Gross Profit

Profit after deducting direct costs from sales revenue

What is Gross Profit?

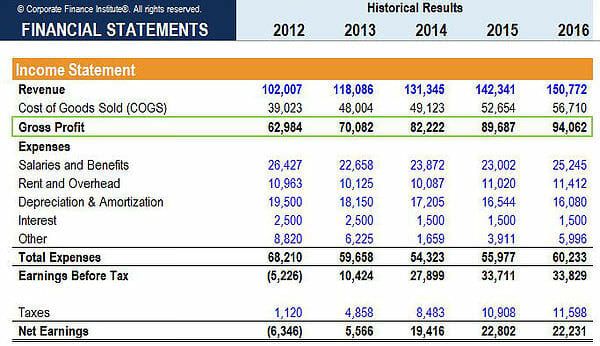

The Gross Profit (GP) of a business is the accounting result obtained after deducting the cost of goods sold and sales returns/allowances from total sales revenue. GP is located on the income statement (sometimes referred to as the statement of profit and loss) produced by a company and used to determine a company’s gross margin. Below is an example:

Formula for Calculating Gross Profit

The gross profit formula is:

Gross Profit = Sales Revenue – Cost of Goods Sold

To illustrate:

As of the first quarter of business operation for the current year, a bicycle manufacturing company has sold 200 units, for a total of $60,000 in sales revenue. However, it has incurred $25,000 in expenses, for spare parts and materials, along with direct labor costs. There were also returns and allowances for a total of $1,000. As a result, the gross profit declared in the financial statement for Q1 is $34,000 ($60,000 – $1,000 – $25,000).

What is Sales Revenue?

Sales revenue or net sales is the monetary amount obtained from selling goods and services to customers – excluding merchandise returned and any allowances/discounts offered to customers. This can be realized either as cash sales or credit sales.

What is Cost of Goods Sold?

Cost of goods sold, or “cost of sales,” is an expense incurred directly by creating a product. It includes any raw materials and labor costs incurred. However, in a merchandising business, cost incurred is usually the actual amount of the finished product (plus shipping cost, if any) purchased by a merchandiser from a manufacturer or supplier. In any event, cost of sales is properly determined through an inventory account or a list of raw materials or goods purchased.

Gross Margin

Gross profit serves as the financial metric used in determining the gross profitability of a business operation. It shows how well sales cover the direct costs related to the production of goods.

The formula for calculating gross margin is:

Gross Margin = Gross Profit / Total Revenue x 100

Gross margin is expressed as a percentage. For example, a company has revenue of $500 million and cost of goods sold of $400 million; therefore, their gross profit is $100 million. To get the gross margin, divide $100 million by $500 million, which results in 20%.

Download the Free Template

Additional Resources

Thank you for reading CFI’s guide to Gross Profit. With that in mind, these additional CFI resources will help you advance your career:

Analyst Certification FMVA® Program

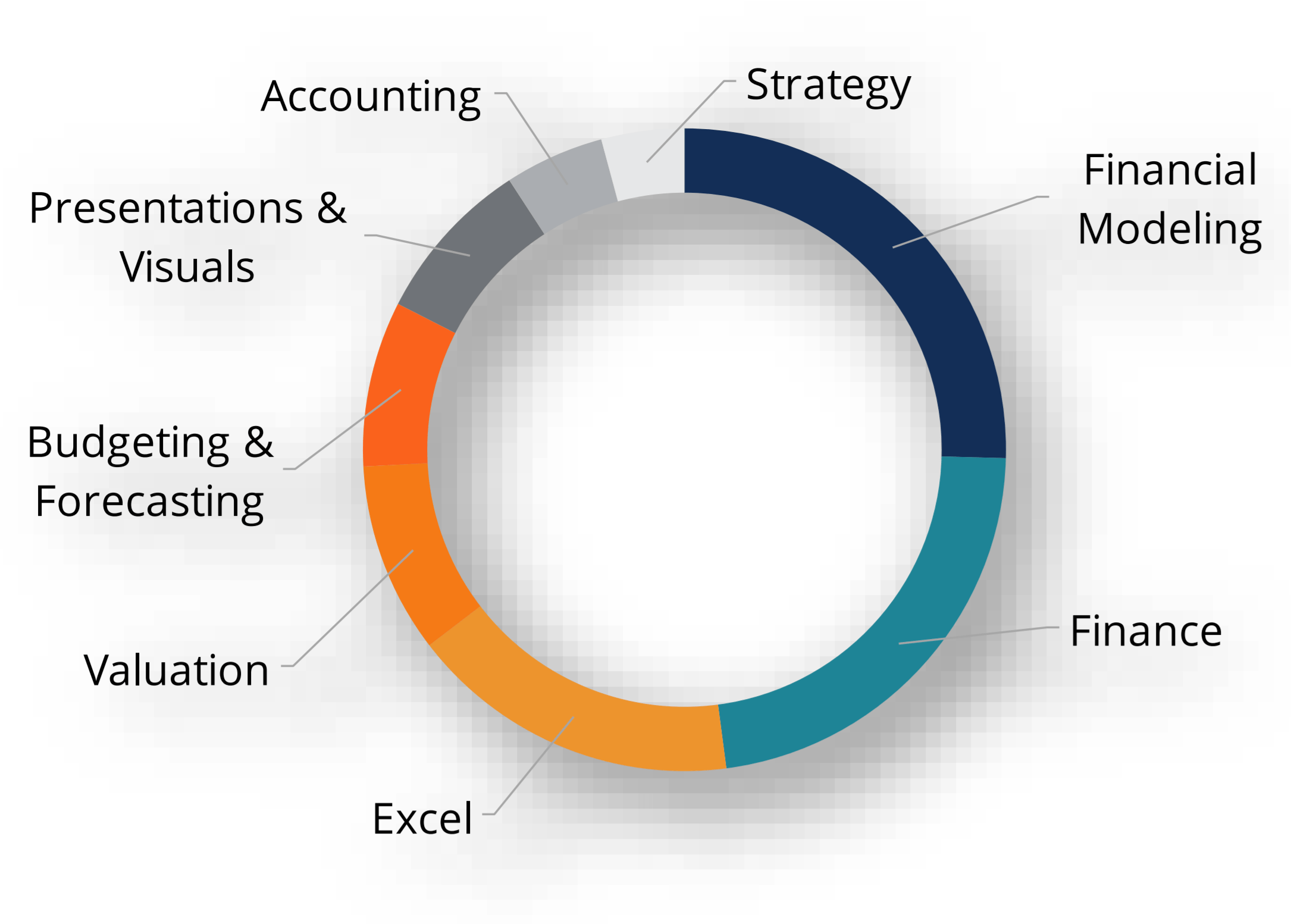

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?