- What is Discretionary Income?

- How Discretionary Income Is Used

- Discretionary Income vs. Disposable Income

- Discretionary Income Formula

- Discretionary Income Example

- Discretionary Income in the Economy

- Key Takeaways

- FAQs About Discretionary Income

- What’s the difference between disposable and discretionary income?

- How do I calculate my discretionary income?

- Is discretionary income taxable?

- What are examples of discretionary expenses?

- Why is discretionary income important?

- Additional Resources

Discretionary Income

Income left over after paying for essential expenses

What is Discretionary Income?

Discretionary income is the money available after paying for essential expenses like housing, food, taxes, and healthcare. In other words, discretionary income is the amount of money left that can be used for saving, investing, or spending on non-essentials.

Essential expenses include costs required for survival or by law, such as rent or mortgage, utilities, medical care, and insurance. Once necessities are covered, discretionary income represents the “extra” money that individuals or businesses can spend or save as they wish.

How Discretionary Income Is Used

Discretionary income can be spent, invested, or saved, and each choice affects both individuals and the economy. When discretionary income rises, households have more flexibility, and businesses see more opportunities for growth.

One reason discretionary income matters is that it drives economic activity. The more money households can put toward goods, services, or financial markets, the more support it provides for production, job creation, and long-term growth.

Discretionary income is allocated in three primary ways: spending, investing, and saving.

1. Spending

Individuals and households spend discretionary income on vacations, entertainment, luxury goods, and other non-essentials. This spending flows into the businesses that provide those products and services. In turn, businesses can reinvest their earnings to expand their operations, hire more workers, and increase shareholder returns. Each of these outcomes feeds back into the economy, which helps generate even more discretionary income.

2. Investing

Directing discretionary income toward investments also stimulates growth. When individuals and households invest discretionary income in financial markets, those funds provide capital for businesses. Companies use that capital to expand their businesses, create more jobs, and drive economic growth. At the same time, investors expect returns on their contributions, which adds to their own discretionary income in the future.

3. Saving

Saving discretionary income typically happens through banks or financial institutions that hold and secure deposits. Banks and financial institutions also lend a portion of deposits to borrowers, who might be individuals financing purchases or companies funding new projects. Those loans support further economic activity, while savers benefit from security and potential interest earnings.

Discretionary Income vs. Disposable Income

Disposable income is the money left after paying taxes, while discretionary income is what remains after covering both taxes and essential expenses. Understanding the difference helps with better financial planning.

The table below highlights the key differences between disposable income and discretionary income:

Comparison of Disposable Income vs. Discretionary Income

| Definition | Money left after paying taxes | Money left after paying taxes & essential expenses |

| Formula | Disposable Income = Gross Income – Taxes | Discretionary Income = Disposable Income – Essential Expenses |

| Covers | Necessities & non-necessities | Only non-necessities |

| Used For | Determining the ability to cover necessities | Determining the ability to spend, invest, or save |

Example: Suppose someone earns $5,000 per month and pays $1,000 in taxes. Their disposable income is $4,000. If they spend $3,000 on essential expenses like housing, food, and utilities, their discretionary income is $1,000.

In short, disposable income covers both necessities and non-necessities, while discretionary income only covers non-necessities.

Discretionary Income Formula

The discretionary income formula is:

Discretionary Income = Disposable Income − Essential Living Expenses

Where:

- Disposable Income = Gross income – Taxes

- Essential Living Expenses = Mandatory Costs (like housing, food, healthcare, transportation, and insurance)

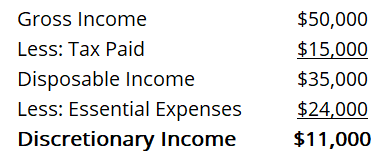

Discretionary Income Example

Imagine an individual who is paid an annual gross (pre-tax) income of $50,000. He pays a 30% tax rate over the year and incurs essential living expenses of $2,000/month for bills, rent, and groceries, etc. What is his disposable income?

Step 1: Calculate disposable income (what’s left after taxes)

- Gross income = $50,000

- Tax rate is 30%.

Taxes owed = $50,000 x 30% = $15,000

Disposable income = $50,000 – $15,000 = $35,000

After taxes, the amount of disposable income is $35,000.

Step 2: Calculate discretionary income (what’s left after essential living expenses)

- Monthly essential expenses = $2,000

Total essential expenses = $2,000 x 12 months = $24,000

Discretionary income = Disposable income – Essential expenses = $35,000 – $24,000 = $11,000

After taxes and essential expenses, the individual’s discretionary income is $11,000.

Discretionary Income in the Economy

Discretionary income is a key economic indicator tracked by governments, economists, and businesses to assess consumer financial health and guide policy.

Consumer Spending Trends

Consumer spending levels are strongly influenced by discretionary income. When it rises, households spend more on travel, dining, entertainment, and luxury goods, fueling economic growth. When it falls, discretionary purchases are the first to be cut, signaling potential downturns.

Example: During the 2008 Global Financial Crisis, consumer spending on travel and entertainment declined sharply. This downturn was the result of reduced discretionary income due to unemployment, investment losses, and overall financial insecurity. (Source: US Bureau of Labor Statistics).

Impact of Inflation

Inflation reduces discretionary income by raising the cost of essentials like housing, food, and energy. Even if wages remain steady, higher living costs shrink what households can spend on non-essentials.

Example: In 2022, U.S. households saw their discretionary income decline, despite wage increases, due to rising inflation that increased consumer prices for necessary expenses. When consumers have to pay more for essential living expenses like food and energy, they have less disposable income to spend on non-essentials. Reduced consumer spending also contributes to slower economic growth. (Source: US Census Bureau)

Policy Relevance

Policymakers monitor discretionary income to design tax relief, stimulus checks, and wage policies. Increasing household discretionary income during recessions stimulates demand and supports economic recovery.

Example: During the 2020 recession, the U.S. government issued stimulus checks to increase consumer discretionary income. The goal of these stimulus checks was to encourage households to spend the extra funds on non-essential goods and services. This spending helped support the domestic economy during the slowdown driven by the global pandemic. (Source: US Department of the Treasury).

Key Takeaways

Discretionary income is the portion of earnings left after taxes and essential expenses are paid.

For individuals, it reflects the capacity to save, invest, or spend on non-essential items. For policymakers, it signals consumer financial health and informs economic decisions.

Viewed together, discretionary income connects personal financial flexibility with the performance of the wider economy.

FAQs About Discretionary Income

What’s the difference between disposable and discretionary income?

Disposable income is the money left after paying taxes. Discretionary income is the money left after paying both taxes and essential expenses such as housing, food, and utilities.

How do I calculate my discretionary income?

Discretionary income is calculated in three steps:

- Start with gross income.

- Subtract taxes to find disposable income.

- Subtract essential expenses from disposable income.

The amount remaining is discretionary income.

Is discretionary income taxable?

No, discretionary income itself is not taxed. Taxes are already deducted before it is calculated. However, how you use discretionary income may create future tax obligations, such as taxes applied to capital gains from investing.

What are examples of discretionary expenses?

Common discretionary expenses include vacations, dining out, luxury goods, hobbies, entertainment, and other non-essential purchases.

Why is discretionary income important?

Discretionary income is important because it measures true financial flexibility. It shows how much an individual can save, invest, or spend on non-essentials after covering mandatory expenses.

Additional Resources

To keep advancing your career, the additional resources below will be useful: