Affiliated Companies

Companies that are related through ownership

What are Affiliated Companies?

Affiliated companies are companies that are related through ownership, either with one owning the other as a minority shareholder or with multiple companies being owned by a third party.

An affiliated company differs from a subsidiary through the size of the ownership. A subsidiary is a company where 50% or more of the company is owned by another. A key characteristic of an affiliated company is that less than 50% of the company is owned by an individual shareholder. Any parent company of the affiliated company is considered a minority shareholder.

Summary

- An affiliated company is a relationship between companies, with either one owning the other as a minority shareholder or multiple companies being owned by a third party.

- The terms affiliated company and subsidiary are used interchangeably but are not synonymous. The two differ based on the percentage of ownership involved.

- In an affiliated company structure, the parent does not have enough ownership control to make business decisions for the affiliate or appoint individuals to the board of directors.

How It Works

A company may become an affiliated company of another when it is bought out or taken over by a company that now holds a minority interest. A company may also spin off a part of its business into a new affiliate as well.

Affiliation between two companies can include:

- Ownership

- Similar interests among a family of affiliated companies

- Sharing of facilities, equipment, and employees

A parent company neither possesses the power to control the management and business decisions of their affiliated companies nor can they control the selection of the board of directors. However, they can exert their influence to the best of their abilities.

Benefits of the Affiliated Companies Structure

There are several benefits to a company becoming affiliated with another:

1. Enter new market

Becoming affiliated with a company that is experienced in a particular market is a quick way to gain access to that market. Going the affiliate route can bypass the learning curve and substantial expenditures that come with breaking into a new market (such as research and development and marketing costs).

2. Enter new geographic region

In addition to a new market, the parent and affiliated companies can give each other access to new geographical regions they otherwise would not be able to enter on their own. In another country where a parent has no brand recognition, it can be disastrous if they try to enter that market with its existing brand and products. By becoming a parent to a company that already has business in that market, they can expand into that market while minimizing the risk of failure.

3. Brands are kept separate

Two or more companies may have iconic brands. Often, it is in the best interests of both companies to keep their brand identities separate.

Changing one company’s branding might result in a decrease in sales due to the branding change. Consumers would not retain their brand loyalty after the change.

4. Investment opportunity

A company can be appealing for another one to take a stake in because it is an attractive investment. The potential returns a parent company can get by investing in an affiliated company can be higher than the returns of other investments they can allocate their capital to.

5. Synergies

In relation to affiliated companies being a good investment, it’s possible that there can be synergies between the affiliated companies as well. When two companies have synergies, it’s possible that 1 + 1 = 3.

This means that each of the affiliated companies combined can have more value together than the sum of their parts. If they possess complementary businesses and resources, both can benefit from each other.

6. Control the supply chain

If Company B is important to Company A’s supply chain, Company A may find it beneficial to purchase a stake in Company B, so that it gains more control over its supply chain. The transaction will move Company A more toward vertical integration.

By gaining influence and acquiring a stake in Company B, Company A can insulate itself more from a rise in supply costs. This can provide Company A with a competitive advantage that has more value than the funds used to purchase a minority shareholding in Company B.

7. Save on taxes

The affiliate structure can enable the companies involved to receive tax benefits in the form of shedding off tax liabilities and receiving deductions.

Affiliated Companies vs. Subsidiaries

The differences between affiliated companies and subsidiaries result from the different ownership percentages and the rights associated with a minority or majority ownership.

Affiliates

- They are less than 50%-owned by a parent company.

- The parent can exert influence but lacks control over business decisions and the board of directors.

- Management teams are kept separated.

Subsidiaries

- They are more than 50%-owned by a parent company.

- The parent holds majority ownership and can control business decisions and the board of directors.

- The company’s management and shareholders are given voting rights.

- Subsidiary financials appear on the parent company’s financial statements.

Example of Consolidated Affiliates vs. Subsidiaries

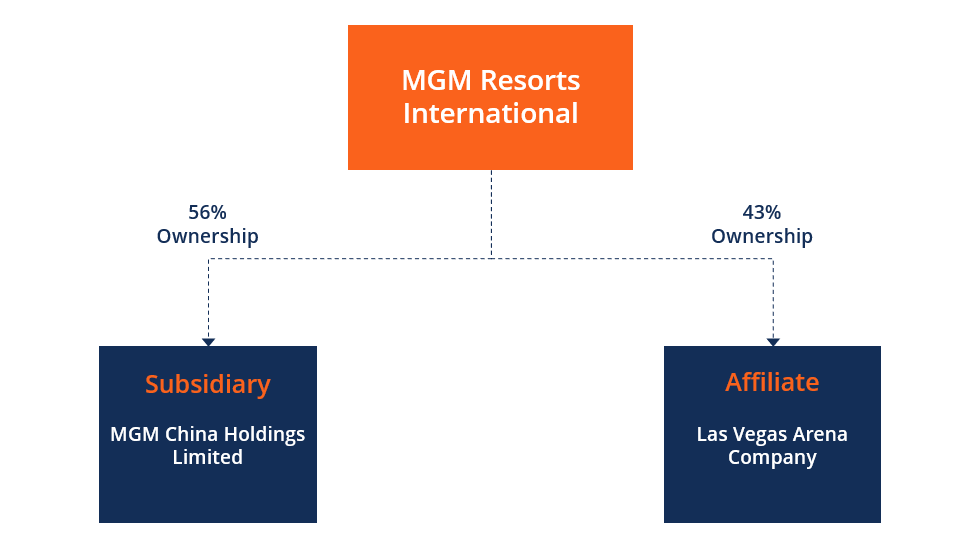

To show an example of a subsidiary and an affiliated company, we will look at MGM Resorts International, the casino and resort company known for its properties in Las Vegas. MGM Resorts operates several casinos across the United States and overseas as well. It has a subsidiary, MGM China Holdings Limited, which it owns 56% of. The 50%+ ownership in the company qualifies MGM China as a subsidiary, and MGM Resorts International has more control.

An affiliated company of MGM Resorts International is the Las Vegas Arena Company. The company manages the T-Mobile Arena in Las Vegas, which is one of the highest-grossing arenas in the world – holding numerous sporting and music events.

According to its earnings presentations, MGM Resorts owns 42.5% of Las Vegas Arena Company. The stake was acquired in a joint venture with AEG and Athena Arena, LLC. MGM Resorts International cannot exercise control over the Las Vegas Arena company like it would be able to with MGM China.

More Resources

CFI is the official provider of the global Commercial Banking & Credit Analyst (CBCA)™ certification program, designed to help anyone become a world-class financial analyst. To keep learning and advancing your career, the additional CFI resources below will be useful:

Accounting Crash Courses

Learn accounting fundamentals and how to read financial statements with CFI’s online accounting classes.

These courses will give you the confidence to perform world-class financial analyst work. Start now!

Boost your confidence and master accounting skills effortlessly with CFI’s expert-led courses! Choose CFI for unparalleled industry expertise and hands-on learning that prepares you for real-world success.