Expenses

A type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income

What is an Expense?

Businesses incur various types of expenses. An expense is a type of expenditure that flows through the income statement and is deducted from revenue to arrive at net income. Due to the accrual principle in accounting, expenses are recognized when they are incurred, not necessarily when they are paid for.

Types of Expenses

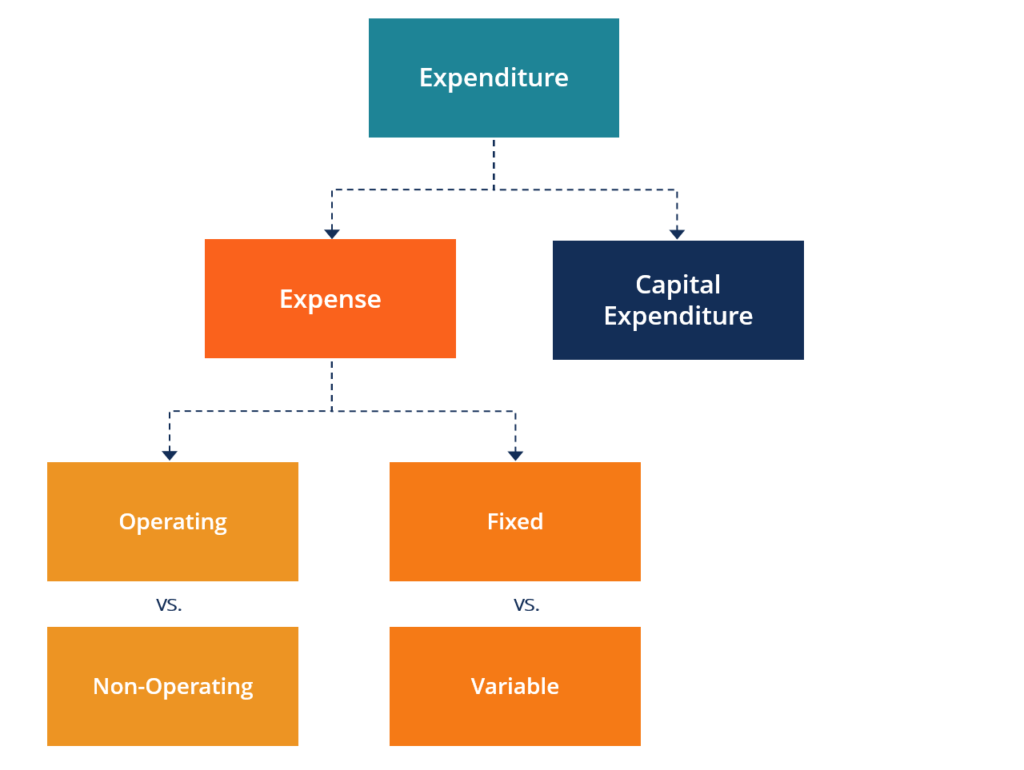

As the diagram above illustrates, there are several types of expenses. The most common way to categorize them is into operating vs. non-operating and fixed vs. variable.

- Operating

- Cost of Goods Sold (COGS)

- Marketing, advertising, and promotion

- Salaries, benefits, and wages

- Selling, general, and administrative (SG&A)

- Rent and insurance

- Depreciation and amortization

- Other

- Non-operating

- Interest

- Taxes

- Impairment charges

- Fixed

- Rent

- Salaries, benefits, and wages (sometimes fixed and sometimes variable)

- Variable

- Transaction fees

- Commissions

- Marketing and advertising (sometimes fixed and sometimes variable)

Expenses vs Capital Expenditures

The only difference between an expense and a capital expenditure is that an expense has been recognized under the accrual principle and is reflected on the income statement, whereas a capital expenditure goes straight to the balance sheet as an asset.

Once a capital expenditure goes on the balance sheet as an asset, it can be expensed later as depreciation and amortization, which flows through the income statement.

The statement of cash flows is where the actual timing of cash payments for all expenditures will be reflected. To learn more, check out CFI’s free tutorial on how to link the three financial statements in Excel.

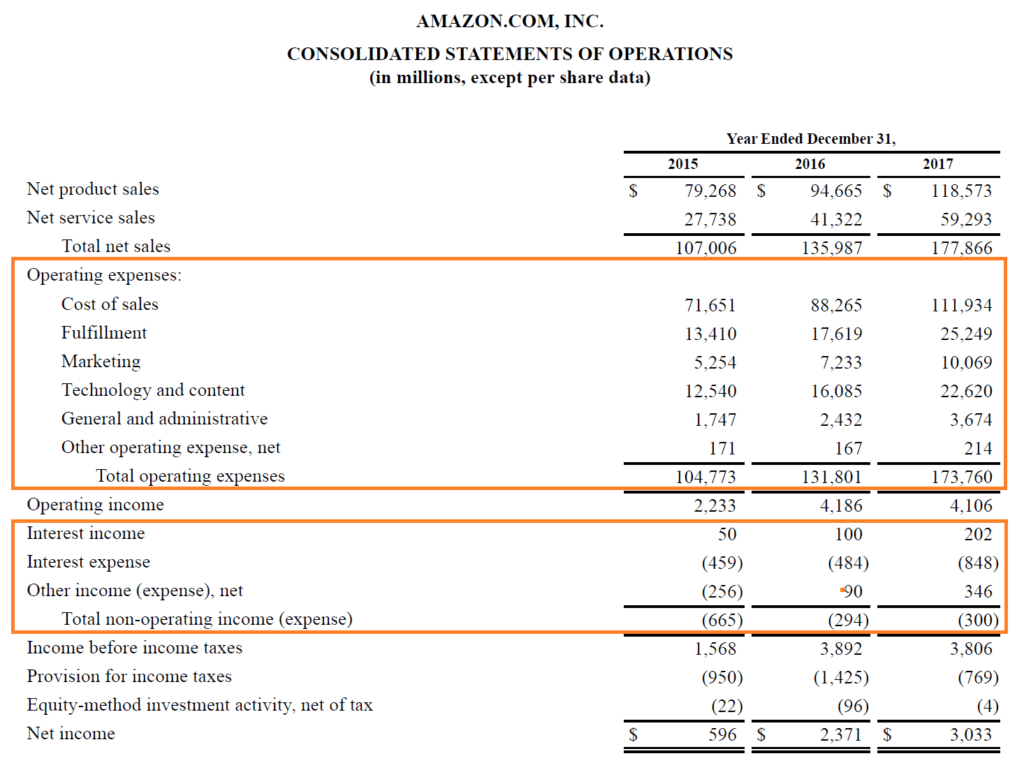

Expenses Example – Amazon

Below is an example of Amazon’s 2017 income statement (statement of operation) which lists their main categories of expense. As you can see, Amazon separates its costs into two categories.

Operating expenses consist of the cost of sales, fulfillment, marketing, technology and content, general and administrative, and others.

Non-operating expenses comprise interest expense (and income), and other expenses (income). Finally, Amazon has charged a provision for income taxes and accounted for equity method investment activity.

To learn more, check out CFI’s Free Accounting Courses.

Tax Deductible Types of Expenses

Most, but not all, expenses are deductible from a company’s income (revenues) to arrive at its taxable income. The most common tax-deductible expenses include depreciation and amortization, rent, salaries, benefits, and wages, marketing, advertising, and promotion.

Items that are not tax-deductible vary by region and country. It’s important to consult a professional tax advisor to learn about what expenses are deductible and not deductible in your or your company’s situation.

