Stock Based Compensation

A form of equity remuneration (non-cash)

What is Stock Based Compensation?

Stock Based Compensation (also called Share-Based Compensation or Equity Compensation) is a way of paying employees, executives, and directors of a company with equity in the business. It is typically used to motivate employees beyond their regular cash-based compensation (salary and bonus) and to align their interests with those of the company’s shareholders. Shares issued to employees are usually subject to a vesting period before they are earned and can be sold.

Types of Equity Compensation

Compensation that’s based on the equity of a business can take several forms.

Common types of compensation include:

- Shares

- Restricted Share Units (RSUs)

- Stock Options

- Phantom Shares

- Employee Stock Ownership Plan (ESOP)

How it Works

Companies compensate their employees by issuing them stock options or restricted shares. The shares typically vest over a few years, meaning, they are not earned by the employee until a specified period of time has passed. If the employee quits the company before the shares have vested, they forfeit those shares. As long as the employee stays long enough with the company, all of their shares will vest. They can hold the shares indefinitely, or sell them to convert them into cash.

Stock-Based Compensation Example

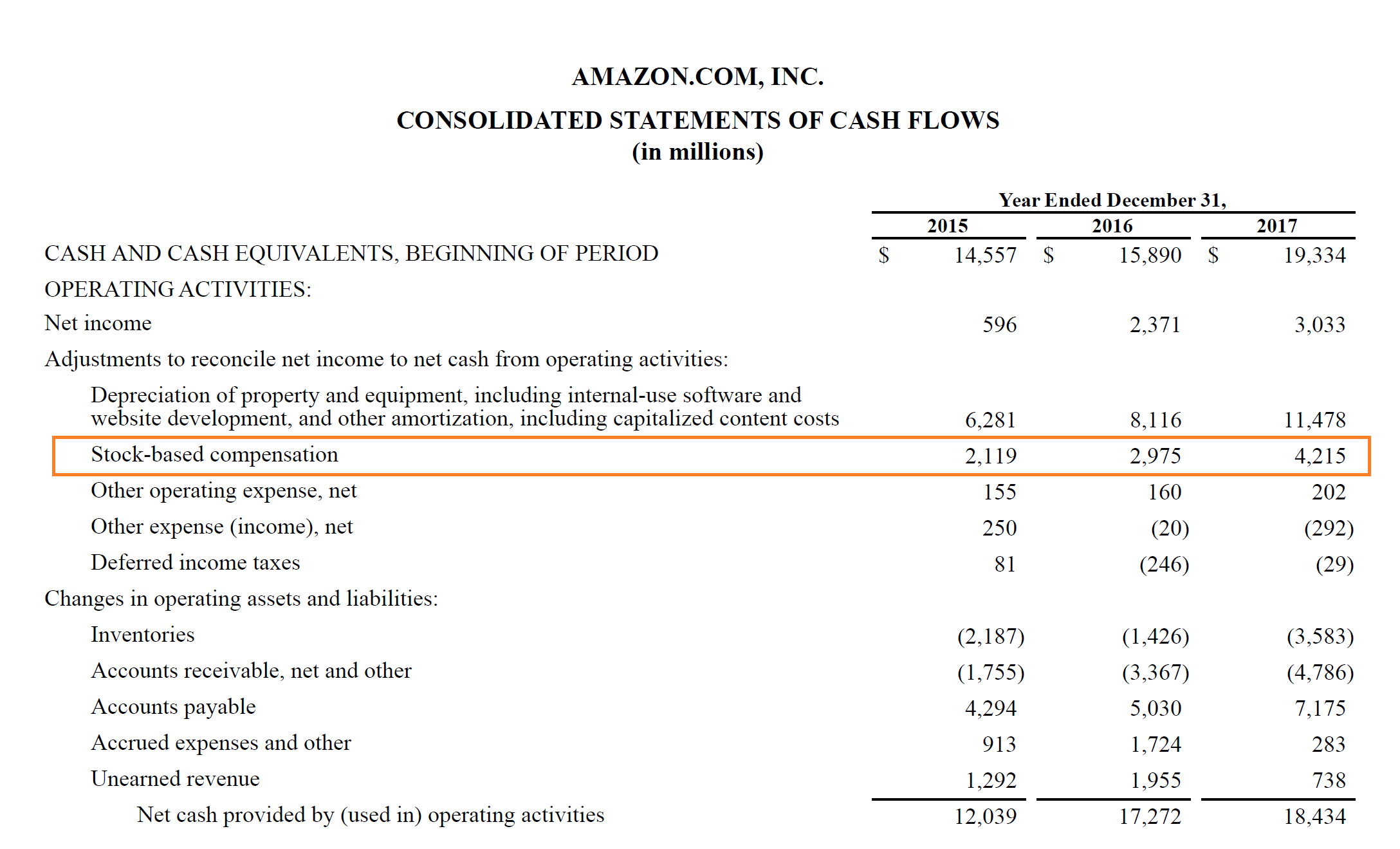

The easiest way to understand how it works is with an example. Let’s look at Amazon’s 2017 annual report and examine how much they paid out in equity to employees, directors, and executives, as well as how they accounted for it on their financial statements.

As you can see in the cash flow statement below, net income must be adjusted by adding back all non-cash items, including stock-based compensation, to arrive at cash from operating activities.

In 2017, Amazon paid $4.2 billion of share-based compensation to its employees.

Since the company has approximately 560,000 employees, that works out to about $7,500 per employee on average.

Advantages of Stock Based Compensation

There are many advantages to this type of remuneration, including:

- Creates an incentive for employees to stay with the company (they have to wait for shares to vest)

- Aligns the interests of employees and shareholders – both want to see the company prosper and the share price rise

- Doesn’t require cash

Disadvantages of Share Based Compensation

Challenges and issues with equity remuneration include:

- Dilutes the ownership of existing shareholders (by increasing the number of shares outstanding)

- May not be useful for recruiting or retaining employees if the share price is decreasing

Implications in Financial Modeling & Analysis

When building a discounted cash flow (DCF) model to value a business, it’s important to factor in share compensation. As you saw in the example from Amazon above, the expense is added back to arrive at cash flow, since it’s a non-cash expense.

While the expense does not require any cash, it does have a capital structure impact on the business, since the number of shares outstanding increases.

Analysts need to decide how to address this issue, and there are two common solutions:

- Treat the expense as a cash item (don’t add it back).

- Add it back and increase the number of shares outstanding by the number of shares awarded to employees (both vested and non-vested).

Additional Resources

Thank you for reading CFI’s guide to Stock Based Compensation. To continue learning and advancing your career, these CFI resources will be helpful: