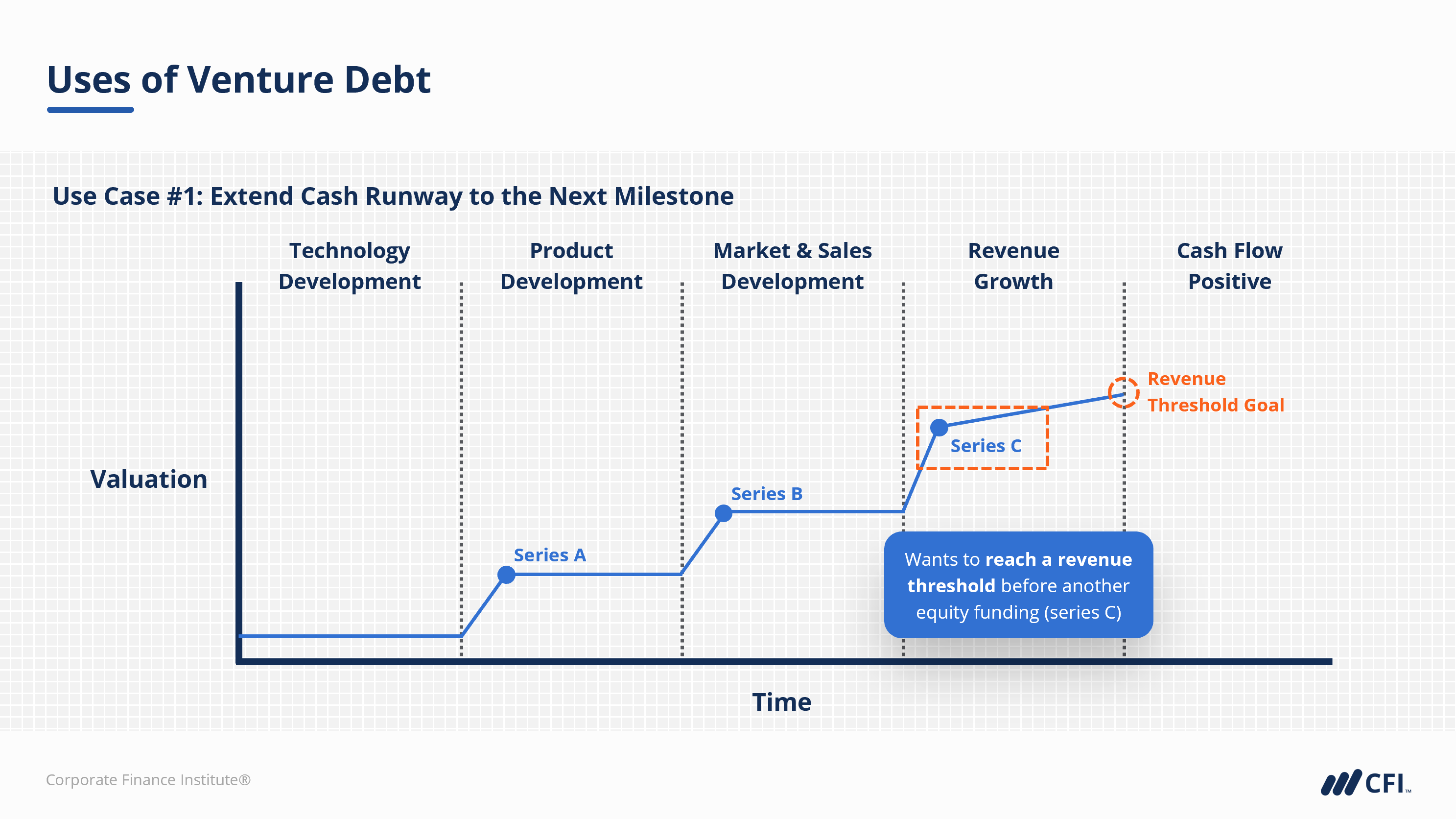

- Explain the early enterprise lifecycle, where venture funding fits within it, and the most common uses of venture debt

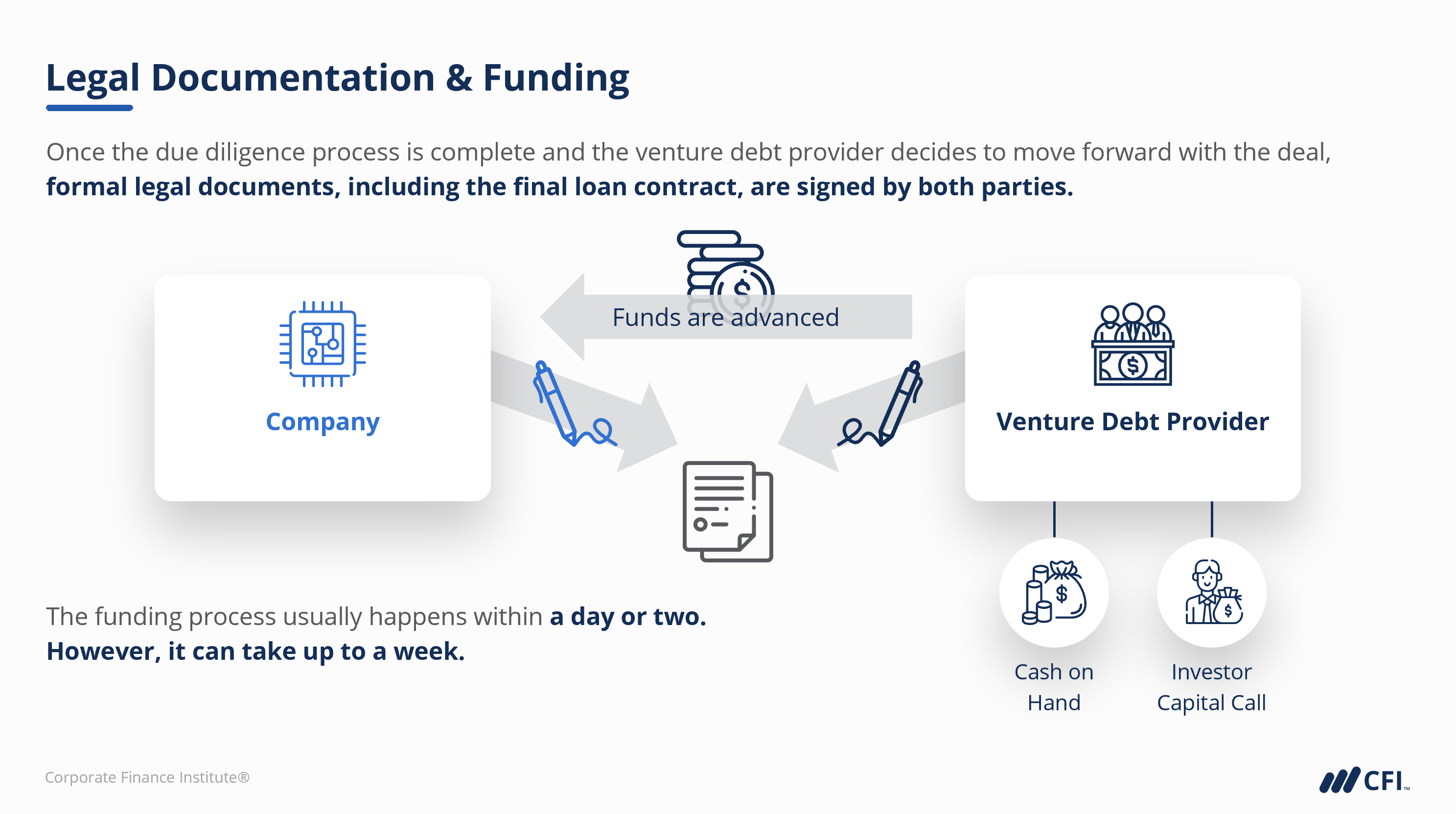

- Navigate the funding process

- Examine how warrants work

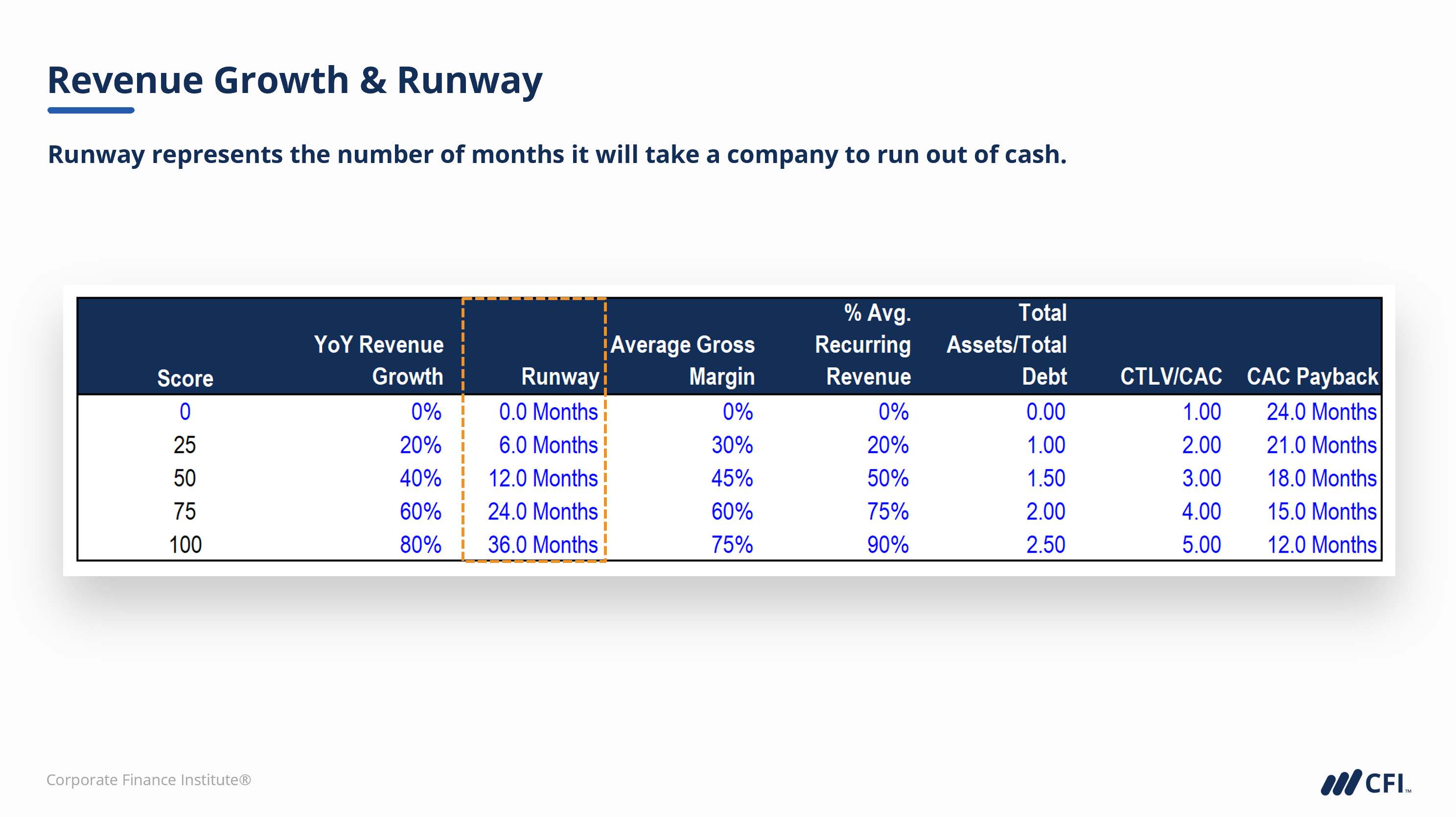

- Interpret a venture debt risk rating model and discuss the key analysis metrics used to assess a transaction

- Analyze an example borrower and risk rate them using a dynamic venture debt risk rating model

Who should take this course?

This Venture Debt course is suited for current and aspiring lending professionals, including credit analysts that are interested in the venture debt space. Commercial lenders and analysts can work for many different types of financial services firms, and it’s important to understand the tools available to support various borrowers. This course will prepare you with the knowledge you need to identify and apply alternative financing strategies.

Prerequisite Courses

Recommended courses to complete before taking this course.

Venture Debt

Level 4

2h 14min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Introduction

Midway Check-In

Venture Debt Risk Rating Model

Term Sheet

Conclusion

Qualified Assessments

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending