What Is Revenue in Accounting?

The value of all sales of goods and services recognized by a company in a period

Understanding Revenue: Meaning and Why It Matters

Revenue is the value of all sales of goods and services recognized by a company in a period. Revenue (also known as sales) forms the beginning of a company’s income statement and is often considered the “Top Line” of a business. Expenses are deducted from a company’s revenue to arrive at its profit or net income.

Revenue Recognition Principle

Under the revenue recognition principle in accounting, revenue is recorded when a company has satisfied its performance obligation to the customer. In practice, this means revenue is recognized when the customer obtains control of the good or service.

For products, customers gain control when the item is delivered. For services, it happens when the promised work has been completed or as the service is performed, depending on the contract terms.

Notice the revenue recognition principle doesn’t include anything about payment for goods/services actually being received. Revenue is recorded when the company has fulfilled its performance obligation, whether or not payment has been received yet.

For example, a customer paying with a credit card effectively provides immediate payment to the retailer. However, a business customer who receives an invoice for services might not have to pay for several weeks.

When a company delivers goods or services and allows the customer to pay later, it records revenue at the time of delivery and records the unpaid amount as accounts receivable on the balance sheet.

When the customer eventually pays, no additional revenue is recorded — cash increases and accounts receivable decrease, but the revenue was recognized at the time of the sale.

Why Revenue Matters

Revenue is a key indicator of a company’s financial health and potential for growth. It helps with:

- Evaluating operational success.

- Determining profitability when paired with cost data.

- Supporting strategic decisions about expansion and investments.

- Attracting investors and lenders by demonstrating earning power.

Revenue is one of the first numbers that executives, analysts, and investors alike analyze.

How to Calculate Revenue

In simple terms, revenue is calculated by multiplying the quantity of a product or service sold by its selling price. The revenue formula a company uses can be simple or complicated, depending on whether the business sells products or services.

Revenue Formulas

For a product-based business:

Revenue = No. of Units Sold x Average Price

or

For a service-based business:

Revenue = No. of Customers x Average Price of Services

or

Revenue = SUM(Value of Contract 1, Contract 2, Contract 3….)

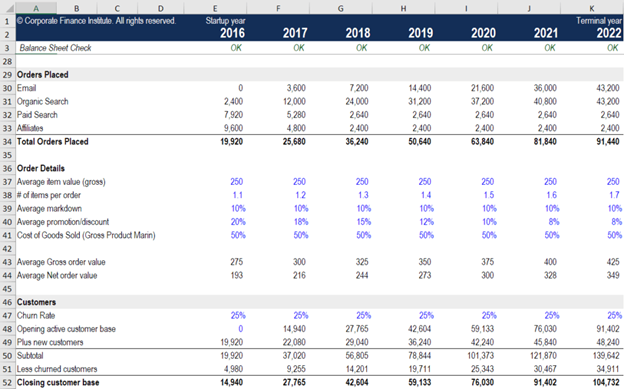

The formulas above can be significantly expanded to include more detail. For example, many finance teams build revenue forecasts all the way down to the individual product level or individual customer level.

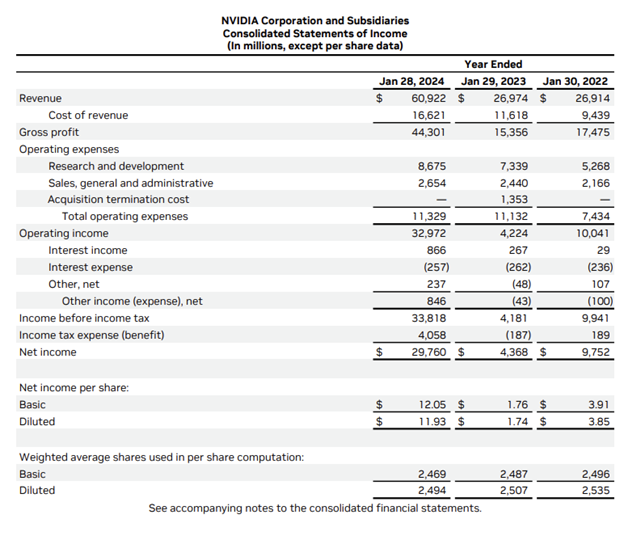

Revenue Example: NVIDIA

Below is an example of NVIDIA’s 2024 income statement. Let’s take a closer look at revenue for a large public company.

In 2024, NVIDIA recorded $60.9 billion in total revenue. Note how revenue forms the top line of the income statement.

NVIDIA then deducts all operating expenses from total revenue to arrive at an Operating Income of $33.0 billion. Operating Income is also referred to as Earnings Before Interest and Taxes (EBIT).

Finally, interest and taxes are deducted to reach the bottom line of the income statement, $30.0 billion of net income (profit).

Forecasting Revenue

Revenue forecasting is essential for budgeting, planning, and valuation. Effective revenue models may include:

- Website traffic

- Conversion rates

- Product prices

- Volume of different products

- Discounts

- Return and refunds

Revenue forecasts help guide executives and managers on key decisions such as hiring, production scheduling, and capital investments.

As you can see in the example above, there is much more that can be included in a forecast other than just No. of Units x Average Price.

CFI’s e-Commerce Financial Modeling Course provides a detailed breakdown of how to build this type of model, which is extremely important for forecasting and business valuation.

Revenue on the Income Statement (and other financial statements)

Sales are the lifeblood of a company, as they allow the company to pay its employees, purchase inventory, pay suppliers, invest in research and development, build new property, plant, and equipment (PP&E), and be self-sustaining.

If a company doesn’t have sufficient revenue to cover the above items, it will need to use an existing cash balance on its balance sheet. The cash can come from financing, meaning that the company borrowed the money (in the case of debt), or raised it (in the case of equity).

In order to perform a comprehensive analysis of a business, it’s important to know how the three financial statements are linked and see how a company either uses its sales to fund the business or must turn to financing alternatives to fund the business.

To learn more, watch CFI’s free webinar on how to link the 3 financial statements in Excel.

Revenue in Different Sectors

Revenue can look different depending on the sector. As you will see, it can be composed of many different things and varies widely in terms of what the most common examples are, by sector.

Personal Finance:

- Salaries

- Bonuses

- Hourly wages

- Dividends

- Interest

- Rental income

Public Finance:

- Income tax

- Corporate tax

- Sales tax

- Duties and tariffs

Corporate Finance:

- Sale of goods

- Sales of services

- Dividends

- Interest

Non-Profits:

- Membership dues

- Fundraising

- Sponsorships

- Product/Service sales

The three main areas that typically make up the finance industry are public finance, personal finance, and corporate finance. As we demonstrated above, the various sources of income in each type can be quite different. While the above lists are not exhaustive, they do provide a general sense of the most common types of income you’ll encounter.

Frequently Asked Questions

What does revenue mean in accounting?

In accounting, revenue refers to the total amount a company earns from its normal business activities before subtracting any expenses. It represents the inflow of money or value from selling goods, providing services, or performing other core operations.

Is revenue profit or income?

No. Revenue is not profit or income. Profit (or net income) is what remains after subtracting costs and expenses from revenue.

What is an example of revenue?

Here are a few clear examples of revenue, or money a company earns from its normal business activities before deducting any expenses:

- A clothing store sells a shirt for $40. The $40 is revenue.

- A consulting firm invoices a client $2,500 for a project. The $2,500 is revenue.

- An online retailer ships an order worth $120. The $120 is revenue.

Get Certified for Financial Modeling and Valuation (FMVA®)

Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst.

Additional Resources

Thank you for reading CFI’s guide to Revenue. To help you advance your career, check out the additional CFI resources below: