Overview

Convertible Bonds Course Overview

This course provides a comprehensive overview of convertible bonds. Students will learn convertible bonds’ benefits, risks, types, and issue processes. In addition, valuation methods will be discussed, including an Excel example for students to apply their learning.

Convertible Bonds Learning Objectives

By the end of this course, you will be able to:- Understand what convertible bonds (CBs) are and their various structures

- Identify the buyers of CBs, as well as the benefits and risks of investing in CBs

- Comprehend the math of CBs and understand various Greeks

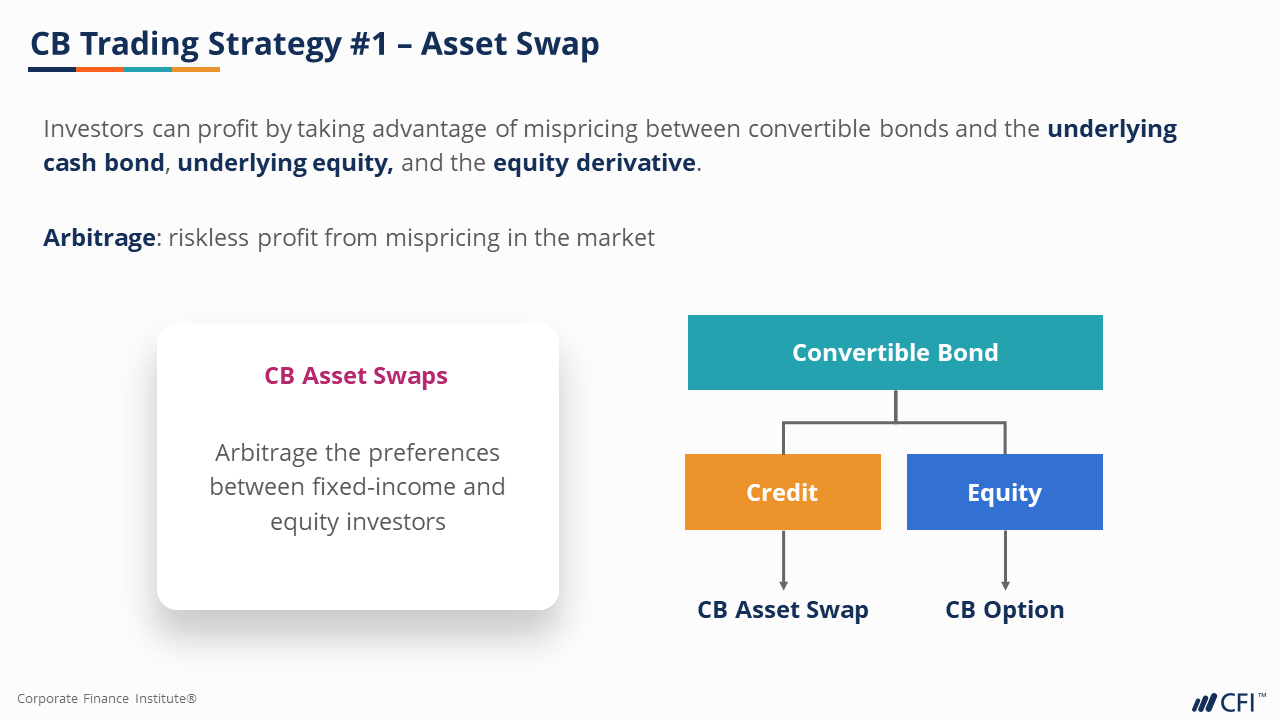

- Appreciate some methods used to trade CBs for arbitrage, hedging, and indexing

Who should take this course?

This Convertible Bonds course is perfect for students interested in learning about the fundamentals of convertible bonds. This course is essential for students pursuing a career in the capital markets since convertible bonds are a necessary type of convertible security issued by many firms and institutions.

Prerequisite Courses

Recommended courses to complete before taking this course.

Convertible Bonds

Level 4

1h 28min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

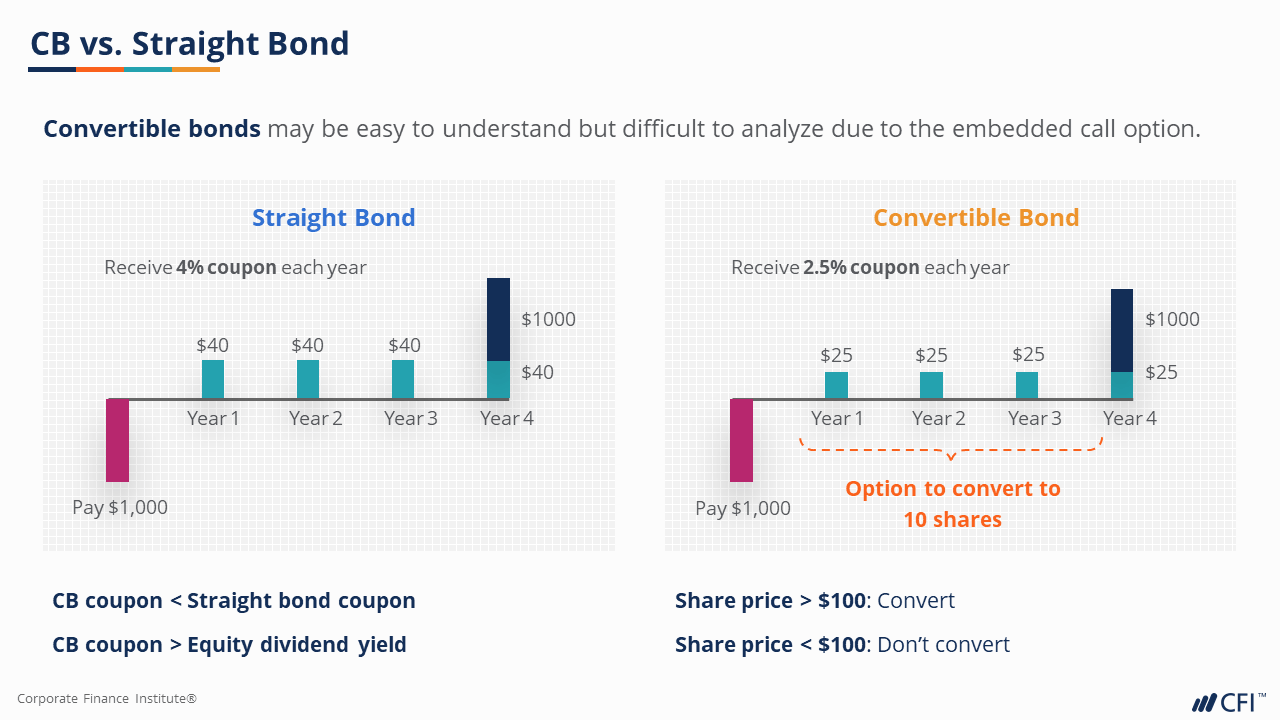

Convertible Bond Basics

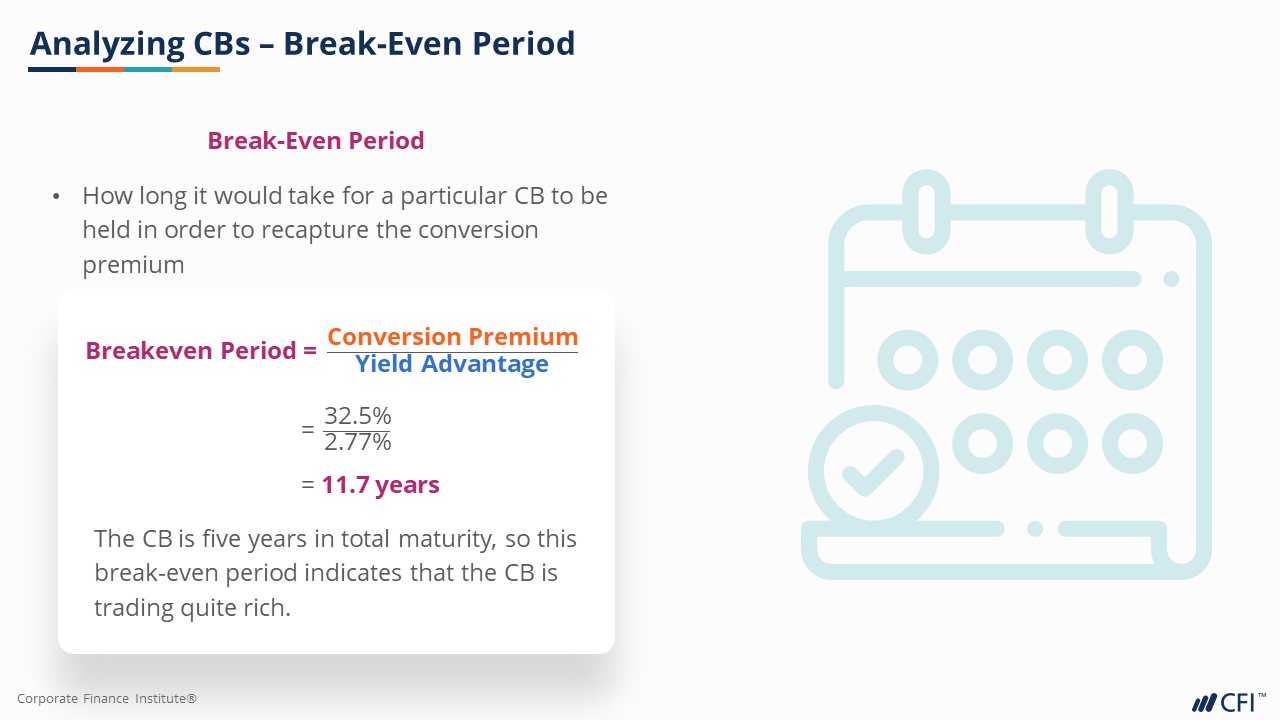

The Math of Convertible Bonds

Trading Strategies

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Capital Markets & Securities Analyst (CMSA®) Certification

- Skills Learned Trading strategies used in the finance and capital markets

- Career Prep Work in capital markets, whether on the buy-side or the sell-side