Electronic Check

A form of online payment that performs the same function as a paper check

What is an Electronic Check?

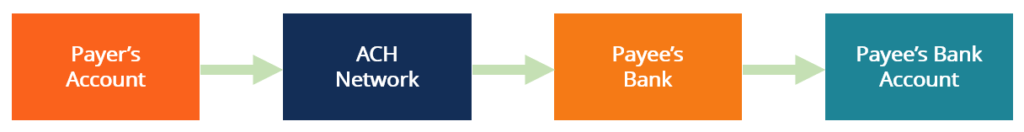

An electronic check is an electronic version of the conventional paper check. It is a form of online payment where money is withdrawn from one account and deposited into another account using the Automated Clearing House (ACH) network.

Through an ACH merchant account, a business can collect payments for products or services directly from a customer’s bank account electronically. However, the payment must first be authorized by the customer, which is usually done through consent taken in various forms, such as acceptance of a website’s terms and conditions or a signed contract.

Summary

- E-check is a form of online payment that performs the same function as a paper check. It is processed in fewer steps and is more cost-efficient.

- E-checks are considered more secure than paper checks as they use components such as authentication and encryption.

- They use the Automated Clearing House (ACH) network to process payments.

How to Process Electronic Checks

The processing of electronic checks is similar to processing paper checks, but it is done faster. As the process is carried out online, paper, as well as time, is saved while transacting using e-checks.

Listed below are the steps involved in processing an electronic check:

- Requesting authorization: The payee needs to get authorization from the payer to make the transaction.

- Setting up the payment: Payment information is fed into the online payment processing software.

- Finalizing the payment: Once all the relevant details are entered, the information is submitted, and it starts the ACH transaction process.

- Payment confirmation and fund transfer: The payment is withdrawn from the payer’s bank account and is deposited in the payee’s bank account. It happens automatically, and a payment receipt is also sent to the payer. Funds usually take around 3-5 business days to transfer once the ACH transaction is initiated.

While ACH funds usually took 3-5 days in the past, the National Automated Clearinghouse Association (NACHA) that oversees ACH, now makes same day funding possible through new capabilities.

E-checks vs. Credit Card Payments

E-checks and credit card payments are processed in very different ways. E-check uses ACH for fund transfer and does not use the card networks. It leads to lower processing fees and can turn out to be very beneficial to businesses that deal with large payments or recurring payments.

E-checks vs. EFT vs. Wire Transfer

Electronic funds transfer (EFT) is a term that covers a range of electronic payments, including wire transfer, electronic wallets, bank transfers, and so on. E-checks and ACH are basically types of EFT.

Wire transfers involve the movement of money from one bank account to another. However, wire transfers happen manually, one transaction at a time, whereas ACH takes place in batches. As such, wire transfers cost more than e-check transactions, and they, once initiated, cannot be reversed.

Businesses that Use E-check Payments

E-check payments enable a business to keep payments coming in as account numbers do not change as often as credit card numbers. The chances of payment failure are, therefore, less.

Types of businesses that use e-check payments:

- Subscription model businesses: As subscriptions are recurring in nature, e-checks make automatic payment and renewal of subscriptions extremely easy and convenient for businesses.

- Businesses that deal with large payments: As ACH is involved in the transfer of funds, middlemen involved in processing credit card payments are eliminated. High interchange fees are avoided by accepting e-check payments.

Security Used with E-check Payments

E-checks are more secure than conventional paper checks.

The major security components for e-check transactions are:

- Authentication: During authentication, the payments provider ensures that the account submitting the information is verified. Fraudulent payment information is, therefore, not submitted to the merchant.

- Encryption: All sensitive data is masked and therefore becomes irrelevant even if it is stolen. All ACH transactions are encrypted as they may take place over unsecured electronic networks.

- Public key cryptography: It is an extension of the encryption process and ensures that data is protected during transit. The public key helps to cipher the data.

- Digital signature: All the data contains digital signatures with timestamps to ensure that e-check transactions are not duplicated.

- Certificate authorities: Certificate authorities issue digital certificates that help protect information, facilitate encryption, and enable secure communication.

More Resources

CFI is the official provider of the Commercial Banking & Credit Analyst (CBCA)™ certification program, designed to transform anyone into a world-class financial analyst.

To keep learning and developing your knowledge of financial analysis, we highly recommend the additional resources below:

Accounting Crash Courses

Learn accounting fundamentals and how to read financial statements with CFI’s online accounting classes.

These courses will give you the confidence to perform world-class financial analyst work. Start now!

Boost your confidence and master accounting skills effortlessly with CFI’s expert-led courses! Choose CFI for unparalleled industry expertise and hands-on learning that prepares you for real-world success.