Operating Return on Assets (OROA)

A measure of operating income that is generated for every dollar invested in its assets

What is Operating Return on Assets (OROA)?

Operating return on assets (OROA), an efficiency or profitability ratio, is a variation of the traditional return on assets ratio. Operating return on assets is used to show a company’s operating income that is generated per dollar invested specifically in its assets that are used in its everyday business operations. Like the return on assets ratio, OROA measures the level of profits relative to the company’s assets, but using a narrower definition of its assets.

Formula for Operating Return on Assets

The formula for the operating return on assets ratio is as follows:

Where:

- Earnings before interest and taxes (EBIT) is equivalent to operating income.

- Average total assets is the average of beginning and ending values of the company’s assets used in its normal business activities.

The formula differs from the formula for the regular return on assets ratio as follows:

1) It uses EBIT rather than net income as the numerator.

2) It uses regular business operations assets rather than total assets as the denominator.

Example of Operating Return on Assets

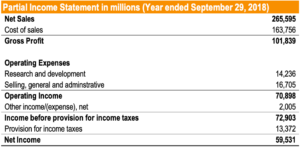

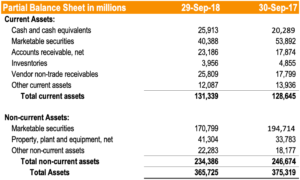

Tim is an equity analyst looking to determine the profitability of Apple Inc. Among other ratios that Tim uses, he decides to also use the OROA to determine the level of profits relative to Apple’s operating assets. He compiles the following information from Apple’s 2018 annual report:

Tim calculates Apple’s OROA for the year ended September 29, 2018, as follows:

Tim concludes that Apple generated $0.1913 in operating income per dollar of operating assets.

Benefits of Using Operating Return on Assets

Similar to the traditional return on assets, the operating return on assets is used to determine the effectiveness of business operations and the profitability generated from assets used. The OROA is commonly used by analysts and investors who want to disregard the cost of asset acquisition that can come in the form of debt (i.e., interest expense) or equity and the effect of taxes (which may vary across countries).

There is no “perfect” OROA – the ratio should be compared relative to competitors. With that said, a higher OROA is desirable.

The OROA can be used:

- To compare how well a company utilizes its assets among companies that operate in the same industry and are engaged in similar business operations;

- On a trended basis to compare its current performance to its performance in the previous year

- To indicate how well a company is using its assets to generate operating income.

Key Takeaways

Operating return on assets (OROA) is similar to the traditional return on assets ratio but uses operating income in the numerator as opposed to net income. OROA is used to determine a company’s operating efficiency by revealing the amount of income generated per dollar invested in its operating assets. It excludes assets that are not part of its normal business operations – such as investments in other companies that it may hold.

The OROA can be used to compare with peer companies, used to determine the trend of company performance, and as an indicator of how well a company is using its assets to generate operating income.

More Resources

CFI is the official provider of the global Financial Modeling & Valuation Analyst (FMVA)™ certification program, designed to help anyone become a world-class financial analyst. To keep advancing your career, the additional CFI resources below will be useful: