Overview

Economics for Capital Markets Course Overview

This course will cover critical economic principles that impact financial markets rather than worry about micro/macro theory. We will introduce economic events and cover how to differentiate between economic releases and economic indicators.

Economics for Capital Markets Learning Objectives

Upon completing this course, you will be able to:- Know how economic principles impact financial markets

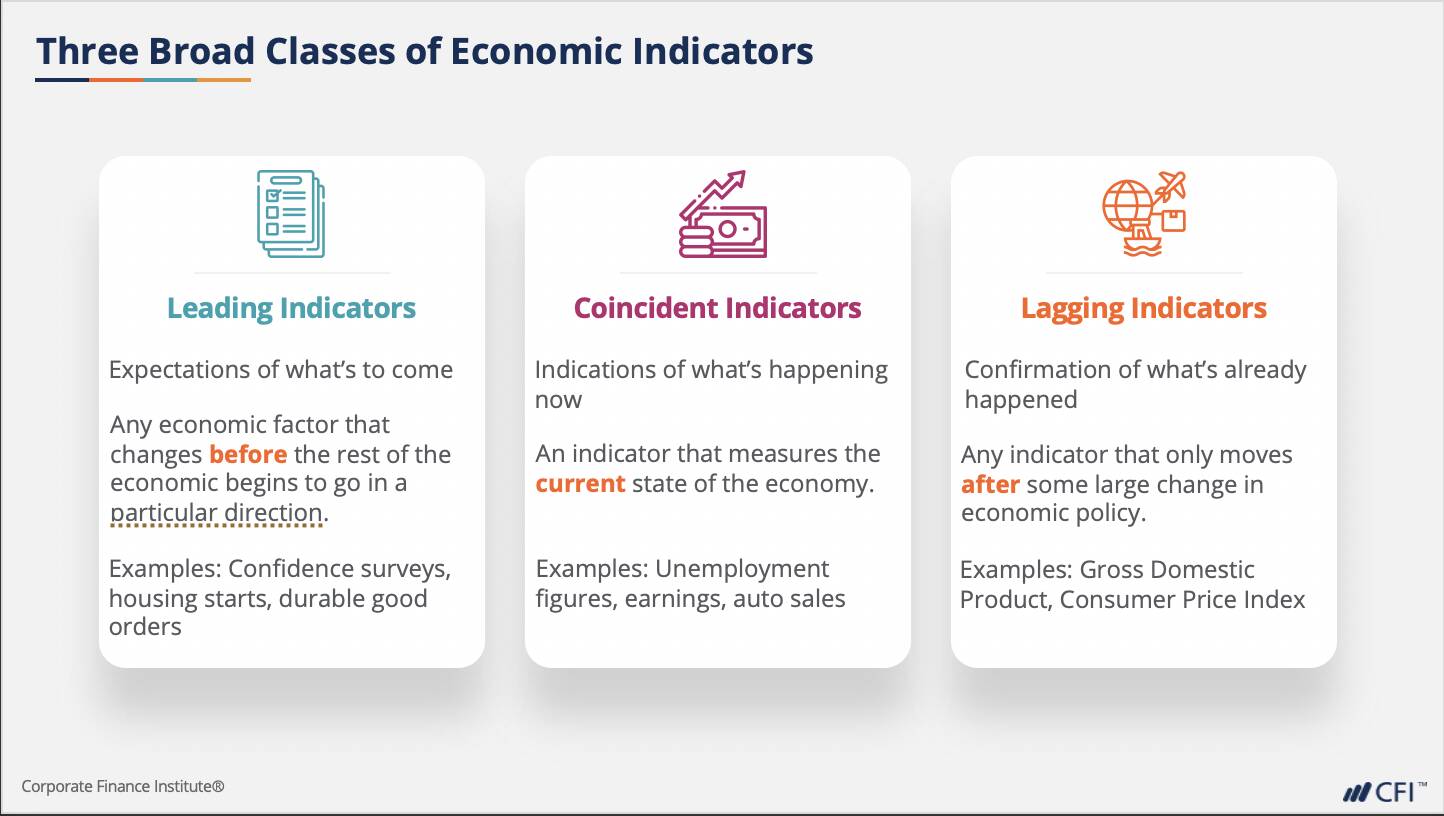

- Classify & interpret economic releases

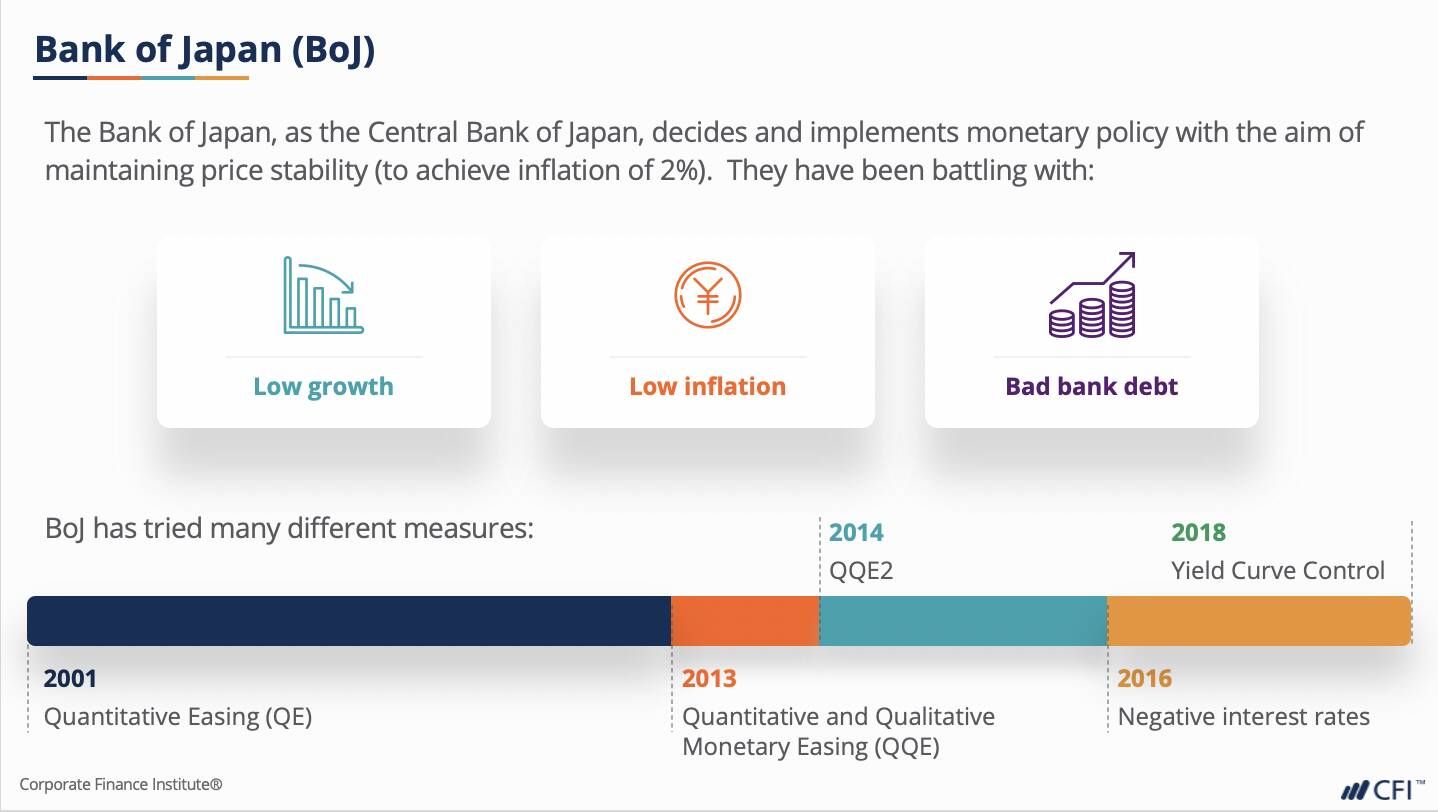

- Understand central banks, their goals, and their role in the economy

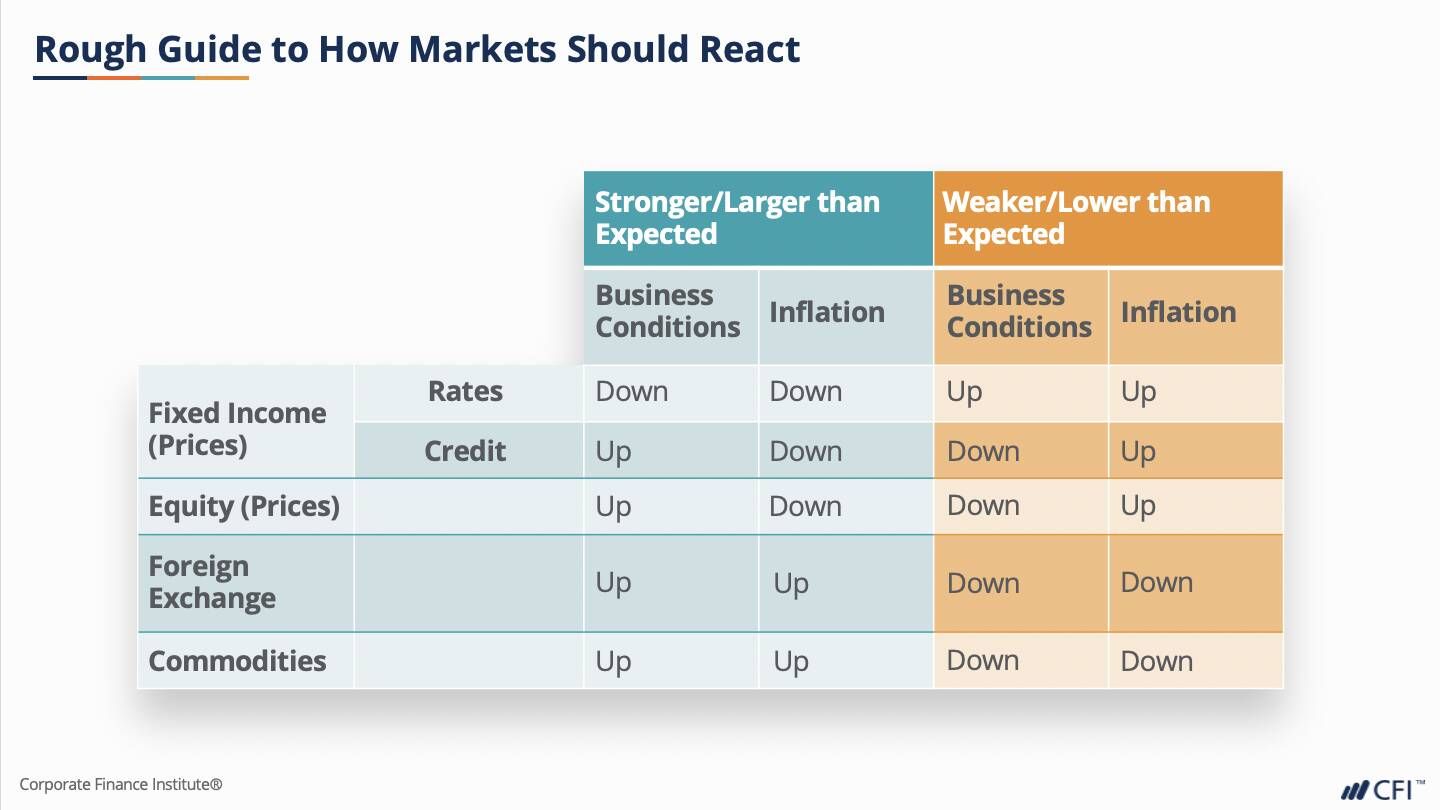

- Perceive how specific economic events impact specific markets

- Grasp how market practitioners use this information to trade and invest

Who should take this course?

This Economics for Capital Markets course is perfect for anyone who would like to build a strong foundation on economic principles before jumping into financial markets, as economics forms the foundation of our monetary system. This course is designed to equip anyone who desires to begin a career in fixed income, equity, sales, trading, or other areas of finance with the fundamental knowledge of economics.Economics for Capital Markets

Get Started Enroll For FreeLevel 2

Approx 3h to complete

100% online and self-paced

Get Recognized With CFI

See All Certification ProgramsWhat you'll learn

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

- Skills Learned Trading strategies used in the finance and capital markets

- Career Prep Work in capital markets, whether on the buy-side or the sell-side

Learner Reviews

The course contains a lot of economic knowledge which I didn't know before. The exam was hard, but I reviewed the course's content to get the correct answers. There are some questions I haven't got the correct answers so I will continually studying the materials until I get 100%. Much appreciated.

Sai Huynh

good professor and also good materials

Yimin Yin

The experience was good

Rohan Basak

Enjoyed the Course, especially real world examples used by the instructor.