Operating Cash Flow

Cash generated from operating activities of a business

What is Operating Cash Flow?

Operating Cash Flow (OCF) is the amount of cash generated by the regular operating activities of a business within a specific time period.

The formula for each company will be a little different, but the basic structure always consists of the same three elements: 1) OCF begins with net income, 2) adds back any non-cash items, and 3) adjusts for changes in net working capital. Summing these three elements together results in the total cash generated or consumed by operations in the period.

When performing financial analysis, operating cash flow should be used in conjunction with net income, free cash flow (FCF), and other metrics to properly assess a company’s performance and financial health.

Key Highlights

- Operating cash flow (OCF) is how much cash a company generated (or consumed) from its operating activities during a period.

- The OCF calculation will always include the following three components: 1) net income, 2) plus non-cash expenses, and 3) minus the net increase in net working capital.

- Financial analysts will look at OCF, along with free cash flow (FCF) and net income, to analyze a company’s profitability.

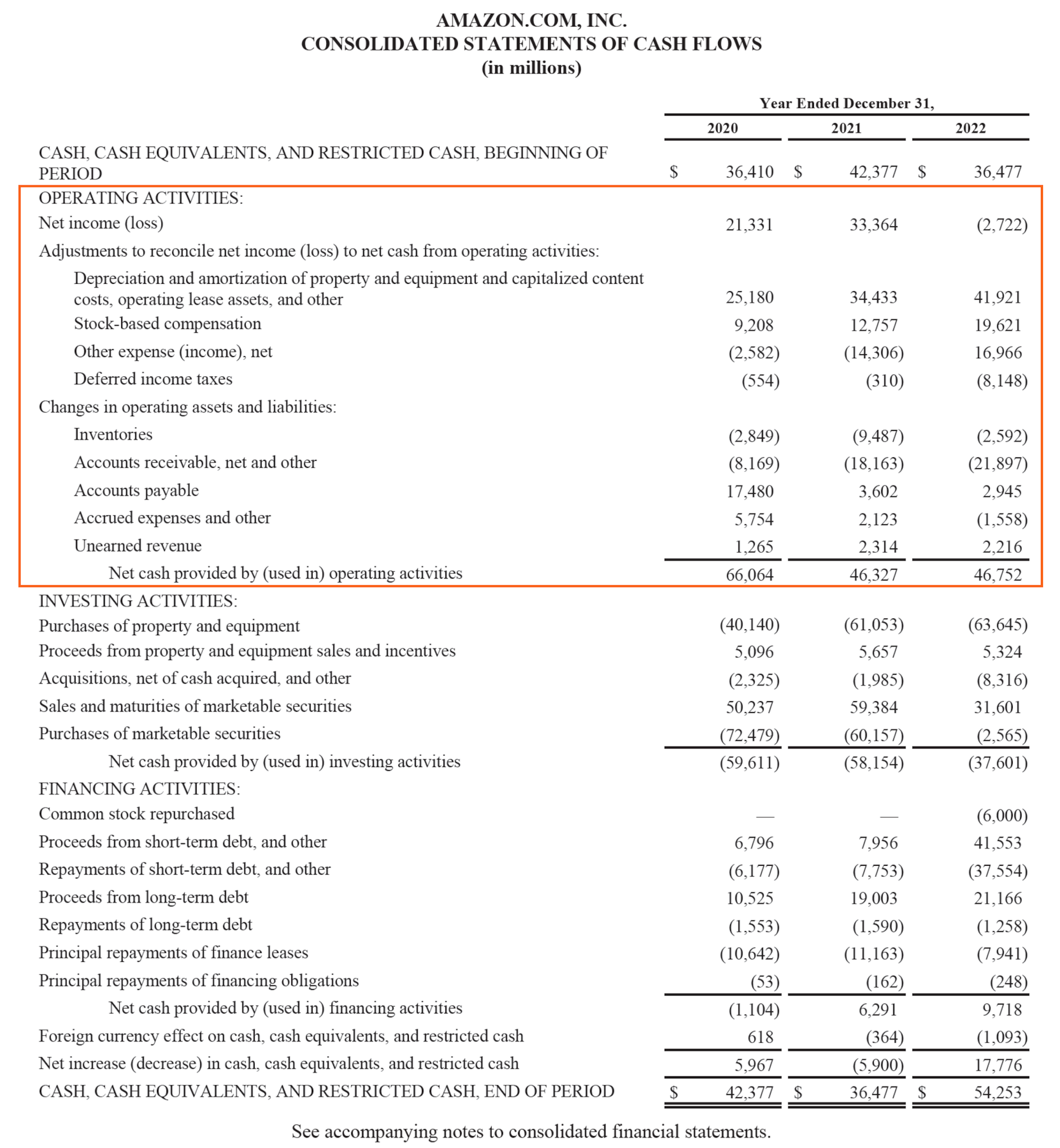

Operating Cash Flow Example

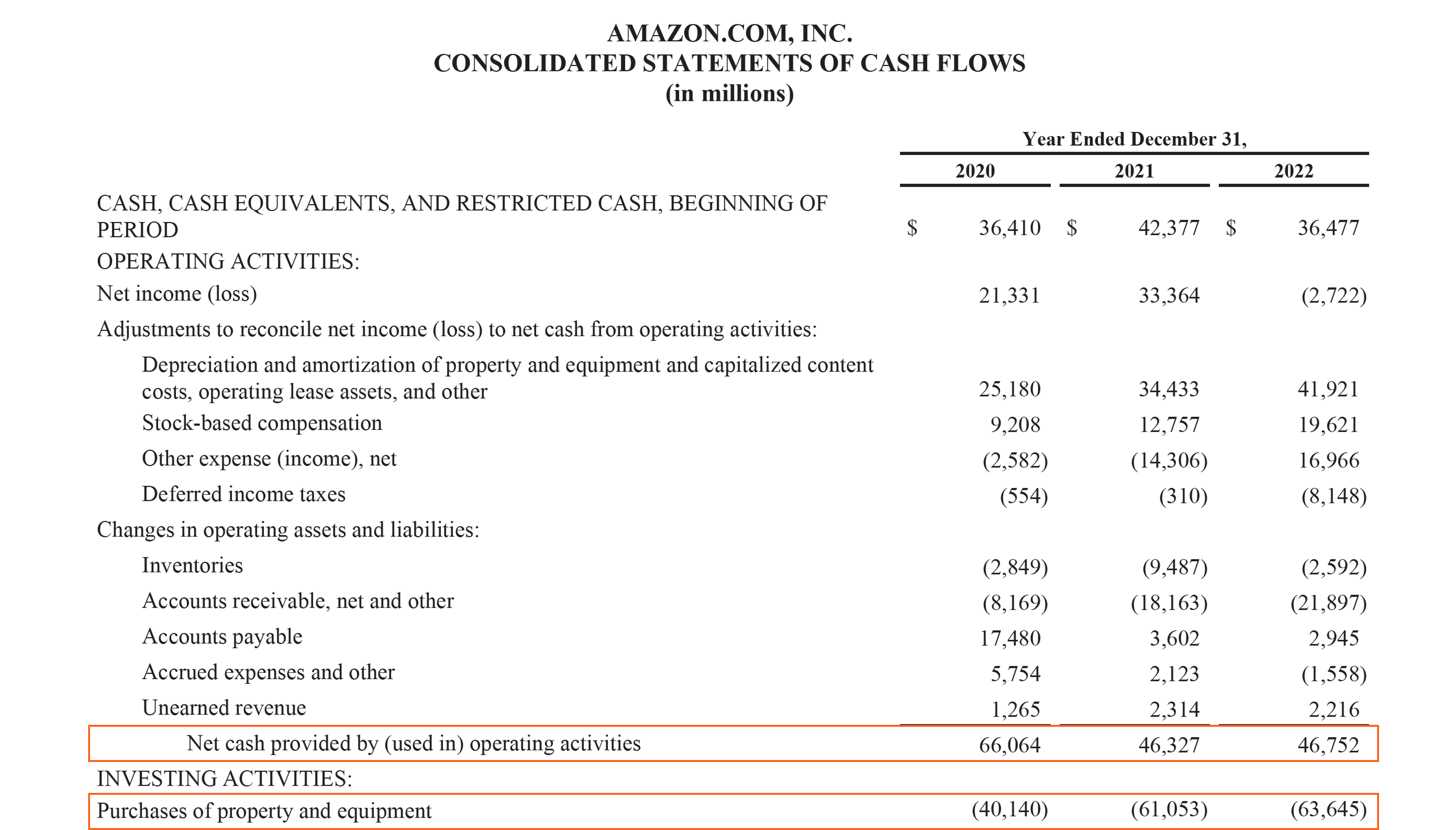

Below is an example of operating cash flow (OCF) using Amazon’s 2022 annual report.

As you can see, the consolidated statement of cash flows is organized into three distinct sections, with operating activities at the top, then investing activities, and finally, financing activities. In addition to those three sections, the statement also shows the starting cash balance, total change for the period, and ending balance.

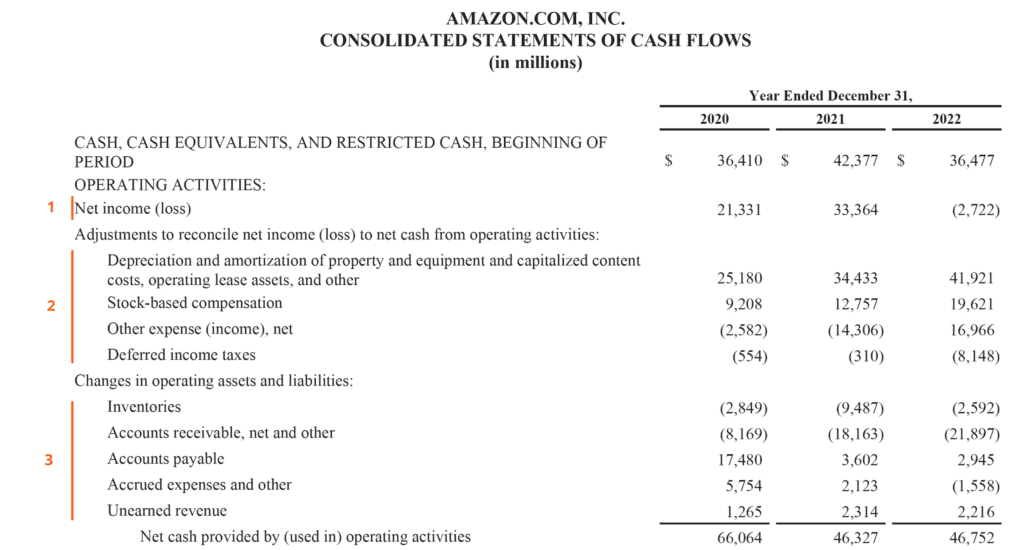

Let’s analyze how the operating section works:

- Net income from the bottom of the income statement is used as the starting point

- All non-cash items are “added back,” meaning any accruals are reversed, including:

- Depreciation and amortization, which is the accrual-based expensing of capital the company invested in maintaining its property, equipment, website, software, etc.

- Stock-based compensation is expensed but not paid out with actual cash; instead, this compensation is paid with the issuance of shares to key employees

- Other expense/income could include various items such as unrealized gains or losses or other accrued items

- Deferred taxes arise from the difference between accounting methods companies use when filing their taxes vs those needed for filing their financial statements

- Change in working capital (operating assets and liabilities) adjustments include:

- When inventory on the balance sheet goes up, it results in a reduction of cash (or vice versa)

- When accounts receivable increases, it also creates a reduction of cash, as it means a portion of the revenues recorded have not yet been paid by customers

- When accounts payable, accrued expenses, and unearned revenue increase, they cause an increase in cash.

At the bottom of the operating cash flow section, we can see the total, which is labeled as “Net cash provided by (used in) operating activities.” The line is the sum of all items above it and represents the total for the period.

Operating Cash Flow Formula

Whether you’re an accountant, a financial analyst, or a private investor, it’s important to know how to calculate how much cash flow was generated in a period. We sometimes take for granted when reading financial statements how many steps are actually involved in the calculation.

Let’s analyze the operating cash flow formula and each of the various components.

Formula (short form):

Operating Cash Flow = Net Income + Non-Cash Expenses – Increase in Working Capital

Using the short-form version of the operating cash flow formula, we can clearly see the three basic elements in every OCF calculation.

- Net Income: Net income is the net after-tax profit of the business from the bottom of the income statement. It is the direct link between the income statement and the cash flow statement.

- Non-cash Expenses: Non-cash expenses are all accrual-based expenses that are not actually paid for with cash or credit in a given period. The most common examples of non-cash expenses include depreciation and amortization, stock-based compensation, deferred tax, impairment charges, and unrealized gains or losses.

- Non-cash Working Capital: Non-cash working capital is all current assets (except for cash) less all current liabilities (except for debt). An increase in current assets causes a reduction in cash, while an increase in current liabilities causes an increase in cash.

Formula (long form):

Operating Cash Flow = Net Income + Depreciation & Amortization + Stock-Based Compensation + Deferred Tax + Other Non-Cash Items – Increase in Accounts Receivable – Increase in Inventory + Increase in Accounts Payable + Increase in Accrued Expenses + Increase in Deferred Revenue

The formulas above are meant to give you an idea of how to perform the calculation on your own; however, they are not entirely exhaustive.

There can be additional non-cash items and additional changes in current assets or current liabilities that are not listed above. The key is to ensure that all items are accounted for, and this will vary from company to company.

Operating Cash Flow vs Net Income

Net income and earnings per share (EPS) are two of the most frequently referenced financial metrics, so how are they different from operating cash flow? The main difference comes down to accounting rules such as the matching principle and the accrual principle when preparing financial statements.

Net income includes various sorts of expenses, some that may have actually been paid for and some that may have simply been created by accounting principles (such as depreciation).

In addition, a company’s revenue recognition principle and matching of expenses to the timing of revenues can result in a material difference between OCF and net income.

Unfortunately, it is not possible to simply say that one number is always higher or lower than the other. Sometimes, OCF is higher than net income (as with Amazon), and sometimes it’s the opposite.

As you can see in the screenshot above, there is a major difference between the two metrics, and Amazon has consistently generated more OCF than net income.

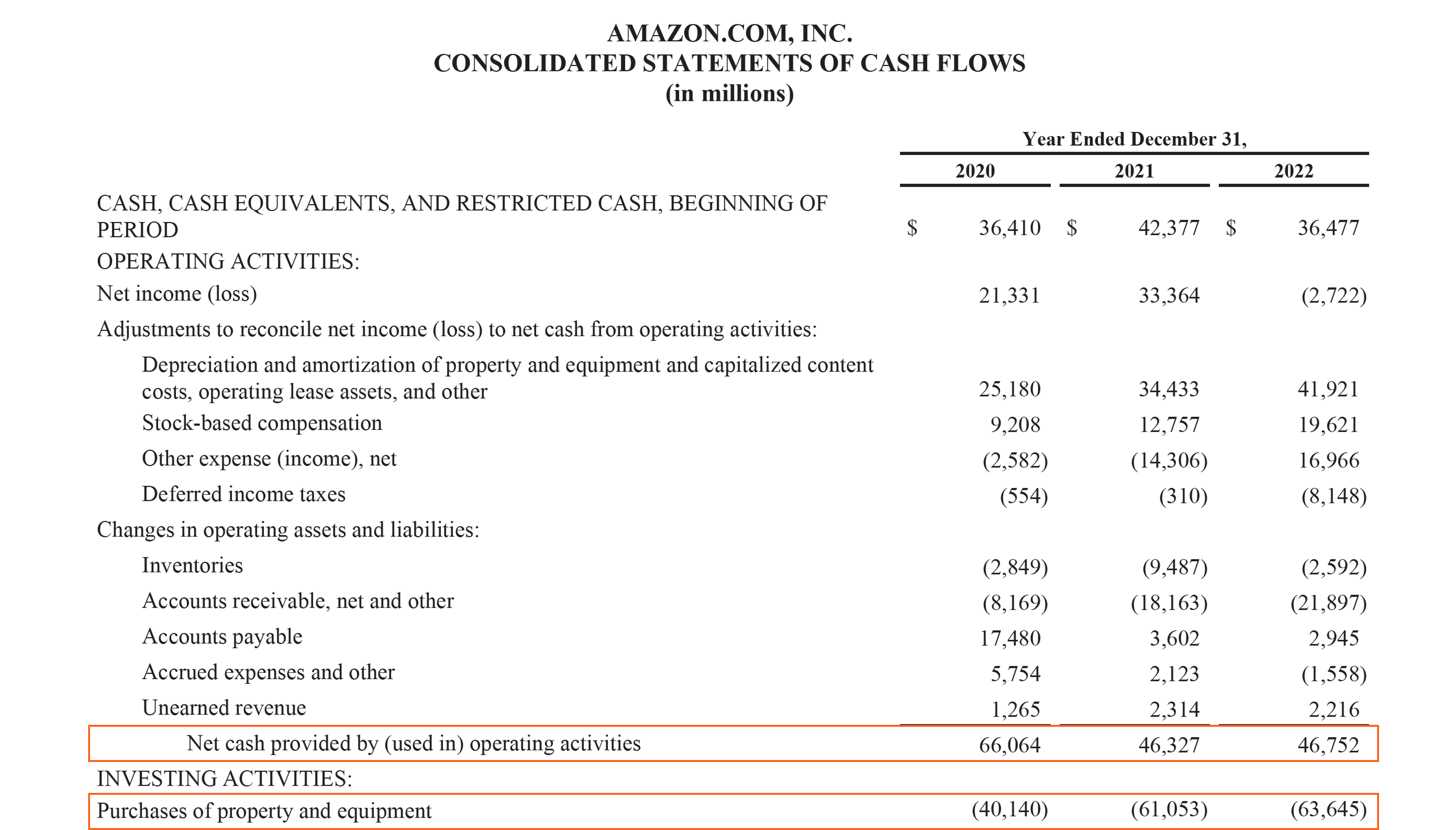

Operating Cash Flow Formula vs FCF Formula

While the operating cash flow formula is great for assessing how much a company generates from operations, there is a major limitation: OCF doesn’t take into account capital expenditures (CapEx) or other long-term investments. By deducting CapEx from OCF, you arrive at Free Cash Flow, which is a better assessment of available cash generated for the period.

