- The Critical Role of FP&A in Growing Companies

- Why Tesla's Story Matters for FP&A Professionals

- FP&A Day in the Life: Morning Data Dive

- Midday: Scenario Analysis and Stakeholder Collaboration

- Afternoon: Presenting Insights and Driving Decisions

- A Day in the Life of an FP&A Analyst

- How to Succeed as an FP&A Analyst

- Additional Resources

Career Insights: A Day in the Life of an FP&A Analyst

The Critical Role of FP&A in Growing Companies

Imagine starting your workday with the goal of helping a company manage its financial health and growth trajectory. That’s the world of a Financial Planning & Analysis (FP&A) analyst, a role crucial to turning raw numbers into actionable insights. At a company like Tesla during its early years, this role wasn’t just about crunching numbers — it was about making decisions that could make or break the business.

In this post, we’ll walk through a day in the life of an FP&A analyst and highlight lessons from Tesla’s finance evolution that can inspire career growth in this dynamic field.

Key Highlights

- A day in the life of an FP&A analyst showcases how technical expertise and collaboration drive impactful business decisions.

- FP&A analysts are the financial strategists who transform raw data into actionable insights that drive a company’s growth and resilience.

- Mastering analytical skills, Excel, and clear communication empowers FP&A professionals to navigate uncertainty and influence key decisions.

Why Tesla’s Story Matters for FP&A Professionals

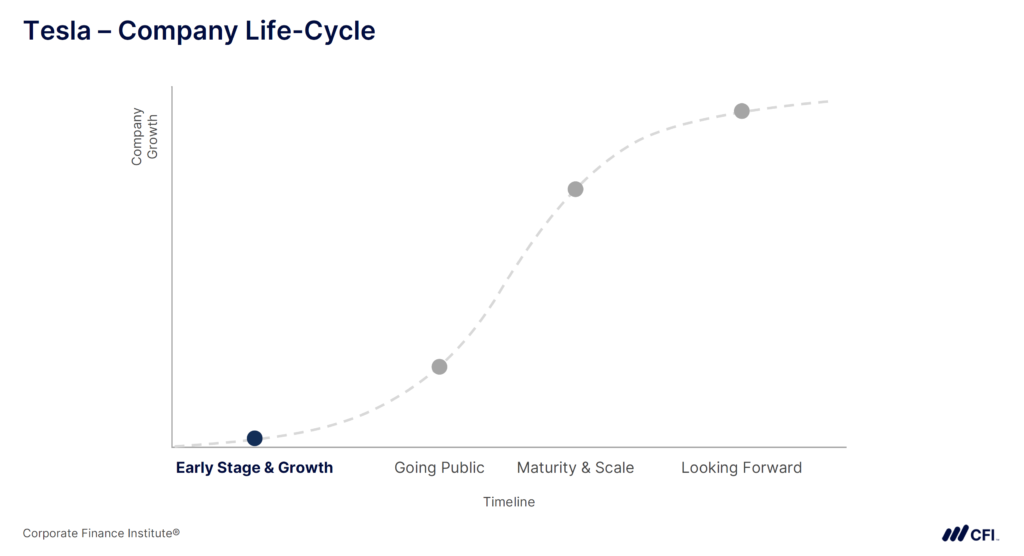

Tesla’s journey from a small startup to a global leader in electric vehicles is a masterclass in the power of financial planning and analysis. At every stage of growth, Tesla faced unique challenges that required careful financial stewardship. The FP&A function played a pivotal role in aligning the company’s ambitious goals with its financial reality.

Consider these key milestones in Tesla’s early years:

- 2003–2006: Tesla needed to manage its initial funding while developing its first product, the Roadster. The FP&A team had to ensure every dollar was spent wisely to balance R&D costs with limited resources.

- 2006–2010: As Tesla moved from prototype to production, it required scenario planning for production costs, market demand, and supplier logistics — all areas where FP&A provides critical insight.

- 2010 Onward: Tesla’s successful IPO opened new funding opportunities, but financial discipline was still essential to support scaled production and new product launches.

Tesla’s early years are an excellent case study to understand a day in the life as an FP&A Analyst, illustrating how this role adapts to support rapid growth. Whether it was projecting costs, presenting budgets, or running forecasts to prepare for uncertain outcomes, Tesla’s FP&A function was at the heart of its financial resilience and success.

With that background, let’s step into the shoes of an FP&A analyst to see how this role unfolds on a typical day.

FP&A Day in the Life: Morning Data Dive

The day typically begins with analyzing the company’s current financial standing. At Tesla in 2006, as it was gearing up for the launch of its first electric vehicle, the FP&A team had to meticulously monitor budgets and forecasts.

For an FP&A analyst, this might mean:

- Building or refining budgets in Excel or similar tools.

- Running forecasts to predict cash flow and expenses as the company scales production.

- Tracking financial metrics such as revenue, cash flow, and capital expenditures.

Tesla’s FP&A team likely worked closely with other departments to ensure every dollar was optimized. Whether it was determining if funds were being allocated efficiently or projecting revenue growth from preorders of the Roadster, the FP&A role demanded a laser focus on detail.

Midday: Scenario Analysis and Stakeholder Collaboration

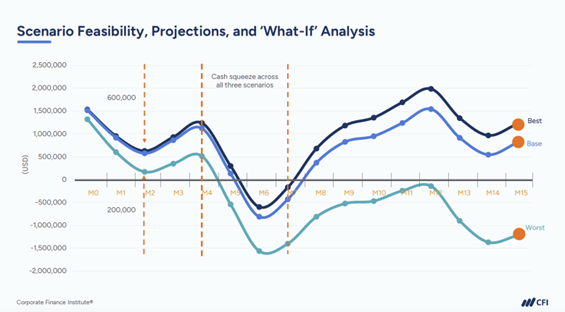

FP&A analysts play a pivotal role in planning for uncertainty. At Tesla, the team would have needed to evaluate scenarios for varying production costs, supplier challenges, or shifts in market demand. Scenario analysis helps companies understand the financial impact of different outcomes and prepare for the unexpected.

For example:

- What happens if battery production costs spike by 10%?

- How would a delay in vehicle delivery affect cash flow?

- What if preorders outpace manufacturing capacity?

Collaboration is critical here. FP&A analysts might have liaised with supply chain managers, engineers, and external vendors to ensure financial projections aligned with operational realities. Strong communication skills are key — translating complex financial data into actionable insights for senior leaders is a core part of the job.

Afternoon: Presenting Insights and Driving Decisions

By the afternoon, it’s time to present findings to key stakeholders. Tesla’s FP&A team likely reported directly to senior leadership, including the CFO. In these meetings, analysts might:

- Present Excel dashboards showing financial health and forecasts.

- Share recommendations on cost-cutting or investment opportunities.

- Model the financial impact of launching new initiatives or delaying projects.

Tesla’s growth relied heavily on such insights. During its early years, every financial decision — from R&D investments to operational expenses — carried significant weight. The ability of FP&A analysts to provide clear, data-driven recommendations would have been pivotal in navigating these challenges.

A Day in the Life of an FP&A Analyst

Success as an FP&A analyst requires more than just a knack for numbers. It’s about mastering a blend of technical, analytical, and interpersonal skills to help businesses make data-driven decisions. Tesla’s early financial journey offers a glimpse into the critical capabilities that every FP&A professional needs to excel.

1. Analytical Skills

FP&A analysts are problem-solvers at their core. Whether evaluating budgets or forecasting market trends, strong analytical abilities are essential for interpreting complex financial data and turning it into actionable insights. At Tesla, the FP&A team relied on these skills to:

- Conduct cost-benefit analyses for projects like the Roadster.

- Identify financial risks and opportunities during production planning.

- Simulate various scenarios to prepare for uncertainty.

Analytical skills empower FP&A analysts to connect the dots and anticipate outcomes, ensuring that leadership can make informed decisions in a fast-paced environment.

2. Mastery of Excel and Financial Tools

Excel is the cornerstone of an FP&A analyst’s toolkit. It’s the go-to platform for budgeting, forecasting, and building financial models. At Tesla, Excel likely played a central role in managing budgets and projecting cash flows as the company scaled operations. Advanced proficiency in Excel enables FP&A analysts to:

- Create dynamic financial models that simulate various business scenarios.

- Automate manual tasks using tools like Power Query, saving hours of work.

- Leverage visualization tools like Power BI to present data clearly and effectively.

Mastering these tools allows analysts to work smarter, not harder, and deliver insights quickly and accurately.

3. Communication Skills

The ability to convey complex financial concepts to non-financial stakeholders is critical. Tesla’s FP&A analysts likely presented their findings to senior leaders, translating raw data into clear, actionable recommendations. Strong communication skills help FP&A analysts:

- Build trust with leadership by simplifying intricate financial data.

- Foster collaboration with cross-functional teams like supply chain or engineering.

- Ensure alignment between financial forecasts and business strategies.

Presenting financial data to non-financial stakeholders is only part of effective communication. The best FP&A professionals also tell the story behind the numbers, guiding leadership’s decision making and driving the business forward.

Tesla’s journey from startup to market leader underscores the importance of these core skills for FP&A analysts. Aspiring FP&A professionals can focus on developing these skills to excel in this dynamic field.

How to Succeed as an FP&A Analyst

The day-to-day role of an FP&A analyst is both challenging and rewarding. It’s about more than crunching numbers in spreadsheets. As an FP&A analyst, you can influence business decisions that shape the future of a company. Whether you’re just starting your career or looking to pivot into FP&A, this field offers endless opportunities to make an impact.

Ready to step into the shoes of an FP&A analyst? CFI’s FP&A Specialization equips you with skills and knowledge you need to thrive in an FP&A Analyst role.

Explore CFI’s FP&A Specialization today!

Additional Resources

Best FP&A Certifications to Further Your Career

Workflow Efficiency for Financial Analysts