Salvage Value

The scrap value or residual value of an asset

What is Salvage Value?

Salvage value is the amount that an asset is estimated to be worth at the end of its useful life. It is also known as scrap value or residual value, and is used when determining the annual depreciation expense of an asset. The value of the asset is recorded on a company’s balance sheet, while the depreciation expense is recorded on its income statement.

Determining the Salvage Value of an Asset

The Internal Revenue Service (IRS) requires companies to estimate a “reasonable” salvage value. The value depends on how long the company expects to use the asset and how hard the asset is used. For example, if a company sells an asset before the end of its useful life, a higher value can be justified. Typically, companies set a salvage value of zero on assets that are used for a long time, are relatively inexpensive, or if the technology becomes obsolete quickly (5-year-old printer, 4-year-old laptop, etc.).

Importance of Salvage Value

If the salvage value is set too high or too low, it can be harmful to a company.

If set too high:

- Depreciation would be understated.

- Net income would be overstated.

- Total fixed assets and retained earnings would be overstated on the balance sheet.

If set too low:

- Depreciation would be overstated.

- Net income would be understated.

- Total fixed assets and retained earnings would be understated on the balance sheet.

- Values for the debt-to-equity ratio and loan collateral would be lower. This may result in difficulties securing future financing or in violation of loan covenants that require the company to maintain certain minimum debt ratio levels.

Using Salvage Value to Determine Depreciation

The estimated salvage value is deducted from the cost of the asset to determine the total depreciable amount of an asset.

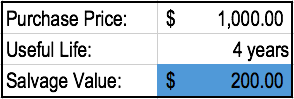

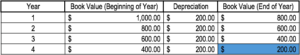

For example, Company A purchases a computer for $1,000. The company estimates that the computer’s useful life is 4 years. This means that the computer will be used by Company A for 4 years and then sold afterward. The company also estimates that they would be able to sell the computer at a salvage value of $200 at the end of 4 years. The company follows a straight-line depreciation method.

The depreciable value of this computer is determined by taking the purchase price and subtracting it from the estimated salvage value. In the example above, the depreciable value on this computer would be $1,000 – $200 = $800 taken over four years (the useful life of the asset). If the company uses a straight-line depreciation method, the computer would be depreciated annually by $200 ($800 / 4).

Download the Free Template

Enter your name and email in the form below and download the free salvage value and depreciation expense template now!

Salvage Value Template

Download the free Excel template now to advance your finance knowledge!

Real-World Example of Salvage Value Fraud

Waste Management, Inc. is a waste company founded in 1968 and was the largest waste management and environmental services company in 1980. Between 1992 and 1997, Waste Management, Inc. committed fraud several times. Among other fraudulent activities, the company:

- Avoided depreciation expenses by inflating salvage values and extending the useful life of the company’s garbage trucks

- Assigned arbitrary salvage values to assets that previously did not possess salvage value

The fraud was perpetrated in an attempt to meet predetermined earnings targets. In 1998, the company restated its earnings by $1.7 billion – the largest restatement in history.

More Resources

Thank you for reading CFI’s guide to Salvage Value. To keep learning and advancing your career as a financial analyst, these additional CFI resources will be a help in your journey:

Analyst Certification FMVA® Program

Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

A well rounded financial analyst possesses all of the above skills!

Additional Questions & Answers

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path.

In order to become a great financial analyst, here are some more questions and answers for you to discover:

- What is Financial Modeling?

- How Do You Build a DCF Model?

- What is Sensitivity Analysis?

- How Do You Value a Business?