Net Asset Value

The value of a fund’s asset minus the value of its liabilities

What is Net Asset Value?

Net asset value (NAV) is defined as the value of a fund’s assets minus the value of its liabilities. The term “net asset value” is commonly used in relation to mutual funds and is used to determine the value of the assets held. According to the SEC, mutual funds and Unit Investment Trusts (UITs) are required to calculate their NAV at least once every business day.

Formula for Net Asset Value

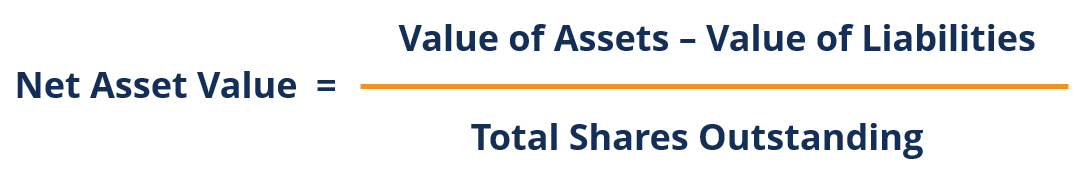

The NAV formula is as follows:

![]()

Where:

- Value of assets is the value of all the securities in the portfolio

- Value of liabilities is the value of all liabilities and fund expenses (such as staff salaries, management expenses, operational expenses, audit fees, etc.)

The NAV is typically represented on a per-share basis. In such a case, the formula would be:

Example

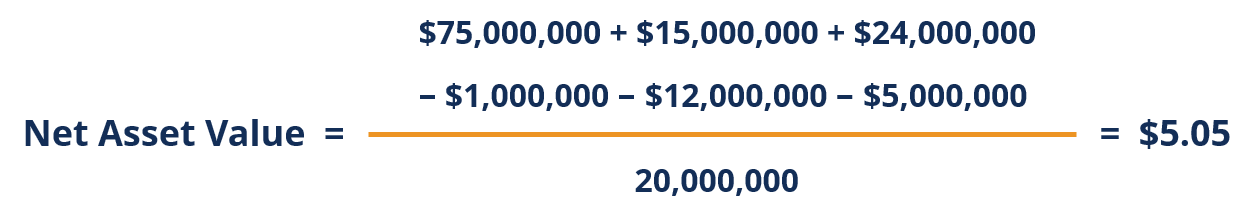

An investment firm manages a mutual fund and would like to calculate the net asset value for a single share. The investment firm is given the following information regarding its mutual fund:

- Value of securities in the portfolio: $75 million (based on end of day closing prices)

- Cash and cash equivalents of $15 million

- Accrued income for the day of $24 million

- Short-term liabilities of $1 million

- Long-term liabilities of $12 million

- Accrued expense for the day of $5,000

- 20 million shares outstanding

Interpreting the Net Asset Value

The net asset value represents a fund’s market value. When expressed at a per-share value, it represents a fund’s per unit market value. The per-share value is the price at which investors can buy or sell fund units.

When the value of the securities in the fund goes up, the net asset value goes up. Conversely, when the value of the securities in the fund goes down, the NAV goes down:

- If the value of securities in the fund increases, then the NAV of the fund increases.

- If the value of the securities in the fund decreases, then the NAV of the fund decreases.

Net Asset Value in Decision-Making

The following are the net asset values of a number of TD funds as of September 7, 2018:

- TD Dividend Income Fund – I: $39.78

- TD Balanced Growth Fund – I: $29.07

- TD Diversified Monthly Income Fund – I: $26.17

- TD Monthly Income Fund – I: $21.96

By looking at the net asset value of various funds, what insight are you able to gain? In short – none. Looking at each fund’s NAV and comparing it to others does not offer any insight into which fund performed better. Similar to share prices, a high share price does not indicate a “better” stock.

As far as determining which fund is better, it is important to look at the performance history of each mutual fund, the securities within each fund, the longevity of the fund manager, and how the fund performs relative to a benchmark (such as the S&P 500 Index).

If a fund’s net asset value went from $10 to $20 compared to another fund whose NAV went from $10 to $15, it is clear to see that the fund which marked a 100% gain in its NAV is performing better.

Key Takeaways

- Net asset value is the value of a fund’s assets minus any liabilities and expenses.

- The NAV (on a per-share basis) represents the price at which investors can buy or sell units of the fund.

- When the value of the securities in the fund increases, the NAV increases.

- When the value of the securities in the fund decreases, the NAV decreases.

- The NAV number alone offers no insight as to how “good” or “bad” the fund is.

- The NAV of a fund should be looked at over a timeframe to assess fund performance.

More Resources

Thank you for reading CFI’s guide to Net Asset Value. To keep learning and developing your knowledge of financial analysis, we highly recommend the additional CFI resources below: