Equity Research Associate Job Description

Equity Research involves performing ratio analysis to analyze a company’s finances

Equity Research Associate Job Description

This equity research associate job description outlines the main roles, responsibilities, skills, and education required to be a successful equity research associate.

To prepare for a career in equity research, launch CFI’s financial modeling courses now!

Equity Research Associate Job Description – Key Responsibilities

- Research securities of target industries and companies to provide investment recommendations

- Collect and interpret company data to facilitate recommendations

- Develop and write research reports and publications to be presented to management or shareholders

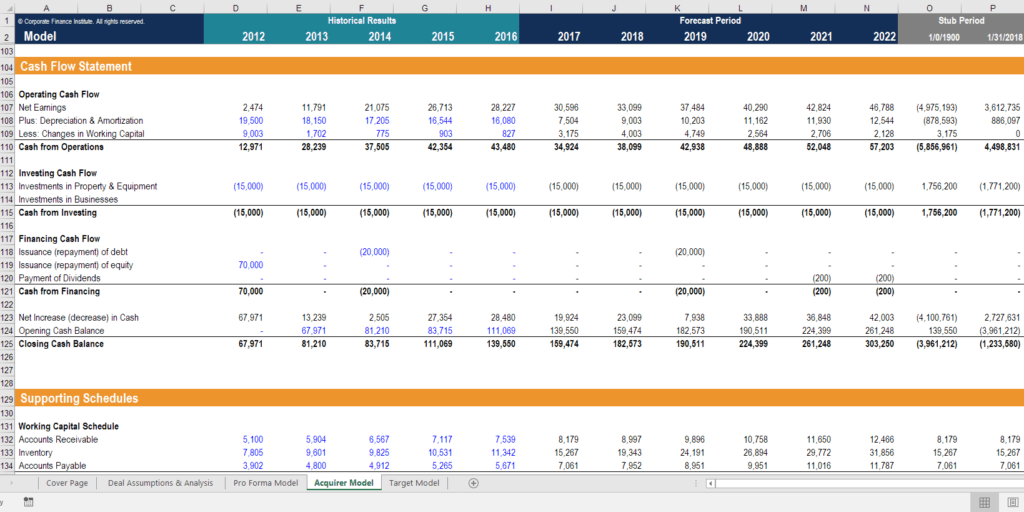

- Financial modeling: input data into proprietary financial models to create charts, dashboards and supporting material

- Maintain up-to-date knowledge of financial services industry happenings and current events

- Conduct primary research from industry sources

Example: Equity Research Associate Job Description – Financial Model

Equity Research Associate Job Description – Relevant Skills, Knowledge, and Experience

- MBAs are preferred, although candidates with a Bachelor’s Degree are accepted as well.

- Finance, Accounting, Economics or Statistics are preferred fields of study

- Ability to communicate effectively and express complex ideas succinctly

- Ability to take initiative and meet deadlines under minimal supervision

- Ability to work under pressure

- Industry experience in specific fields such as mining, manufacturing, technology, or transportation is an asset

- Strong proficiency in MS Office, Excel, Word is required

- Proficiency in Bloomberg or Capital IQ, or other data mining software is an asset

What is Equity Research?

The basic Equity Research Associate job description is providing analysis of securities data to inform fund managers and aid them in the investment process. The job requires problem-solving expertise and a broad knowledge of the stock market to successfully interpret data into meaningful recommendations. These recommendations are in regard to buying or selling certain equity investments.

The primary duty of an equity research associate is to assist senior analysts in regard to investment decision research. As an equity research associate, you will assist the company’s Equity Analysts and Portfolio Managers in the critical evaluation of potential equity investments. Oftentimes, direction is provided by senior team members, but the research associate must do the brunt of the valuation and sensitivity analysis work on their own. Other aspects of research associate work involve producing financial models, evaluating public information, and gathering any other available forms of data. Equity research associates may also be tasked with interviewing managers, suppliers, customers, and even competitors, to collect data.

To prepare for a career in equity research, launch our financial modeling courses now!

The Role of an Equity Research Associate – Job Description

- Being an equity research associate is a pivotal role as it involves the responsibility for providing information to business management, which is then used in making important investment decisions

- Other duties undertaken by the equity research associate may involve direct interactions with clients. The investment researcher has the responsibility of explaining to customers why the particular models are important in the implementation of successful business portfolios

- An equity research associate might be working for a firm or for individual salespeople, such as a stockbroker

This equity research associate job description is drawn from the responsibilities outlined by companies like Merrill Lynch Bank of America, JPMorgan, Morgan Stanley, and other top global banks.

Career Map

To see how the role of the equity research associate compares to other positions in corporate finance, explore our interactive career map to find out which path is right for you!

More Reading

Thank you for reading CFI’s Equity Research Associate Job Description. To learn more about jobs in the financial industry, take a look at the following free CFI resources: