CFP® vs CFA®

What is right for you?

CFP vs CFA: Which Path to Choose?

Certified Financial Planner® (CFP) and Chartered Financial Analyst® (CFA) are the two most talked about designations in the field of finance. Both of them serve different interests, and candidates will eventually perform work of a different nature. Both may sound similar but, in reality, they serve different purposes (although there is some overlap). Let us discuss CFP vs CFA separately and talk about the differences.

The field of corporate finance is a broad one and is comprised of lots of career tracks. There is no dearth of opportunities if you choose the right path and clear the obstacles to achieve your goals. Choosing a path that is aligned with your goals and interests is important, and this guide seeks to help you do that in regard to CFP vs CFA.

CFP vs CFA – the CFP

Financial Planning for Individuals

The CFP is for professionals who advise individuals on managing their personal portfolio and planning for the future. Certified Financial Planners advise people on many areas, including investment management, estate and retirement planning, tax planning, personal cash flow, and insurance.

Some Certified Financial Planners may also form partnerships with people such as lawyers and tax experts.

After earning the CFP designation, professionals must meet ongoing CFP continuing education requirements to maintain their certification.

Requirements and Examination

The CFP Board of Standards sets the CFP requirements. To get the CFP mark, one must hold a bachelor’s degree, have at least three years of experience in financial planning, and complete the prescribed course. In some cases, one might be exempt from taking the course. CFP involves only one exam and can be completed in one year if cleared on the first attempt.

The courses include the following:

- Financial planning (environment and process)

- Income tax

- Fundamentals of insurance planning

- Retirement needs analysis and planning

- Investments

- Estate planning fundamentals

CFP vs CFA – Careers

CFP’s work with clients, especially individual investors. Success depends on the quality and loyalty of the client list – and that depends on the quality of service the CFP provides. As a result, there is no set salary for a CFP. It depends on the relationships the planner forms.

CFP vs CFA – the CFA

Financial Analysts

The exam to become a CFA focuses on developing professionals who can do financial analysis and manage large sums of money. The designation, which opens up opportunities for jobs that are otherwise difficult to get into, has a very broad scope.

The Program provides a strong foundation for investment analysis and portfolio management. It is sometimes compared to a Master’s Degree, with minors in economics, accounting, and statistical concepts.

Requirements and Examination

The charter, issued by the CFA Institute (headquartered in the U.S.), has a strong reputation due to its demanding examination series. Candidates need to study extensively to pass. It consists of three levels: candidates must sit a six-hour exam for each level. The Level 1 exam is administered twice a year (June & December), whereas the other two levels are given only once a year – in June.

The Level 1 examination focuses on investment tools (Quantitative Methods, Financial Reporting and Analysis, etc.), while Level 2 emphasizes asset class analysis (Equity Investments, Fixed Income, Derivatives, etc.). The Level 3 exam places greater emphasis on Portfolio Management and Wealth Planning. All exams share a core section on Ethics and Professional Standards.

To get a charter, candidates must meet all three conditions: hold a bachelor’s degree, pass all three levels of exams, and possess four years of experience in the finance domain.

Career Paths

According to the CFA Institute Factsheet, Charterholders primarily work as

- Portfolio Managers

- Research Analysts

- Chief Level Executives

- Consultants

- Risk Managers

Other roles that you may find Charterholders in are risk analysts, financial analysts, advisors, and traders.

CFP vs CFA – Overlapping Careers

A CFP designation can help get roles such as financial analyst, trading, equity research associate, or financial consultant; however, it generally has the most pull for financial planning and financial advisor roles.

The CFA credential, on the other hand, can be used for both corporate roles (such as financial analyst, trading, equity research associate, investment banking, and private equity) and personal financial planning/advisor roles.

Both designations offer a wide scope of opportunities. Some opportunities overlap, but in general, they are meant for different paths. Choosing according to one’s interests and aspirations is crucial.

Financial Modeling Careers

Both are great options on your resume for careers that require financial modeling, but neither credential really teaches the step-by-step applied skills you need to perform financial modeling in Excel. The most effective way to learn modeling skills is on the job in roles such as investment banking, equity research, or FP&A.

If you’re not already in one of those jobs, you can learn online through CFI’s financial modeling courses and certifications.

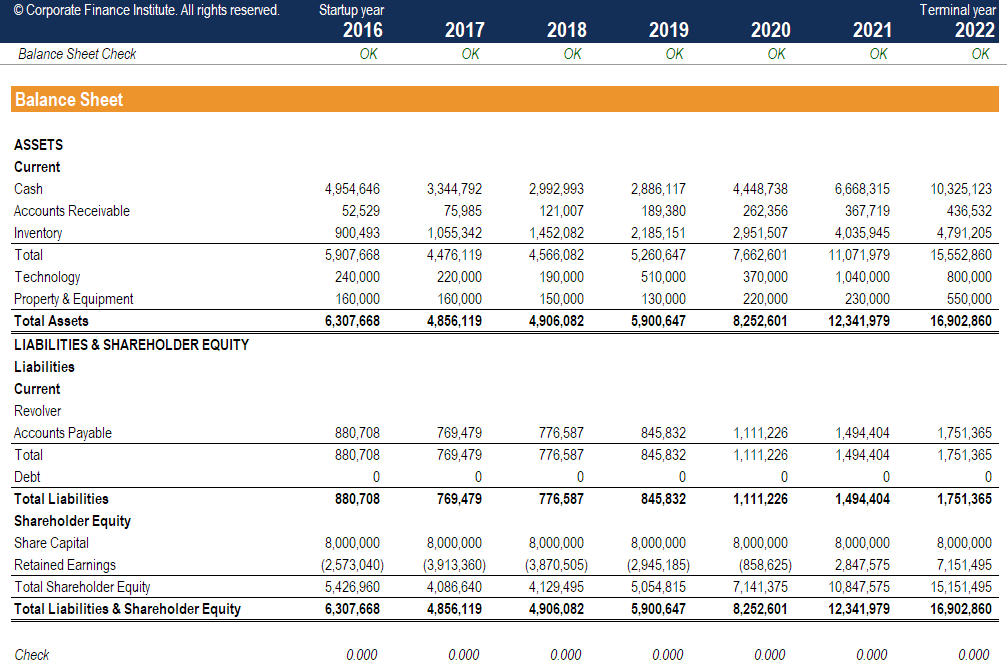

Below is a screenshot from one of CFI’s financial modeling courses.

Compare More Designations

Below is a helpful table for comparing additional designations.

| Number of Levels | ||||||

| Costs | ||||||

| Exam Pass Rate | ||||||

| Content Focus | Financial Modeling, Valuation | Portfolio Management, Investments | Financial Reporting, Audit | Real Assets, Alternative Investments | Financial Planning | Financial Risk Management |

| Career Application | All Encompassing | All Encompassing | Accounting and Finance | Asset Management | Retail and Wealth Management | Risk Management |

| Study Time (hrs) | ||||||

| Completion Time | ||||||

| Work Experience |

Additional Resources

Thank you for reading CFI’s guide to the CFP vs. CFA designations. To learn about other designations and career paths, check out these additional CFI resources: