Exit Strategies

Plans for the future liquidation of a financial position

What are Exit Strategies?

Exit strategies are plans executed by business owners, investors, traders, or venture capitalists to liquidate their position in a financial asset upon meeting certain criteria. An exit plan is how an investor plans to get out of an investment.

When Are Exit Strategies Used?

An exit plan may be used to:

- Close down a non-profitable business

- Execute an investment or business venture when profit objectives are met

- Close down a business in the event of a significant change in market conditions

- Sell an investment or a company

- Sell an unsuccessful company to limit losses

- Reduce ownership in a company or give up control

Examples of Exit Plans

Examples of some of the most common exit strategies for investors or owners of various types of investments include:

- In the years before exiting your company, increase your personal salary and pay bonuses to yourself. However, make sure you are able to meet obligations. It is the easiest business exit plan to execute.

- Upon retiring, sell all your shares to existing partners. You will get money from the sale of shares and be able to leave the company.

- Liquidate all your assets at market value. Use the revenue to pay off obligations and keep the rest.

- Go through an initial public offering (IPO).

- Merge with another business or be acquired.

- Sell the company outright.

- Pass on the business to a family member.

Exit Strategies for Start-ups

Exit plans are commonly used by entrepreneurs to sell the company that they founded. Entrepreneurs will typically develop an exit strategy before going into business because the choice of exit plan has a significant influence on business development choices.

For example, if your plan is to get listed on the stock market (an IPO), it is important that your company follow certain accounting regulations. In addition, most entrepreneurs are not interested in a big-company role and are only interested in starting up companies. A well-defined exit plan helps entrepreneurs swiftly move on to their next big project.

Common types of exit strategies:

- Initial public offering (IPO)

- Strategic acquisitions

- Management buyouts

The exit plan chosen by the entrepreneur depends on the role they want in the future of the company. For example, a strategic acquisition will relieve the entrepreneur of all roles and responsibilities in his or her founding company as they give up control of it.

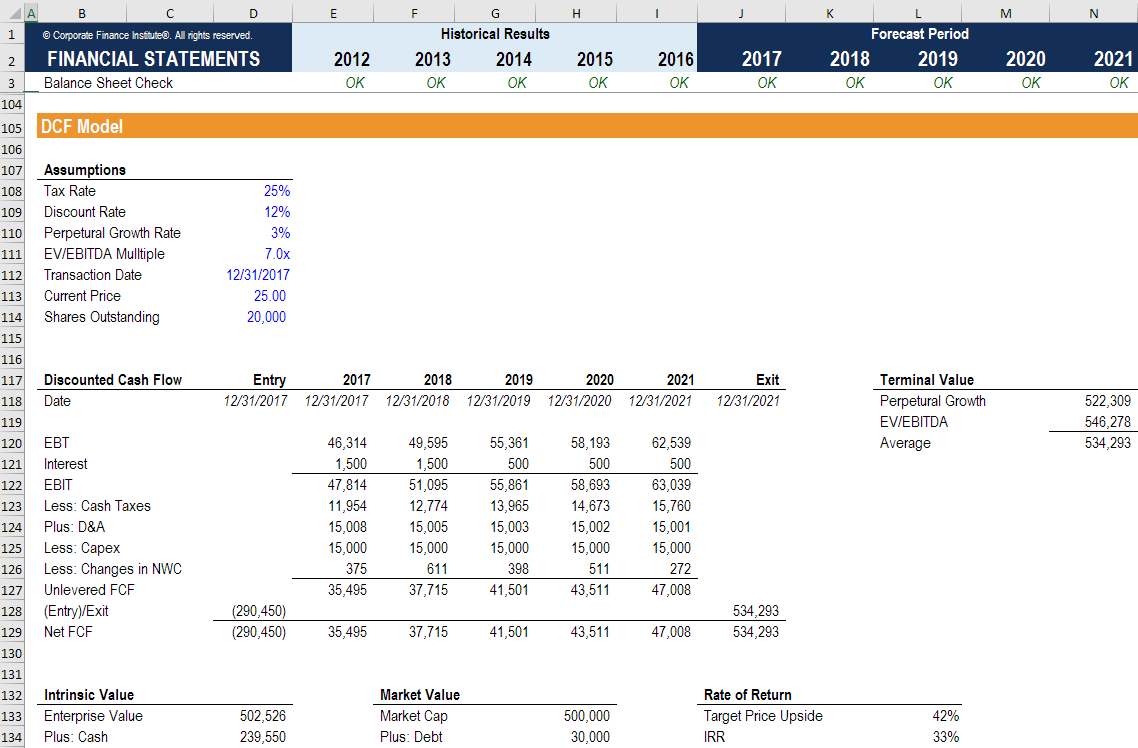

Exits in Financial Modeling and Valuation

In financial modeling, it’s necessary to have a terminal value when building a DCF model. The terminal value can be calculated in two different ways – using a perpetual growth rate and using an exit multiple. The latter method is more common among industry practitioners and assumes that the business is sold for a “multiple” of some metric, like EBITDA.

In the example of a DCF model below you can see the terminal value section, which assumes the company is sold for 7.0x EBITDA.

Learn more in CFI’s DCF modeling courses online now!

Importance of an Exit Plan

It may seem counter-intuitive for a business owner to develop exit strategies. For example, if you are an e-commerce business owner with increasing revenue, why would you want to exit your company?

In fact, it is important to consider an exit plan even if you do not intend to sell your company immediately. For example:

- Personal health issues or a family crisis: You may be affected by personal health issues or experience a family crisis. These issues can take away your focus on effectively running the company. An exit plan would help ensure the company will be run smoothly.

- An economic recession: Economic recessions can have a significant effect on your company and you may want your company to avoid assuming the impact of a recession.

- Unexpected offers: Large players may look to acquire your company. Even if you do not have any intentions of immediately selling the company, you would be able to have an insightful conversation if you have thought of an exit plan.

- A clearly defined goal: By having a well-defined exit plan, you will also have a clear goal. An exit plan has a significant influence on your strategic decisions.

Additional Resources

Thank you for reading CFI’s guide to developing an Exit Strategy. To keep learning and advancing your career as a financial analyst, these CFI resources will be a big help: