Income Elasticity of Demand

The responsiveness to change in consumers’ income with the change in the demand for a certain good

What is Income Elasticity of Demand?

Income elasticity of demand measures the relationship between the consumer’s income and the demand for a certain good. It may be positive or negative, or even non-responsive for a certain product. The consumer’s income and a product’s demand are directly linked to each other, dissimilar to the price-demand equation.

Demand for a normal good grows with an increase in customer wages and vice versa, assuming other factors of demand are constant. Income elasticity of demand is the level of response in demand to the adjustment in customer income. The larger the income elasticity of demand for a certain product, the greater the shift in demand there is from a change in consumer income.

Summary

- Income elasticity of demand denotes the responsiveness to change in consumers’ income with the change in the demand for a certain good.

- For a certain product, the income elasticity of demand can be positive or negative, or non-responsive.

- The larger the income elasticity of demand for a certain product, the greater the shift in demand there is from a change in consumer income.

Income Elasticity of Demand Measurement

The following formula is used:

Income Elasticity of Demand = % Change in Demand Quantity / % Change in Income of Consumer

Where:

- % Change in Demand Quantity = Change in Demand Quantity / Original Demand Quantity

- % Change in Income of Consumer = Change in Income of Consumer / Original Income of Consumer

Income Elasticity of Demand Types

Based on numerical value, the income elasticity of demand is divided into three classes as follows:

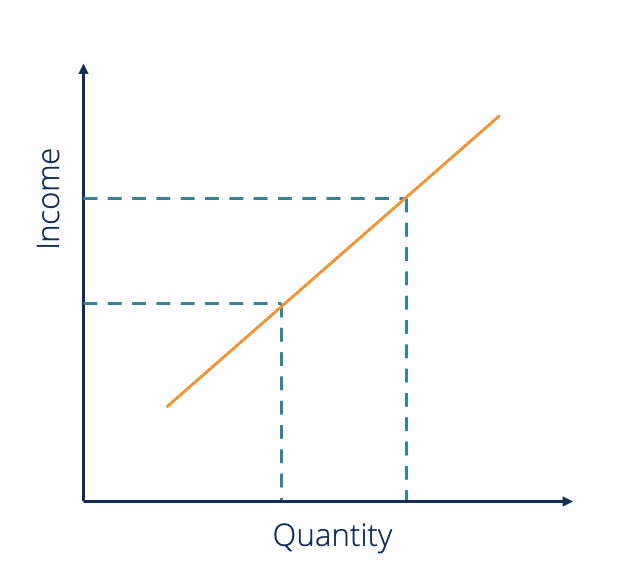

1. Positive income elasticity of demand

It refers to a condition in which demand for a commodity rises with a rise in consumer income and declines with a decline in consumer income. Commodities with positive income elasticity of demand are normal goods.

The upward slope implies that the rise in income contributes to a rise in demand and vice versa. There are three forms of positive income elasticity of demand stated as follows:

- Unitary – The positive income elasticity of demand will be unitary if the proportionate change in the amount of a product demanded equals the change in consumer income in due proportion.

- More than unitary – The positive income elasticity of demand will be more than unitary if the proportionate change in the amount of a product demanded is higher than the change in consumer income in due proportion.

- Less than unitary – If the change in the amount of a product demanded in due proportion is less than the change in consumer income in due proportion, positive income elasticity of demand will be less than unitary.

2. Negative income elasticity of demand

It refers to a condition in which demand for a commodity decreases with a rise in consumer income and increases with a fall in consumer income. Inferior goods are such commodities. For example, the demand for millet will decrease if the income of consumers increases since they will prefer to purchase wheat instead of millet. Thus, millet is an inferior good to wheat for customers.

The downward slope implies that the increase in income contributes to a fall in demand, and a decrease in income causes a rise in demand.

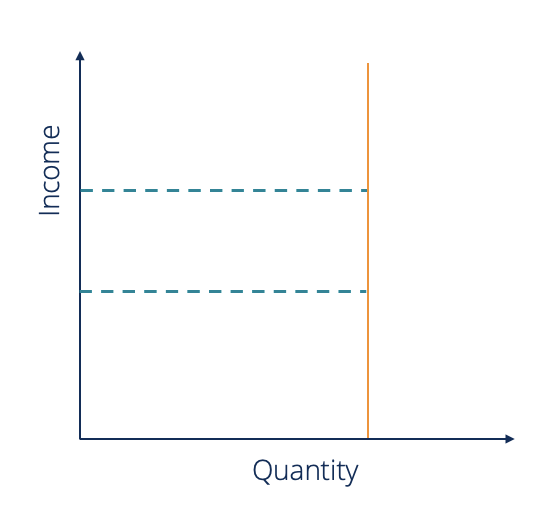

3. Zero income elasticity of demand

It corresponds to the situation when there is no impact of rising household income on commodity production. Such goods are termed essential goods. For example, a high-income consumer and a low-income consumer will need salt in the same quantity.

Uses of Income Elasticity of Demand

1. Forecasting demand

Forecasting demand applies to the idea that the income elasticity of demand tends to predict demand for commodities in the future. If there is a substantial change in wages, the change in demand for products will also be significant. This is because when buyers become aware of a shift in income, they will change their preferences and expectations for such products.

2. Investment decisions

The idea of national income is very important to businesses as it helps them to decide which sectors they should invest their money in. In general, investors tend to invest in markets where they can predict that the demand for commodities is related to a growth in national income or where the income elasticity of demand is greater than negligible.

Related Readings

Thank you for reading CFI’s guide to Income Elasticity of Demand. To keep advancing your career, the additional CFI resources below will be useful: