Non-Recurring Item

An infrequent or abnormal gain or loss reported in the company’s financial statements

What is a Non-Recurring Item?

In accounting, a non-recurring item is an infrequent or abnormal gain or loss that is reported in the company’s financial statements. Unlike other items reported by a company, non-recurring items do not arise from the normal company’s operations. The items are generally caused by unusual and infrequent events that are not likely to happen again in the future.

Non-Recurring Items in Financial Analysis

Understanding the nature of a non-recurring item and its impact on a company’s profitability is crucial in financial valuation. Generally, analysts adjust their profitability analysis for non-recurring items. Since the items arise from extraordinary events and/or occur only once, it is not likely that they will affect the company’s future long-term profitability.

However, analysts should still carefully assess the guidance on non-recurring items provided by the company’s management. It may turn out to be that the non-recurring items can reoccur in the future, impacting the company’s profitability.

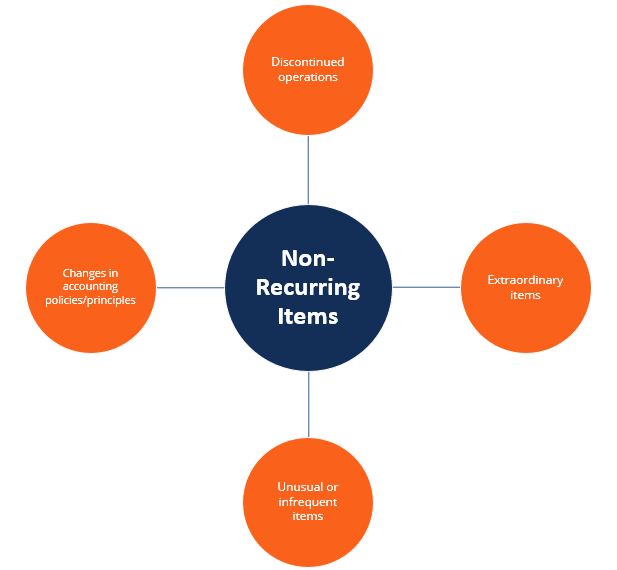

Types of Non-Recurring Items

Generally, we can derive four main types of non-recurring items:

- Discontinued operations: Relates to the disposal of a company’s segment or division distinct from the continuous company’s operations that generate recurring net income.

- Extraordinary items: Non-recurring items that are both unusual and infrequent in their nature. The best examples of extraordinary items are losses arising from natural disasters.

- Unusual or infrequent items: Non-recurring items that are either unusual or infrequent in their nature. They include various items such as gains/losses on a sale of a subsidiary, restructuring costs, and asset impairments.

- Changes in accounting policies: This refers to the company’s decision to voluntarily change its accounting policies or make changes in accounting principles that may change the values of certain recurring items reported by a company. The impact of the changes is recorded as a gain or loss.

Accounting Reporting of Non-Recurring Items

Non-recurring items are reported by a company on the income statement. Depending on the type of item, it may be reported as before-tax or after-tax. Generally, unusual or infrequent items are reported before tax.

In addition, the nature of such items is usually discussed in detail in the management discussion and analysis (MD&A) section of the company’s financial reports. In addition, detailed information about the items can be found in the footnotes to the financial statements.

More Resources

CFI is the official provider of the Financial Modeling and Valuation Analyst (FMVA)® certification program, designed to transform anyone into a world-class financial analyst.

To keep learning and developing your knowledge of financial analysis, we highly recommend the additional CFI resources below:

Analyst Certification FMVA® Program

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?

Accounting Crash Courses

Learn accounting fundamentals and how to read financial statements with CFI’s online accounting classes.

These courses will give you the confidence to perform world-class financial analyst work. Start now!

Boost your confidence and master accounting skills effortlessly with CFI’s expert-led courses! Choose CFI for unparalleled industry expertise and hands-on learning that prepares you for real-world success.