The FCF formula is:

Free Cash Flow = Operating Cash Flow – Capital Expenditures

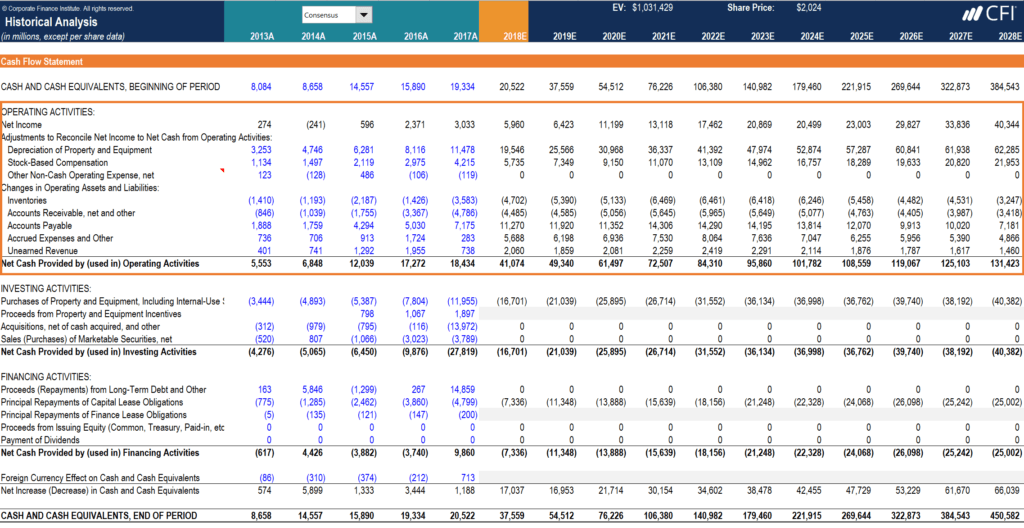

Operating Cash Flow in Financial Modeling

Calculating the operating cash flow can be one of the most challenging parts of financial modeling in Excel. Below is an example of what this activity looks like in a spreadsheet.

As you can see in the screenshot below, there are various adjustments to items necessary to reconcile net income to net cash from operating activities, as well as changes in operating assets and liabilities.

In a financial model, there are separate sections for the depreciation schedule and working capital schedule, which then feed into the cash flow statement section of the model. The example below is taken from CFI’s Amazon Case Study Course.

As you can see in the above example, there is a lot of detail required to model the operating activities section, and many of those line items require their own supporting schedules in a financial model.

What is the Operating Cash Flow Ratio?

The Operating Cash Flow Ratio, a liquidity ratio, is a measure of how well a company can pay off its current liabilities with the cash flow generated from its core business operations. This financial metric shows how much a company earns from its operating activities, per dollar of current liabilities.

Since earnings involve accruals and can be manipulated by management, the operating cash flow ratio is considered a very helpful gauge of a company’s short-term liquidity.

Operating Cash Flow Ratio Formula

The formula for calculating the operating cash flow ratio is as follows:

Where:

- Cash flow from operations can be found on a company’s statement of cash flows. Alternatively, the formula for operating cash flow is equal to net income + non-cash expenses + changes in working capital.

- Current liabilities are obligations due within one year. Examples include short-term debt, accounts payable, and accrued liabilities.

Example of the Operating Cash Flow Ratio

The following information was taken out of Company A’s Q2 financial statements:

Therefore, the company earns $1.25 from operating activities per dollar of current liabilities. Alternatively, it can be viewed as, “Company A can cover its current liabilities 1.25x over.”

Download CFI’s Free Operating Cash Flow Ratio Template

Enter your name and email in the form below and download our free Operating Cash Flow Ratio template now!

How to Interpret the Operating Cash Flow Ratio

- If the ratio is less than 1, the company generates less cash from operations than is needed to pay off its short-term liabilities. This signals short-term problems and a need for more capital.

- A higher ratio – greater than 1.0 – is preferred by investors, creditors, and analysts, as it means a company can cover its current short-term liabilities and still have earnings left over.

Companies with a high or uptrending operating cash flow are generally considered to be in good financial health.

Additional Resources

Thank you for reading this CFI guide to Operating Cash Flow. To continue learning and progressing in your career, these additional CFI resources will be helpful: