Horizontal Merger

Two companies that produce similar products and/or services

What is a Horizontal Merger?

A horizontal merger occurs when companies operating in the same or similar industry combine together. The purpose of a horizontal merger is to more efficiently utilize economies of scale, increase market power, and exploit cost-based and revenue-based synergies.

Reasons for a Horizontal Merger

When companies undergo a horizontal merger, the underlying principle is to create value. A successful merger should create value in which combining the companies would be worth more than if each company were under independent ownership. In a horizontal merger, 1 + 1 (referring to two independent companies) should be greater than 2 (the merged company).

Reasons for merging horizontally:

- Increase market share and reduce competition in the industry

- Further utilize economies of scale (thus reducing costs)

- Increase diversification

- Reshape the company’s competitive scope by reducing intense rivalry

- Realize economies of scope

- Share complementary skills and resources

Problems in Achieving Merger Success

Although there are many benefits to a horizontal merger, they may not be fully realized and the merger may not actually create added value. Merging companies face problems such as:

- Integration difficulties: Merging two different corporate cultures can be difficult.

- Difficulty in building a working relationship: Due to differing management styles, it may be difficult to build a working relationship.

- Inability to achieve synergies: The expected synergies may never be realized and this may end up reducing overall value.

- Bureaucratic controls: There may be legal repercussions if the horizontal merger creates a company that may be considered a monopoly. Horizontal mergers are scrutinized in the US because the combination of competitors can create a monopoly and raise prices for the consumer.

Horizontal Merger vs. Vertical Merger

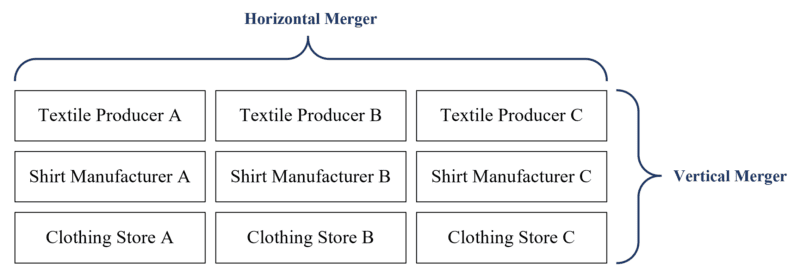

Though one is often confused with the other, there is a distinct difference between the two types of mergers.

- Horizontal merger: When companies that sell similar products merge together.

- Vertical merger: Occurs between companies at different stages in the production process (between companies where one buys or sells something from or to the company).

The diagram below shows the difference between the two:

Assuming Clothing Store A, B, and C are competitors. If Clothing Store A merges with Clothing Store B or Clothing Store C, it is a horizontal merger.

The production process: Textile Producer A → Shirt Manufacturer A → Clothing Store A. If Clothing Store A merges with Shirt Manufacturer A or Textile Producer A, it is a vertical merger.

Example of a Horizontal Merger

Consider a famous horizontal merger: HP (Hewlett-Packard) and Compaq in 2011. The structure was a stock-for-stock merger with an exchange ratio of 0.63 HP share per Compaq share, valued at approximately US$25 billion. The new company would be held 64% by HP and 36% by Compaq shareholders.

The rationale behind the horizontal merger of HP and Compaq was based on the following points:

- Combat the increasing competition in the industry from IBM and Dell

- Cut costs by nearly US$3 billion annually

- Share complementary resources and enhance business segments

- Respond quicker to changing customer demands in the industry and set a product standard

- Face the challenge of a shrinking market

The merger created a US$87 billion global technology leader offering the most comprehensive set of IT products and services for businesses and consumers. The new HP became the top global player in IT services, imaging and printers, and access devices. Cost and revenue synergies were established, creating substantial shareholder value and providing new growth opportunities.