Additional Resources

Thank you for reading CFI’s explanation of Types of Expenses. To keep learning and advancing your career, the following CFI resources will be helpful:

Analyst Certification FMVA® Program

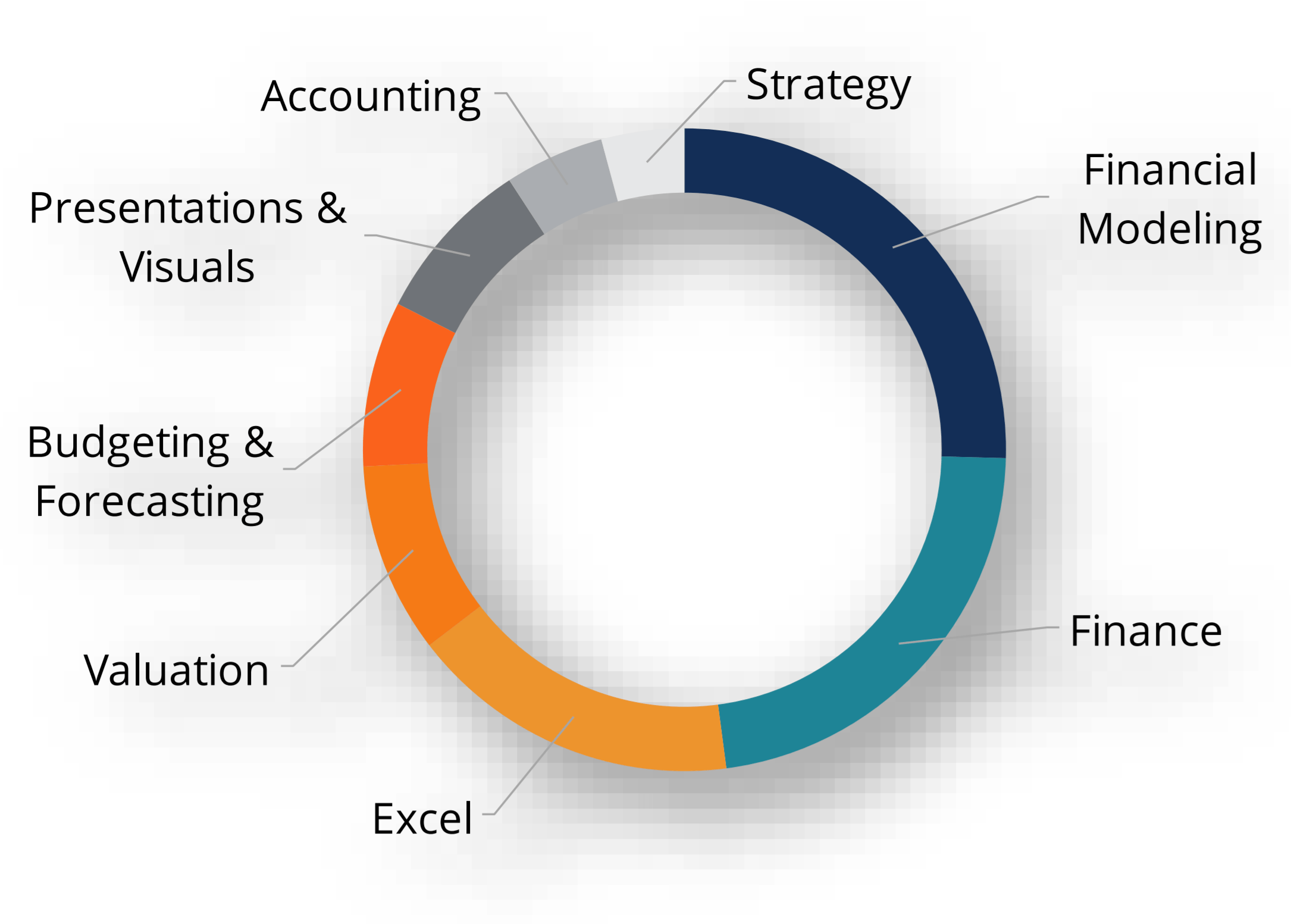

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?