Real Estate Financial Modeling (REFM) Course

Real Estate Financial Modeling Course

Real Estate Financial Modeling

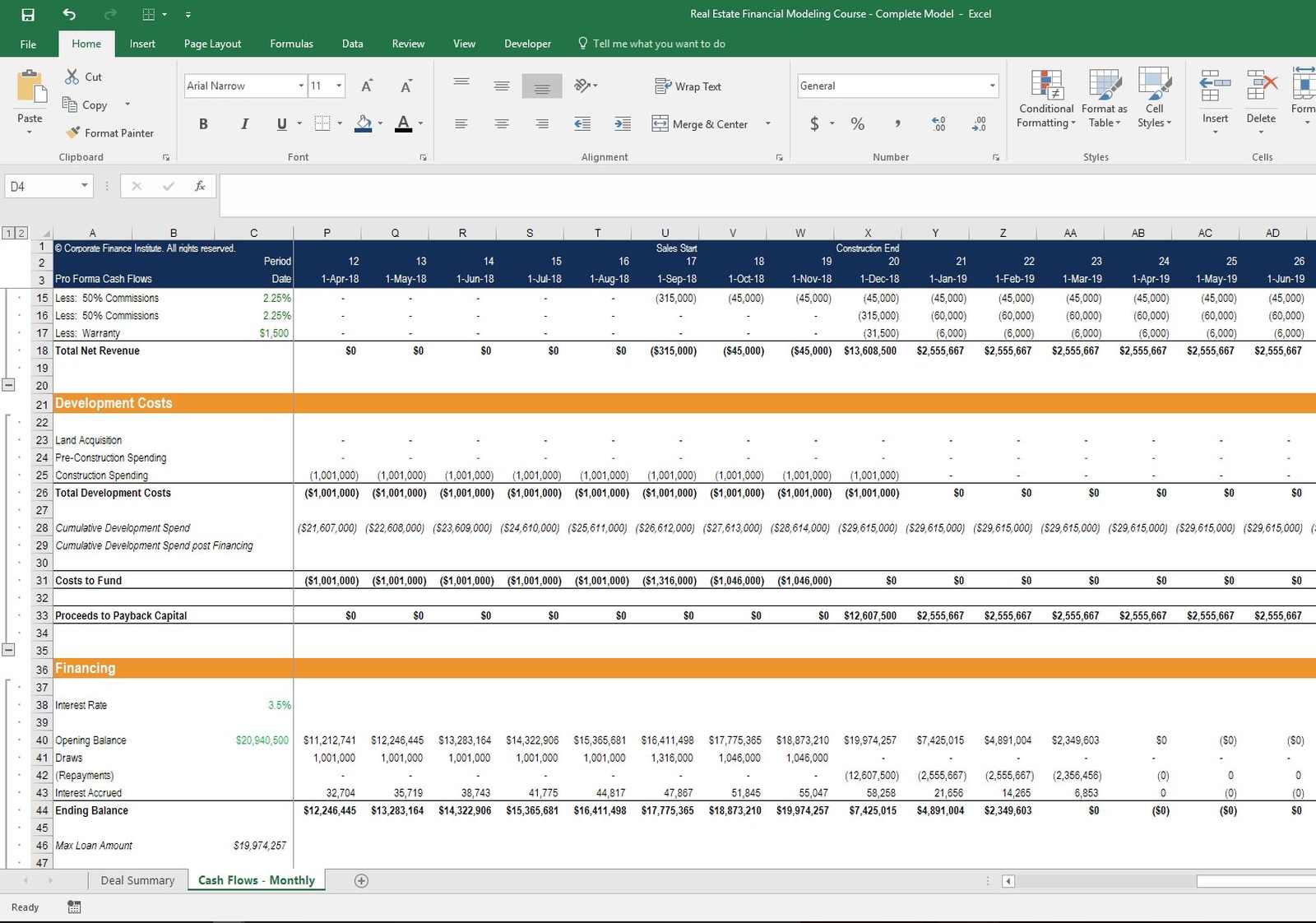

Our Real Estate Financial Modeling (REFM) course is designed to teach you how to build a development model in Excel from the ground up.

Real estate developers need to build dynamic cash flow models to analyze investment opportunities. They are specifically designed to accommodate changes in key assumptions, such as land acquisition cost, interest rates, building materials, labor, absorption rates, sales prices, market expenses, permitting, and much more.

Overview of the REFM Course

CFI’s REFM course covers a wide range of real estate development topics. The course will lead you step-by-step through the development process, from land acquisition to construction and absorption.

The key topics covered in the course include:

- Industry Overview

- Calculate Cap Rate and Net Operating Income (NOI)

- Build an interactive financial model to assess a project’s financial viability

- Understand how project financing (both debt and equity) flow in and out depending on stage of development

- Design and structure an Excel-based project finance model

- Model cash flows for a real estate development project

- Build in “triggers” and sensitivities to understand a project’s exposure to key drivers

- Build in ownership and financial structures (debt & equity)

- Calculate Internal Rate of Return (IRR), Return on Sales, Return on Cost

- Produce a one-page investment summary memo

- Includes blank and completed financial models to download

- Certificate of completion

Want to learn more? Take a free trial of our REFM course now!

What Else is Covered in the REFM course?

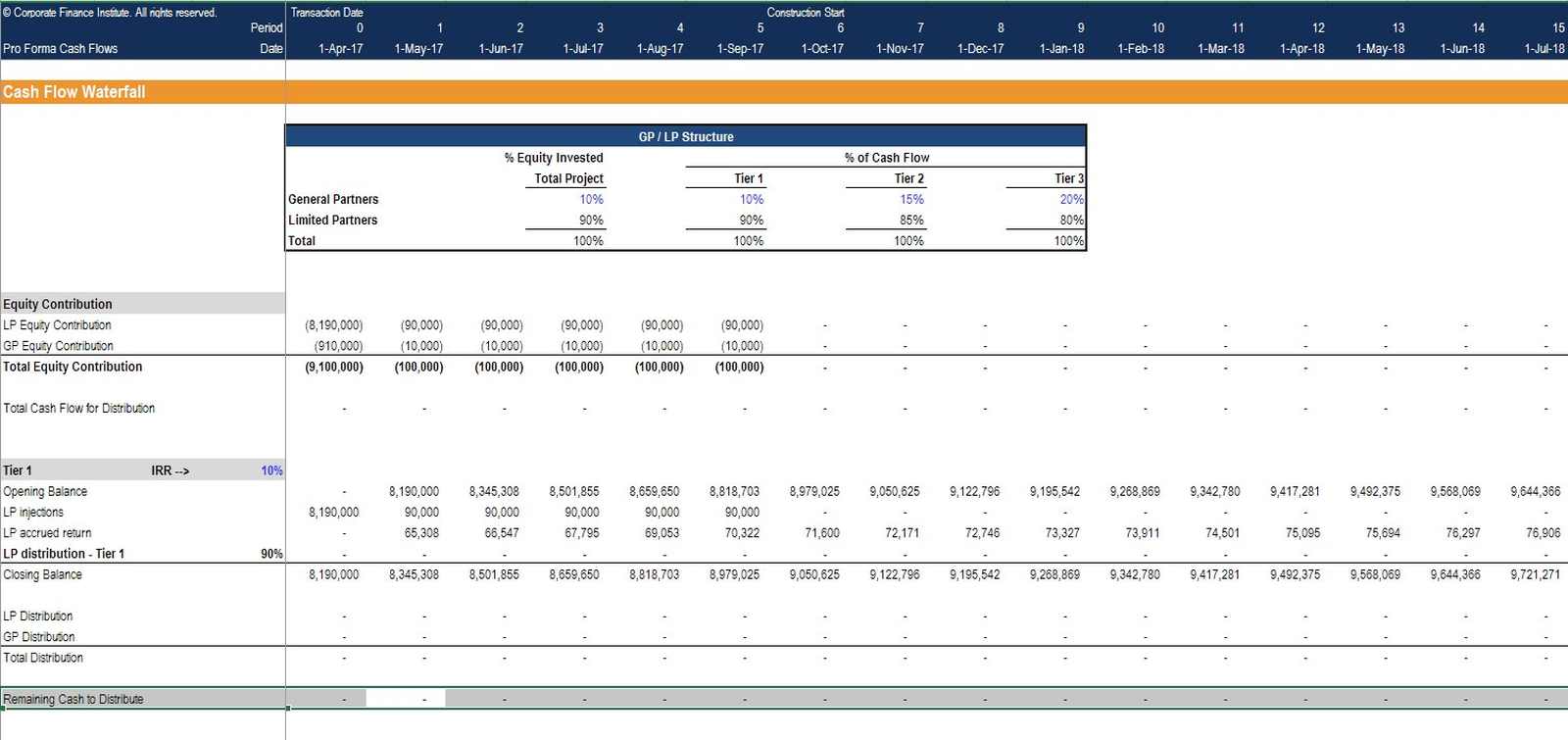

Our Real Estate Financial Modeling Course also includes very detailed and advanced cash flow waterfall modeling between General Partners (GPs) and Limited Partners (LPs). Such an approach to modeling cash flows allows some partners in the project to earn disproportionate returns relative to other partners. They can achieve the returns by clearing Internal Rate of Return (IRR) hurdle rates that increase their percentage of cash flow distribution.

To learn more about cash flow waterfalls, launch our REFM course now!

Additional Resources

CFI’s mission is to help you advance your career, whether in real estate or any other industry. To that end, we’ve created a wide range of resources to help you move up the ladder. In addition to our REFM course, you may want to check out:

- What is Financial Modeling

- Financial Modeling for Dummies

- Excel Formulas and Shortcuts

- Excel for Dummies

- Financial Modeling Certifications

To find out more about finance careers, check out our interactive Career Map. Also, see our financial modeling resources and commercial real estate resources.