- What is a Lease?

- Why is Lease Accounting Important?

- What are the Benefits of the New Lease Accounting Standards?

- Understanding Lessee vs Lessor

- Operating Leases vs. Financing Leases (Capital Leases)

- Pros and Cons of Leasing

- Lease Accounting Example and Steps

- Step 1: Identify the Type of Lease

- Step 2: Lease Amortization Schedule

- Step 3: Journal Entries

- Treatment Under Operating Lease Terms

- Analytical Implications

Lease Accounting Explained

A guide to accounting for leases

What is a Lease?

Leases are contracts in which the property/asset owner allows another party to use the property/asset in exchange for some consideration, usually money or other assets. The two most common types of leases in accounting are operating and finance (or capital) leases. It is worth noting, however, that under IFRS, all leases are regarded as finance-type leases. This step-by-step guide covers the basics of lease accounting according to IFRS and US GAAP.

Why is Lease Accounting Important?

Lease accounting is important because it requires companies to record and fully report their lease obligations. This increased transparency helps stakeholders fully assess a company’s financial obligations. In turn, lease accounting has a significant impact on company financial statements, ratios, and evaluating a company’s overall financial health.

Lease accounting helps prevent off-balance-sheet financing, where companies could previously “hide” significant liabilities, primarily related to operating leases. New accounting standards require most leases to be recognized on the balance sheet, making financial reporting more transparent.

Key Highlights

- Leases are contracts in which the asset owner allows another party to use the asset in exchange for money or other consideration.

- Lease accounting is important because it increases transparency in financial reporting, helping stakeholders fully assess a company’s financial obligations.

- Under IFRS, there is only a single lease accounting model: the finance lease. Both finance leases and operating leases are allowed under US GAAP.

What are the Benefits of the New Lease Accounting Standards?

Traditional lease accounting standards changed several years ago with the adoption of Accounting Standards Codification (ASC) 842 for US GAAP companies and IFRS 16 for companies that report using IFRS. As discussed earlier, the previous accounting standards allowed certain leases to remain off the balance sheet. Instead, these off-balance-sheet liabilities were only disclosed in company footnotes.

The main purpose of the change in lease accounting was to improve transparency by ensuring that most leases are presented on a company’s balance sheet. This change helps investors, analysts, and other stakeholders gain a more accurate view of a company’s financial health and leverage.

Understanding Lessee vs Lessor

Before we move into the accounting, it’s important to understand the following terminology:

- Lessee: The lessee is the party that obtains the right to use the leased asset. Essentially, the lessee agrees to the terms and conditions of the lease agreement and makes lease payments.

- Lessor: The lessor is the party that owns the asset. The lessor grants the right to use the asset to the lessee in exchange for lease payments over a specified period. Basically, the lessor is the landlord and retains ownership of the asset, while the lessee gains the temporary right to use the asset per the lease arrangements.

Operating Leases vs. Financing Leases (Capital Leases)

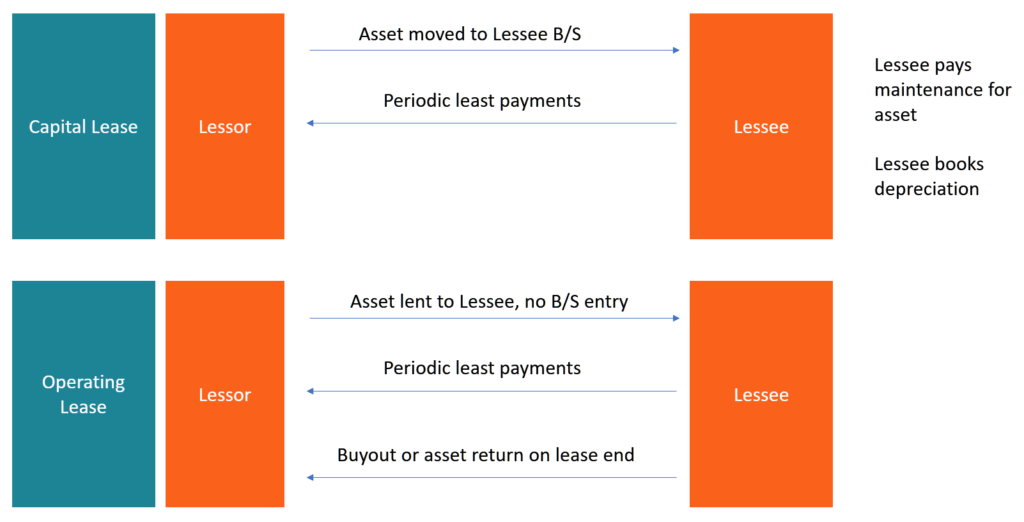

The two most common types of leases are operating leases and financing leases (formerly called capital leases). In order to differentiate between the two, one must consider how fully the risks and rewards associated with ownership of the asset have been transferred to the lessee from the lessor (although the lessor still legally owns the leased asset).

Recall that under IFRS, lease classification has been abandoned as a practice. Under US GAAP, there are two classifications: finance leases and operating leases.

Whether the risks and rewards have been fully transferred can be unclear, so IFRS (and US GAAP) outlines several criteria to identify finance leases from the lessee’s perspective. At least one of the following conditions must be met in order to classify a lease as a financing lease:

- Ownership transfer: The ownership of the right-of-use asset transfers from the lessor to the lessee by the end of the lease period.

- Bargain purchase option: An option is given to the lessee to purchase the asset at a price lower than its fair market value at a future date (typically the end of the lease term). This option is determined at the beginning of the lease, and the lessee is reasonably certain it will exercise this option.

- Lease term: The period of the lease lasts at least 75% of the useful economic life of the asset. The lease is noncancelable during this time.

- Present value: The present value of the minimum lease payments required under the lease equals or exceeds substantially all (at least 90%) of the fair value of the underlying asset at the inception of the lease.

- No alternative use: The underlying asset is of a specialized nature, and it is expected to have no alternative use to the lessor at the end of the lease term.

Any other type of lease is referred to as an operating lease. Having said that, under IFRS there is a single lease accounting method for lessees, so these conditions are more relevant for US GAAP, which clearly differentiates finance leases and operating leases.

Pros and Cons of Leasing

Advantages of Leasing

Leasing provides several benefits to lessees:

- Asset finance: Leasing allows a company access to assets without the hefty cost often associated with the purchase of property, plant, and equipment.

- Protection against obsolescence: At the end of the lease term, the leased equipment can be returned to the lessor and replaced with newer equipment through a new lease agreement. This allows a company to operate using the latest machinery for maximum efficiency.

- Flexible payment terms: Payment schedules are more flexible than traditional loan contracts.

- Tax benefit: Depreciation is a tax-deductible expense, which is recognized by both the lessor and lessee.

Disadvantages of Leasing

One major disadvantage of leasing is the agency cost problem. In a lease, the lessor will transfer all rights to the lessee for a specific period of time, creating a moral hazard issue. Because the lessee controls the asset but is not the owner of the asset, the lessee may not exercise the same amount of care as if it were his/her own asset. This separation between the asset’s ownership (lessor) and control of the asset (lessee) is referred to as the agency cost of leasing. This is an important concept in lease accounting.

Another disadvantage of leasing is that lease accounting can be quite complex… much more so compared to building and owning the asset outright.

Lease Accounting Example and Steps

Let’s walk through a lease accounting example. On January 1, 2024, Company XYZ signed an eight-year lease agreement for equipment. Annual payments of $28,500 are to be made at the end of each year. At the end of the lease, the equipment will revert to the lessor. The equipment has a useful life of eight years and has no residual value. At the time of the lease agreement, the equipment has a fair value of $165,000. An interest rate of 10.5% and straight-line depreciation are used.

Step 1: Identify the Type of Lease

- There is no bargain purchase option because the equipment will revert to the lessor.

- The life of the lease is eight years and the economic life of the asset is eight years. This is 100% (refer to the lease term condition above).

- In Excel, we can calculate the PV of the minimum lease payments:

- nper = 8

- rate = 10.5%

- PMT = 28,500

- FV = 0

- type = 0 (payment is made at the end of the year)

- Calculate PV as =PV(10.5%,8,28500,0,0) = $149,317

- 149,317/165,000 = 90% (refer to the present value condition above)

Therefore, this is a finance/capital lease because at least one of the finance lease criteria is met during the lease, and the risks/rewards of the asset have been fully transferred. We have determined the proper lease accounting.

Step 2: Lease Amortization Schedule

| Year | Lease Liability | Interest Expense | Lease Payment | Principal Payment | Balance |

| 0 | $149,317 | $15,678 | $28,500 | $12,822 | $136,495 |

| 1 | $136,495 | $14,332 | $28,500 | $14,168 | $122,327 |

| 2 | $122,327 | $12,844 | $28,500 | $15,656 | $106,671 |

| 3 | $106,671 | $11,201 | $28,500 | $17,299 | $89,372 |

| 4 | $89,372 | $9,384 | $28,500 | $19,116 | $70,256 |

| 5 | $70,256 | $7,377 | $28,500 | $21,123 | $49,133 |

| 6 | $49,133 | $5,159 | $28,500 | $23,341 | $25,792 |

| 7 | $25,792 | $2,708 | $28,500 | $25,792 | $0 |

Year 0 is considered the current year, 2024.

Interest expense is calculated as the opening lease liability balance multiplied by the interest rate of 10.5%, and the lease liability opening balance can be calculated in one of two ways:

- =PV(10.5%,8,-28500,0,0) — the negative figure shows that this is a cash outflow

- =NPV(10.5%, E3:E10) — the lease payments shown in the table above are in the range E3:E10

The principal payment is the difference between the actual lease payment and the interest expense. The year’s closing balance is calculated as lease liability + interest – lease payment.

Step 3: Journal Entries

January 1, 2024

| DR Equipment | $149,317 |

| CR Lease Liability | $$149,317 |

The right-of-use (ROU) account in the balance sheet is debited by the present value of the minimum lease payments, and the lease liability account is the difference between the value of the asset and any cash paid at the inception of the lease.

In some lease agreements, the payment is due at the beginning of the year, so the lease liability account balance would equal the right-of-use account balance less the cash lease payment. However, since we are assuming the lease is paid at the end of the year, the right-of-use asset is equal to the lease liability. The cash entry would not be required at this point, but at the end of the year upon payment.

December 31, 2024

| DR Depreciation Expense | $18,665 |

| CR Accumulated Depreciation | $18,665 |

The leased equipment is shown on the balance sheet as a right-of-use asset, and it must be depreciated similarly to property, plant, and equipment. The straight-line depreciation method is typically used for the equipment that is leased. This is based on the calculated equipment cost of $149,317, which is depreciated equally over eight years at $18,665 per year.

| DR Interest Expense | $15,678 |

| CR Interest Payable | $15,678 |

The interest expense is the beginning lease liability ($149,317) multiplied by the interest rate of 10.5%.

| DR Lease Liability | $12,882 |

| DR Interest Payable | $15,678 |

| CR Cash | $28,500 |

Cash is credited for the lease payment of $28,500. Note that this payment is made up of an interest component ($15,678) and a principal component ($12,822). As the company debits the lease liability account with the principal payment each year, its balance reduces until it reaches zero at the end of the lease term.

December 31, 2025

| DR Depreciation Expense | $18,665 |

| CR Accumulated Depreciation | $18,665 |

| DR Interest Expense | $14,332 |

| CR Interest Payable | $14,332 |

| DR Lease Liability | $14,168 |

| DR Interest Payable | $14,332 |

| CR Cash | $28,500 |

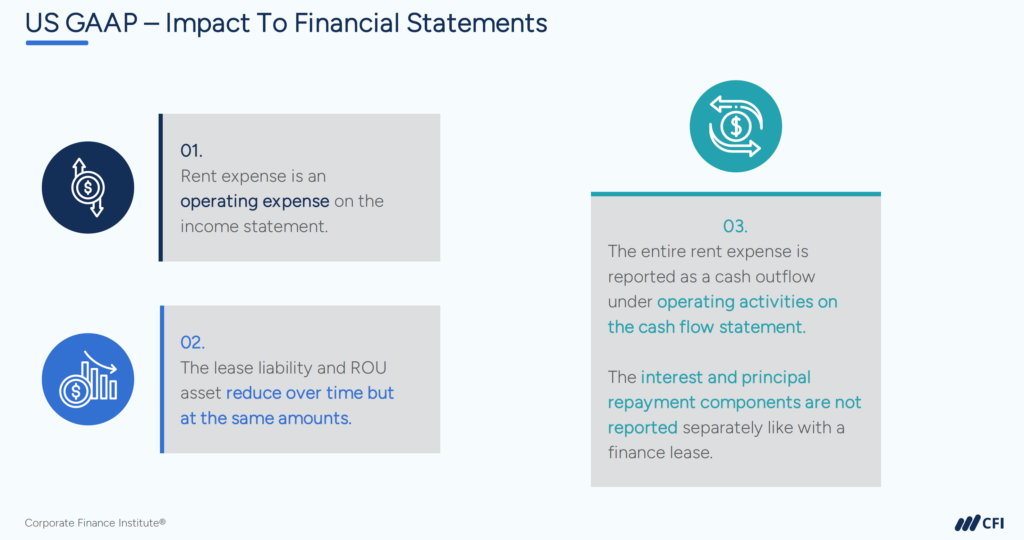

Treatment Under Operating Lease Terms

Recall that only US GAAP differentiates between an operating lease and a finance lease. Let’s now assume that the above lease is actually an operating lease.

January 1, 2024

| DR Equipment | $149,317 |

| CR Lease Liability | $149,317 |

December 31, 2024

| DR Lease Expense | $28,500 |

| CR Cash | $28,500 |

In the operating lease scenario, the lease expense is constant throughout the lease term: the only expense recognized is the lease expense of $28,500. The lease liability and the right-of-use asset are both reduced by the same amount: $12,822 in the first year. This is calculated as $28,500 less the implied interest expense of $15,678 ($149,317 * 10.5%).

December 31, 2025

| DR Lease Expense | $28,500 |

| CR Cash | $28,500 |

In the operating lease scenario, the lease expense is constant throughout the lease term. The lease liability account is reduced annually by an amount equal to the lease payment and the lease’s interest expense. Lastly, the equipment/right-of-use account is reduced by the same amount as the lease liability (the lease payment less the interest expense). This last quantity is a plug to get our debits and credits equal, and these amounts will sum up to the lease liability balance over the lease term.

Analytical Implications

With finance leases, the expense of leased assets is split into a depreciation component and an interest component. This single lease classification under IFRS means companies are easily comparable.

However, the two different lease classifications allowed under US GAAP make financial analysis a little more complicated. While finance lease accounting is effectively the same as IFRS (expense split into depreciation and interest components), operating lease expense is just a single expense based on the lease payment.

EBITDAR

The operating lease expense reduces EBITDA; however, expenses associated with finance leases would not impact EBITDA (since this metric is before deducting interest expense and depreciation). This makes it difficult to compare two companies: one company primarily uses finance leases, while the second company primarily uses operating leases. In order to adjust for these accounting differences, some analysts will add back the operating lease expense — usually referred to as rent expense — to EBITDA to derive EBITDAR (EBITDA plus rent expense). By adding back rent expense and calculating EBITDAR, the two companies can be more easily compared.

Cash Flow Statement Classifications

Another important point to bring up is that IFRS allows companies to recognize interest expense on the cash flow statement in either operating activities or financing activities. US GAAP requires that interest expense be considered an operating activity. Because finance leases have an interest component under both IFRS and US GAAP, otherwise similar companies may report interest expense in different parts of the cash flow statement. In turn, this impacts comparability.

Free Cash Flow

Another consideration is how to treat leases when calculating free cash flow. Any free cash flow calculation should deduct the value of new leases similar to how capital expenditures are deducted. This is because leases are fundamentally capital expenditures financed with debt.

Additional Resources

You can read more about lease accounting on the IFRS website.

To keep learning and developing your financial knowledge, we recommend these additional CFI resources: