Overview

Lending to Complex Structures Overview

For a Credit Analyst, understanding complex business structures is extremely important in determining the optimal credit structure for both the financial institution and the borrower.

This course will walk you through understanding a group of companies and the issues that come up when lending to a corporate group. We will also look at mitigation strategies to address these risks through the proposed credit structure. Next, we will help you understand the importance of borrower selection and work through the complexity you may encounter in financial reporting. Then, we walk through how to identify beneficial ownership and control and how this may also impact your credit decision. Finally, we cover related party relationships and how they affect group lending.

Lending to Complex Structures Learning Objectives

Upon completing this course, you will be able to:-

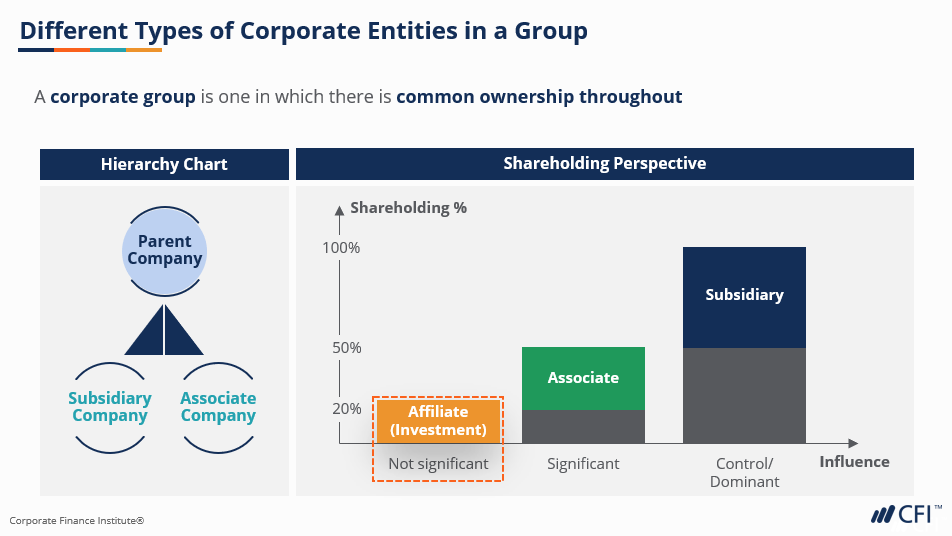

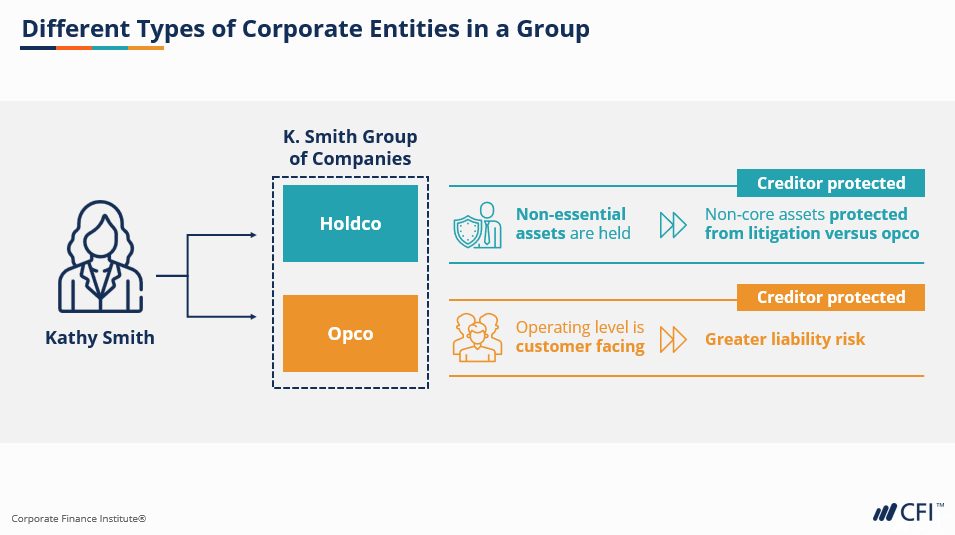

Understand a group of companies

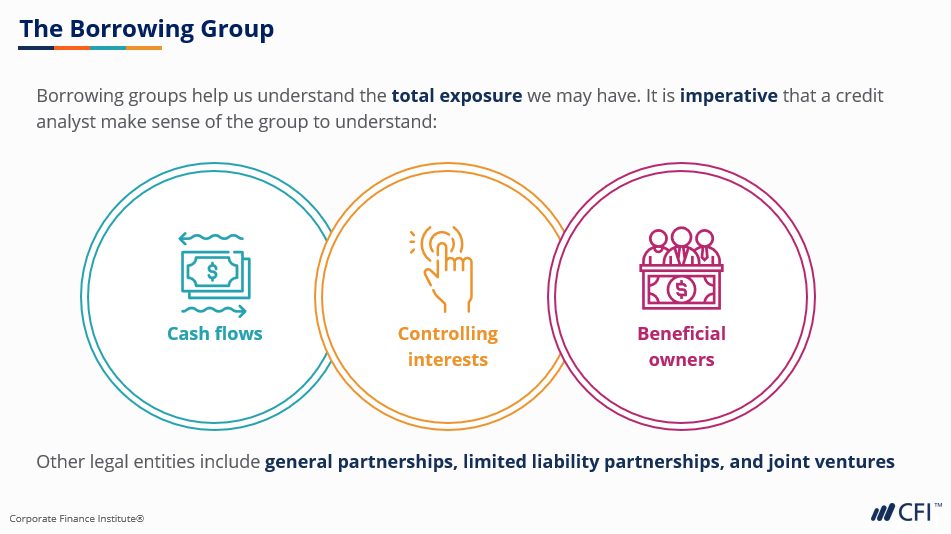

- Consider issues in group lending and mitigating strategies

-

Understand the importance of borrower selection

-

Identify beneficial ownership and control in complex structures

-

Describe the relationships between related parties

Who should take this course?

The Lending to Complex Structures course is perfect for any aspiring credit analysts working in insurance, underwriting, rating agencies, commercial lending, corporate credit analysis, and other areas of credit evaluation.

The exercises and tools explored in this course will be useful for any financial analyst who wishes to work in credit analysis, commercial banking, and other areas of lending and credit evaluation.

Prerequisite Skills

Recommended skills to have before taking this course.

- Financial accounting

- Critical thinking

Lending to Complex Structures

Level 3

2h 7min

100% online and self-paced

Field of Study: Finance

Start LearningWhat you'll learn

Key Considerations & Mitigation Strategies

Repayment Sources Exercise

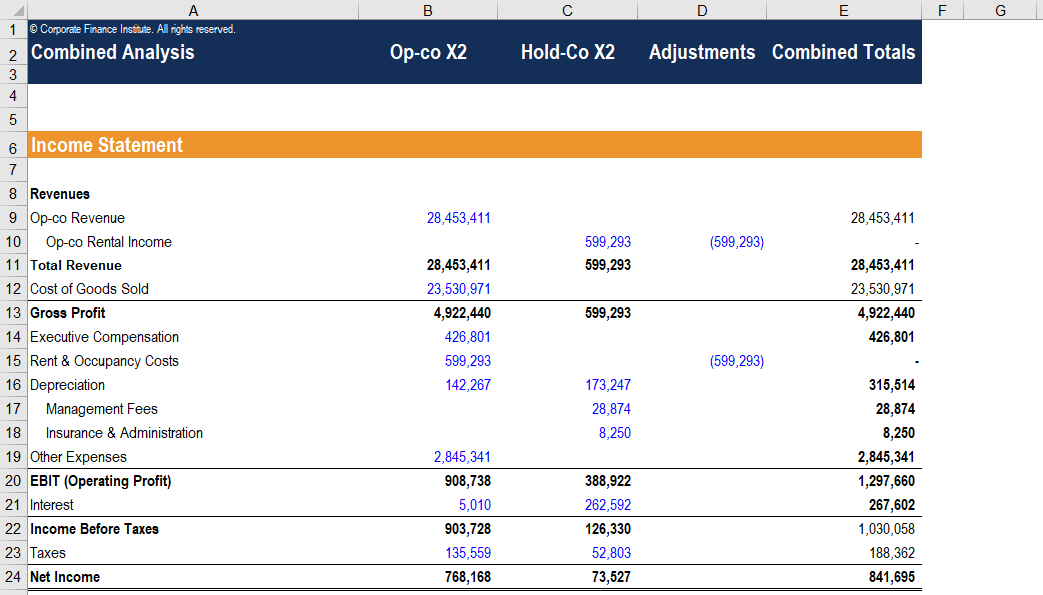

Combined Statements Case Study

Course Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

Commercial Banking & Credit Analyst (CBCA®) Certification

- Skills Learned Financial Analysis, Credit Structuring, Risk Management

- Career Prep Commercial Banking, Credit Analyst, Private Lending